Revised: Proving once and for all that U.S. defense spending is mostly about maintaining access to oil

It turns out that last year's fleet average of miles per gallon of all vehicles on the road in the U.S. was 21 mpg, not 17 mpg. Therefore the numbers below need to be revised.

-------------------------

The Washington Post suggests today in an editorial, "Paying for war," that to pay for the increased cost of war in Afghanistan, that the federal excise tax on gasoline be increased, not to pay for costs for roads and transit--as the estimated cost per mile of driving is 11 cents to maintain the road system as it is, and 20 to 30 cents per mile to improve the system (including transit--but for war, and when the war is done then the money can be dedicated to transportation. From the editorial:

As we have pointed out before, the federal gas tax of 18.4 cents a gallon has not been raised since 1993 and is long overdue for an increase. Two federal commissions have proposed one in the past couple of years. In January the National Surface Transportation Infrastructure Financing Commission said its recommended hike of 10 cents a gallon for gasoline and 15 cents for diesel would raise $20 billion a year.

car culture and automobility, gasoline excise taxes, public finance and spending, transportation planning

A 40-cent increase over five years, proposed by a second federal commission, would cover most or all of the war's costs and still leave gasoline prices well short of where they were in the summer of 2008. Those months showed that higher prices could do much to reduce U.S. carbon emissions -- another national imperative. While most proponents of a higher gasoline tax want to use the money for highway infrastructure, or refund it to taxpayers, Congress could shift funding to those purposes once the U.S. mission in Afghanistan begins to wind down.

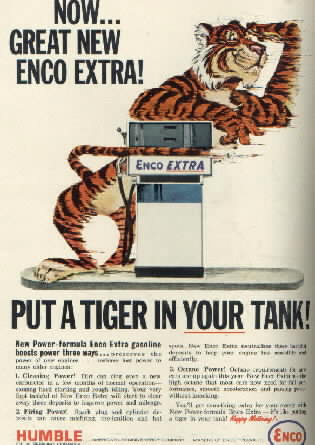

I am not an artist, but for a long time I've wanted to do a political-artistic redo of the old Exxon advertisements with the tagline "put a tiger in your tank" to "put a dead soldier in your tank" to make very clear the links between U.S. foreign and military policy and maintaining automobility and sprawl.

The average yearly number of vehicle miles traveled in the U.S. is about 3 trillion. And the cost to maintain the road system (not to improve it) is about 11 cents/mile, so the total is $330 billion.

The average mileage per vehicle in the U.S. is 21 miles per gallon.

That means that the number of gallons of gasoline consumed in 2008 was about 142,857,142,857.

The average yearly cost of war in Iraq and Afghanistan is about 100 billion dollars.

And probably half the cost of the rest of the military budget is related to maintaining stability in areas where the U.S. has strategic interests related to access to oil. Last fiscal year, that was over $500 billion, so let's say the net dedicated to maintaining access to oil is about $250 billion.

Adding the cost of the wars in Iraq and Afghanistan to this amount equals $350 billion.

So we need to pay $330 billion to maintain roads and $350 billion for the military including wars, totalling $680 billion. Divide that by 142,857,142,857 and the cost is:

$4.76 per gallon of gas.

And the federal gasoline excise tax is 18.3 cents per gallon.

So let's talk about subsidies for driving...

Of course, I think that the gasoline excise tax should be pegged at the average mpg per vehicle, not at the specific rate by car, so yes, people with better mileage would be penalized under this system. But over time, as the average mileage of the fleet of all vehicles improved, the rate could be adjusted.

------------

Note that I have wanted to write about Afghanistan even though it has nothing to do with the blog, which is why I haven't written about it. Today's cover story in the Post by Keith Richburg, "Plan to show possibility, limits of nation building," starts with a flawed premise, that Afghanistan is a nation that needs to be restored to social, economic, and political health.

Actually, Afghanistan is a collection of tribes. It's not a nation. (Of course, I am an expert on this having read the schlock fiction book Far Pavilions many years ago.) Just like Yugoslavia wasn't really a nation either but a collection of ethnic provinces. Or how Czechoslovakia was really two separate nations, etc.

So like with humpty dumpty, putting Afghanistan back together as a "nation," when it was never a nation to begin with, is an impossible task

Labels: car culture and automobility, gasoline excise taxes, public finance and spending, transportation planning

1 Comments:

Single taxpayers pay a 12% tax rate on incomes up to $9,700 in 2020, but they pay 32% on income over $160,725 up to $204,100.

London tax specialist

Post a Comment

<< Home