The automobile legend that will not die

Is that automobile (and truck) drivers, through federal and state gasoline excise taxes and registration fees, pay for the cost of roads.

Not true.

Numbers vary, and I use the figures provided by Martin Wachs in a Brookings Institution paper, Improving Efficiency and Equity in Transportation Finance, which states that about 50% of the cost of roads comes from sources other than fees paid by drivers. (I was introduced to this paper by Neil Peirce's column "GAS TAX HIKES: NEEDED BUT POLITICALLY PERILOUS," from May 2003.)

Somewhere I saw a webpage by the Texas Dept. of Transportation which I can't find, that does such calculations on a road by road basis, making the point that some roads are subsidized upwards of 80%.

This comes up because of an article in the Baltimore Sun, "No tax rise seen to avert MTA cuts," which includes the flip side of this myth, that "transit is subsidized but driving is not." And note, it is ok, from the standpoint of supporting the economy (Adam Smith and all that) to subsidize somewhat, transportation, to ease the movement of people and goods.

From the article:

A gallon of gas costs less than $2, and Maryland's gasoline tax hasn't been raised for 15 years.But don't look for Howard County's State House delegation to lead the charge in Annapolis for a tax increase to prevent big cuts to commuter transit and highway projects. ...

Republican Dels. Gail H. Bates and Warren E. Miller and state Sen. Allan H. Kittleman argue that taxing rural motorists' gasoline purchases to support mass transit isn't fair. Bates said mass transit should pay for itself, and Kittleman said he has no objection to higher bus fares. ...

"I think gas tax revenues should be used for roads," Kittleman said. Miller agreed."I think that mass transit has bled off desperately needed road money," he said. Del. Shane Pendergrass, a Democrat, disagrees."Those of us who rarely use public transit, like me, have some obligation to subsidize people who are getting off the roads," she said. "I'm very comfortable subsidizing public transportation."

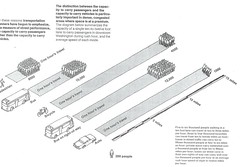

One justification by the way for paying for mass transit, some, from gasoline taxes, is by providing more efficient means for mobility -- a bus can move 60 people in the same space as 4 cars, which would probably need about 50 cars to move the same number of people, and that's far fewer than are moved by comparison in the rail modes (train, subway, light rail) -- there are fewer cars on the road and traffic moves more quickly.

Mobility efficiency. Diagram from the Central Washington Transportation and Civic Design Study, 1977, funded in part by the National Endowment of the Arts.

But the real question is on the whole, who is really the free--or most subsidized--rider here in terms of getting the most financial benefit from the subsidy provided?

Labels: car culture and automobility, gasoline excise taxes, transit, transportation planning

0 Comments:

Post a Comment

<< Home