DC Metro Urban Diary reports in "

Shops at Dakota Crossing and Costco to Start Now, Open Next Year" that developers are moving forward with

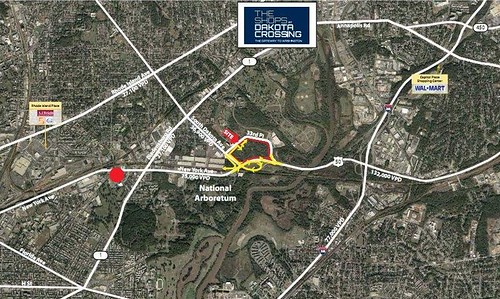

the Costco-anchored shopping center at South Dakota Avenue at the entry into DC abutting the Fort Lincoln development and New York Avenue.

The article reports that various potential tenants such as Target and Shoppers Food Warehouse have begged off.

Likely this was partly because the location is somewhat awkward, on the edge of the city, in an area where people aren't accustomed to going to as opposed to driving through, and requires that just about 100% of trips made to the center will be by car.

Even though they are going ahead with building the center while only about 1/3 of the space is rented, I think they will have a harder time getting other tenants, because of the future opening of a Walmart just down the street, at Montana Avenue NE.

Interestingly, the map of the development by the group shows a Walmart in Prince George's County, but not the site of the coming Walmart less than one mile away. If the map were just a bit bigger, it would also be able to show two other future Walmart locations (and there will be three others). The map below has a helpful red dot that I've inserted, to show where the Walmart will be.

The Costco likely will be successful in any case. According to industry reports, the average sales/store for a Costco are about $131,466,000/year. That's huge.

Figuring that about 60% of the volume is groceries, and DC doesn't tax groceries, that means that 40% of those sales will generate about $3,155,184 in annual sales tax revenue.

Two types of adjacencies should be evaluated before committing to a center acquisition: One can be fixed, and the other can not be fixed. Anchor and inline tenant adjacencies within the center impact the duration of shopper visits and overall center performance. New centers give these adjacencies careful consideration in order to exploit anchors and key tenants. However, over time, these strategic adjacencies erode and need to be recalibrated. Adjacencies that cannot be fixed are uses in the vicinity of the center. Nearby major athletic venues, schools, high-density residential, etc. can all have positive or negative implications on a shopping center, and they should be factored into the due diligence process.

Tenant adjacencies, or the other retailers that open up in shopping centers and districts next to "anchor" retailers, came up in the

Washington City Paper Housing Complex blog entry, "

Walmart Would be Happy With Nothing Next To It." Walmart doesn't like adjacencies, while typical supermarkets do.

Between the Costco and the Walmart, garnering adjacencies will be tough, with the possible exception of Kohls.

Lowes has said they aren't interested in opening in the Walmart shopping center that the same developer is building in Baltimore, so it remains to be seen if they will still open in DC. (I think they will, because they are relatively understored in this region, which is a stable real estate and development market, which is advantageous to home improvement stores.)

Labels: formula retail, sales tax revenues, tax incentives, urban revitalization

0 Comments:

Post a Comment

<< Home