Reprint: Height Act: It's important to discuss but too late to make any difference on what has already happened

This is a reprint from 2010. It's appropo because people are talking about this issue even more now, including Dan Malouff's (BeyondDC/GGW) nice piece "Height limit questions, answers, and more questions" plus there is a good comment thread.

The major point I make is that people, including me, are arguing theoretically about the impact of the Height Act. I would argue that most of the people discussing it don't have much experience in dealing with developers--I write below "not having a good grounding of how the various real estate submarkets might function and interact under a change in the height act."

There is no way that changing the Height Limit tomorrow will lead to an immediate decrease in commercial or residential rents (something that Matt Yglesias argues in "Living Social and the Folly of Targeted Job-Creation Subsidies" and elsewhere--note that I agree with his general argument about how cities should focus on what we might call supporting the architecture of exchange, rather than providing incentives to specific types of businesses).

Changing the Height Limit won't result in commercial property value decreases, although on a per square foot basis, value would fall. But this drop would be countered by increases in overall property value resulting from an imputed value increase based on the new allowable total square footage being added to each lot in the impacted area. Rents wouldn't change.

Below I argue that it would take two to four decades to have the kind of real impact that people say will happen if taller buildings are allowed. I think, in reality, that it could be even longer, more like 50 years.

It takes that long to have the kind of substantive increase in supply/inventory of rentable commercial and residential space necessary to have a significant impact on rents.

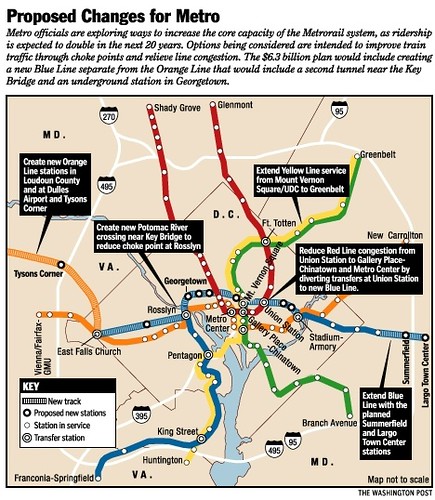

The other thing that I would argue for, which I haven't as of yet, speaking of transit, that there has to be linkage with adding high capacity fixed rail transit service to the core, to support more density.

The WMATA subway system will reach capacity in the core in the middle of the next decade. So if you want to support higher density with taller buildings in the core of the city, you have to have more transit service. That means the separated blue line at the very least. (I lament that the way the WMATA system was designed that you can't retrofit double deck subway cars into the current system.)

Changing the Height Limit should only be allowed if linked to a commitment to add high capacity fixed rail transit capacity at the core of the city.

Proposed separated blue line. Washington Post graphic from 2002.

-------------

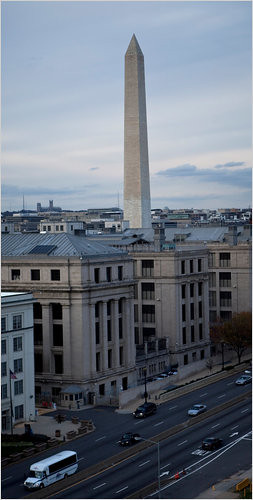

Brendan Smialowski for The New York Times. The Washington Monument stands 555 feet high. In 1910, 26 years after the monument was completed, Congress passed an act limiting the heights of buildings in the capital. Most Washingtonians say the act preserves the unique nature of their city.

The DC height act has been in the news for awhile. The act limits commercial buildings to about 160 feet.

Witold Rybczynski lectured about it at the Building Museum. The New York Times ran an article, "Washington Rethinks Its Rules on Building Height." Blogs cover it. And the City Paper is about to publish an article on the topic. Plus, Monday Properties has broken ground on a 35 story office building in Rosslyn, in Arlington County ("Monday Properties breaks ground on 1812 N. Moore St." from the Washington Business Journal).

I've been arguing for about 4 years maybe, in a theoretical argument only, that the Height Act should be punctured, in order to allow for the preservation and extension of local commerce, to allow for the provision of somewhat economical space in commercial buildings.

Without more space and at a lower cost, all uses other than those where proximity to the federal government is highly valued, are displaced from core of the city, especially the central business district. Note that to some extent, because of the fact that the downtown real estate market is a national and international market, all commercial space in the city to some extent is valued more highly than it would be otherwise. I've written a lot about this over the years in terms of commercial property taxes. See "Avoiding the real problem with DC's property tax assessment methodologies" among others.

I think my bonafides on historic preservation are pretty well understood.

But I came to this position after having been involved in neighborhood revitalization and commercial district revitalization issues in the Greater H Street neighborhood for a number of years, I came to realize, especially after pondering, analyzing, and observing the process of development and commercial expansion across the city.

In Death and Life of Great American Cities, Jane Jacobs writes about the need for cities to maintain a large stock of old buildings--in order to seed and maintain innovation. That kind of space doesn't exist in DC. Not anymore.

Instead, marginal commercial space and residential neighborhoods abutting the central business district have been "reproduced" into higher density commercial and residential districts (cf Social Production of Urban Space by Gottdiener) and "Downtown" (the central business district) has been expanded through outward expansion east mostly (East End of downtown, NoMA) and south (M Street SE, "Capitol Riverfront District"), not to mention the expansion of Arlington, Alexandria, Bethesda, and Silver Spring as metropolitan office centers directly competitive with DC (to a large extent, the forces that drive the success of Tysons Corner, Reston, Fairfax County more generally, and the I-270 corridor are somewhat different), is in fact a result of the building height restriction in DC.

The thing is, now, it's too late, it doesn't matter. Because NoMA and M Street SE and the warehouse district along 1st and 2nd Streets NE is changed and changing and it can't be changed back.

And commercial rents in DC, especially in the "Central Business District" are amongst the highest in the U.S. See "DC office rents top those in New York City from the Washington Post.

Of course, that's what Molotch says the local political and economic elite wants. As the abstract from "City as a Growth Machine: Toward a Political Economy of Place" states:

A city and, more generally, any locality, is conceived as the areal expression of the interests of some land-based elite. Such an elite is seen to profit through the increasing intensification of the land use of the area in which its members hold a common interest. An elite competes with other land-based elites in an effort to have growth-inducing resources invested within its own area as opposed to that of another. Governmental authority, at the local and nonlocal levels, is utilized to assist in achieving this growth at the expense of competing localities. Conditions of community life are largely a consequence of the social, economic, and political forces embodied in this growth machine.

Although Washington Post business columnist Steven Pearlstein argues that's ok, that the region can develop "back office" functions at lower cost in places like New Carrollton, that this serves the region, even if it doesn't necessarily serve DC, as DC has the highest unemployment rate of all local jurisdictions, where a certain segment of the population remains extremely unemployed. (This would be somewhat comparable to how places like Jersey City and Hoboken in New Jersey, and Brooklyn and Queens vis-a-vis Manhattan function in the context of regional economic integration and commerce in New York City.)

Most people are arguing theoretically, not having a good grounding of how the various real estate submarkets might function and interact under a change in the height act.

Although I suppose on a long time frame, 30-50 years, changing the height limit would make a difference in terms of reviving downtown and extending the ability of the business district to compete on a metropolitan basis and have space for innovative uses.

But then, you lose the viewsheds to places like the U.S. Capitol and the Washington Monument.

There are no easy tradeoffs.

Basically there are three types of arguments:

1. Historic -- don't change the height limit because it gives Washington overall an attractive overall built form and preserves desirable viewsheds.

2. Economic -- DC office space goes up in price and becomes less economic, therefore hollowing out commerce in the city and driving innovative commerce to the suburbs.

3. Open Space-Smart Growth-Transportation -- more intense development in the core of the region preserves open space and minimizes sprawl and exurban development. Steve Belmont in Cities in Full argues for focused development on the core because transportationally speaking this is much more economic and efficient (monocentric vs. polycentric development patterns).

Some people argue that historic preservation and aesthetic considerations mean that the height restrictions should stay in force downtown, but maybe other parts of the city can allow higher buildings.

That this could promote economic development in underdeveloped places such as Anacostia.

That may be the case, but it promotes a different kind of polycentric sprawl, merely within the city, something I call intra-city sprawl, and it is dissipates the value of agglomeration ("agglomeration economies") that a central business district is supposed to generate.

I'd favor a change in the law, even downtown. But it will take til after I am likely dead to see the necessary changes result.

Labels: historic preservation, intensification of land use, sustainable land use and resource planning, urban design/placemaking

7 Comments:

Well, as usual you bring an adult perspective to this.

Time is always the biggest unstated equation here. As in short term/long term. And I agree, it will be very long term.

In terms of the agglomeration economies, I think you are overstating the case here.

Look at the list of private employers in DC. All hospital and education in the top 10. Most are tax-exempt.

(you get a sense when Living Social, with something like 800 employees in DC, is considered one of the largest "private" employers, in one place. Advisory Board is another.

Then look at the region -- who are the big employers. Again, healthcare and then defense contrators.

After that, you're back in law firm terrority. Hogan was maybe 800 people in DC. Other firms total in the 600+ range - and I am including support staff.

As I said on GGW, well over half of "Downtown DC" employemnet is federal, World Bank, or diplomatic. Federal consultants are another huge chunk, and they work in federa building.

And the reason you don't have agglomeration here isn't the real estate -- is the the occupations.

All the height limit could do, at best, is get various defense contractors to move from Vienna into DC. They do move out to Tysons because it is cheap.

Name a few firms here that aren't "takers." Corproate Executive Board and Advisory Board. Microstragy. Mariott. And now HIlton and VW although their head count is very very low.

For almost everyone else, there is a value add to being close to the feds. In the case of the biggest -- defense contractors -- being close to the Pentagon, Mark Center, Ft. Belvoir and Ft. Meade.

Oh yeh, no question about the federal interest and maybe even about my overstating the case.

E.g., takers include telecommunications (DARPA, DOD, FCC) and MCI/WorldCom, PSINet, AOL, BellAtlantic even (Verizon isn't based in NoVA like Bell Atlantic was).

I am not necessarily talking about "huge" businesses, but lots more smaller knowledge based businesses, along with a lot more arts uses, etc. (E.g., in Minneapolis a few years ago, the alternative weekly had lots of ads for music rehearsal studio spaces in under used warehouse buildings.)

There are other issues involved in industrial ecologies and the business ecosystem though. E.g., I remember reading an obit for a CUA engineering professor and how he started lots of businesses, but based in Howard County, where he lived.

again, the aggloermation exists but only because of the feds. Take Nextel,for instance. They started because of the Jones/Day telecom law department realized they could buy taxi radio licences instead of the A/B block lotteries. Or MCI, when it was on 19th st, so they could be next to the FCC.

AOL is one example contra that, and also Dan Synder. There are others.

The biggest reason I've heard tech poeple move out to Tysons is the savings on parking.

Really the same problem as SF; DC is just becoming the consumption capital of the region, but the real economy exists outside of it.

Experience the journey into data with unbeatable savings assisted by exclusive coupons from 365 Data Science! 365 Data Science is a comprehensive platform for courses in data analytics, statistics, machine learning, programming, etc. The course materials have been designed to cater to beginners as well as professionals and consist of structured learning routes, real-life projects, and lessons conducted by experts. 365 Data Science Coupons allow you to access top-quality education and skills development at subsidized prices. For those aspiring for career growth or want more insights into data science, these coupons will make a great chance for investment in your future. So do not miss this opportunity to gain useful knowledge and save your money.

At online quran classes we’re dedicated to bringing the beauty and depth of the Quran to learners of all levels.

nadra card uk is always ready to offer easy solutions and great support for any issues you have.

Great points on why height and design matter so much in urban spaces. It’s an important discussion that’s often overlooked. I also like finding useful coupons & deals that make exploring cities more accessible.

Post a Comment

<< Home