Federal historic, development, and housing tax credits under threat

(Likely to be the first in a series of many examples of "Yes, it really does matter who gets elected.")

Lathrop Homes in Chicago is slated to be redeveloped as a mix of lower income and market rate housing ("Chicago Plan Commission approves redevelopment of Lathrop Homes," Chicago Tribune).

While I figure President-elect Trump's developer friends at firms like Related Companies ("Building a Niche, Orange County Register; "Related Buys Affordable Housing Portfolio," Wall Street Journal) which while known for high profile projects in New York and other major cities, make a considerable amount of money via tax credit supported projects, will set him straight on the value of housing and development tax credits, an email from Preservation Maryland calls our attention to Speaker of the House Paul Ryan's previous proposals to eliminate the historic preservation and housing tax credits.

From the email:

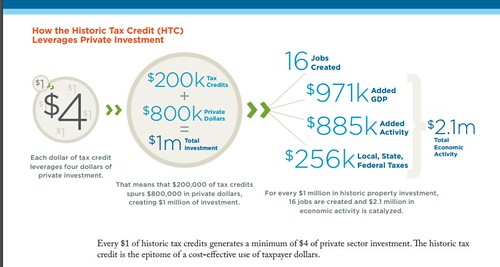

President-Elect Trump and Speaker Ryan have prioritized moving tax reform legislation in the first 100 days of the next Congress. A tax reform package could move quickly through Congress by way of the budget reconciliation process, which only requires a simple majority for passage in the Senate, instead of the typically needed 60 votes to cut off debate.Typically, economic impact studies including Federal Historic Tax Credit: Transforming Communities by the National Trust for Historic Preservation find great economic returns from the Federal Historic Preservation Tax Credit. Not only can the projects help transform commercial districts and communities, the credit leverages $4 in private investment for every dollar. Other studies find that more federal tax revenue has been generated by the projects than was spent on the tax credit.

We expect tax reform legislation will follow Speaker Ryan’s A Better Way blue print, released earlier this year that recommends eliminating the Historic Tax Credit (HTC), the New Markets Tax Credit (NMTC) and the Low Income Housing Tax Credit (LIHTC).

If we lose the federal tax credit, many, if not most large-scale historic rehab projects in Maryland would become financially unfeasible.

The good news in Maryland is that our federal delegation is exceptionally supportive of the program and credit. Senator Ben Cardin is of the biggest champions of the credit in the entire congress.

However, we need to make certain that the future of the credit is a priority for our federal delegation in the face of many other priorities – and that our legislators use their position to influence legislators from around the nation.

Your voice is needed to remind our legislators that this credit is a priority to their constituents.

What can you do?

Contact your legislators and let them know: "Please contact House Ways & Means Chairman Kevin Brady and other members of the House Ways and Means Committee to explicitly state your support of the Historic Tax Credit when reviewing draft Tax Reform Bill."

One project I was involved in within DC that utilized federal historic preservation tax credits was the rehabilitation of the Atlas Theater into the now Atlas Performing Arts Center.

One project I was involved in within DC that utilized federal historic preservation tax credits was the rehabilitation of the Atlas Theater into the now Atlas Performing Arts Center. It was an important anchor project and catalyst in an overall revitalization plan which will generate more than $1 Billion in new development and economic activity on H Street NE. The cost of the tax credits for the Atlas was about $5 million.

While no one would argue that the Atlas project alone is responsible for H Street's resurgence, which totals more than $1 billion in new development and economic activity including thousands of units of new housing, mostly in mixed use projects, there is no question that at the time, the Atlas project, facilitated by federal tax credits, moved development along and significantly changed the perception of H Street when at the time the area was considered undesirable and not a great area to live or invest in, despite its proximity to Union Station, Capitol Hill, and Downtown.

Especially in rising markets, the Low Income Housing Tax Credit helps generate additional housing serving market segments typically underserved by for profit housing developers, and the New Markets Tax Credit facilitates development in economically challenged areas. According to one study, use of the NMTC can generate up to a 15x overall increase in federal revenues over time, compared to the revenues generated without the new development.

According to the Partnership for Job Creation:

The PJC report, which focuses on net federal tax revenue ultimately generated by the NMTC Program, concludes that revenues directly and indirectly attributable to CDE investments in operating businesses and commercial developments substantially exceed revenues foregone by the tax credit. BDA estimates that the resulting net return to U.S. taxpayers may range in value from 2.2 to 14.8 times the value of tax credits awarded under the program, based on an average of projected NMTC-related tax outlays.Unfortunately, an ideological commitment to a philosophical belief about "how the market [capitalism] works" means that many elected officials would rather eliminate successful programs designed to facilitate economic development in those places where the real estate development and management market isn't working.

From the Related Affordable website:

To date, Related has developed or acquired over 55,000 affordable housing units with a total value of approximately $3.5 billion. Currently, we have over 7,000 units under development or under contract throughout the country with a value in excess of $1.5 billion. Our broad portfolio of award-winning affordable and mixed-income developments demonstrates our continuing ability to create affordable housing opportunities in a variety of geographically, economically and socially diverse neighborhoods.

Related is one of the nation’s largest developers of 80/20 rental housing in New York City and also boasts award-winning developments in California and Chicago ranging from family, senior, urban, suburban, HOPE VI, SRO and intergenerational. Our in-house expertise in all disciplines ensures our developments consistently set new standards for creative design and financing and add value to the neighborhoods in which they are located.

Labels: commercial district revitalization planning, historic preservation, real estate development, suburban revitalization, tax credit programs

2 Comments:

Bad idea on the HTC, but good idea on the LIHTC.

Also,the policy that I've seen on tax is

1. simply into 3 bands.

2. Increase individual deduction to 21K.

3. Remove deductions (including mortage) for higher income holders.

Not great for strong market urban areas; I'm sure more than 50% of the DC metro area would no longer be able to deduct mortgage interest.

why do you think it would be good for the LIHTC to go?

I think it's reasonable to provide financial support to build this kind of housing, which the market normally isn't too interested in.

I do understand the value of "getting rid"of the mortgage interest deduction although obviously it's seemingly not great for homeowners. It does distort the market in various ways.

Post a Comment

<< Home