Building a Better Gas Tax – A New 50-State Report from ITEP

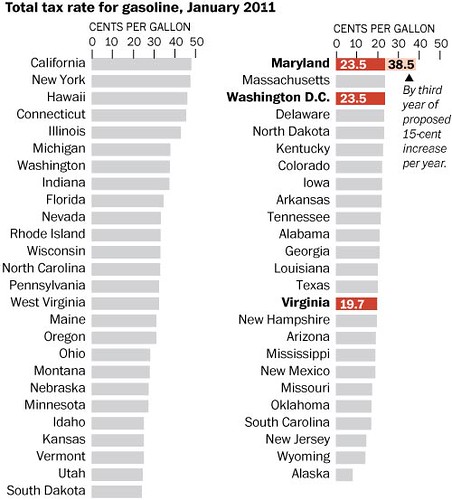

Gasoline excise taxes, U.S. Washington Post graphic.

Maryland and Virginia are among 17 states that have not increased their gas tax in the last 19 years, according to a new report from the nonprofit, non-partisan Institute on Taxation and Economic Policy entitled Building a Better Gas Tax: How to Fix One of State Government's Least Sustainable Revenue Sources. The report is the first of its kind to examine the impacts of every state's gas tax rates.

According to the executive summary:

Unfortunately, most state gas taxes are built to fail. Thirty six states levy only a fixed-rate tax that collects the same number of cents in tax, year after year, on every gallon of fuel purchased. But as this report shows, inflation has been eating away at these fixed rate taxes as the price of asphalt, concrete, and other transportation construction inputs continues to grow almost every year.

• After adjusting to account for growth in construction costs, the average state’s gas tax rate has effectively fallen by 20%, or 6.8 cents per gallon, since the last time it was increased. Among the 36 states levying only a fixed-rate tax, effective gas tax rates have plummeted by 29%, or 9.5 cents per gallon since they were last increased. New Mexico (20.1 cents), Montana (18.5 cents), and Maryland (15.8 cents) have seen larger absolute declines in their gas taxes than any state other than Alaska.

The report shows that the average state has not increased its gas tax rate in over a decade, and fourteen states have gone twenty years or longer without an increase. As the cost of paving roads and building bridges rises, the tax that’s designed to pay for them keeps shrinking.

Adjusting for construction cost growth, the average state’s gasoline tax rate has effectively fallen by 20 percent, or 6.8 cents per gallon, since the last time it was raised. Diesel taxes have fallen by a similar 18 percent, or 6.0 cents per gallon.

The report offers three policy recommendations for modernizing state gas taxes:

1. Increase gas tax rates to (at least) reverse their long term declines.

2. Restructure state gas taxes so that their rates rise automatically alongside the inevitable growth in the cost of transportation construction projects.

3. Create or enhance targeted tax credits for low income families to offset the impact of gas tax reform.

I make a similar point to #3 when objections are raised to congestion charging, car registration fees to support local transportation initiatives (this is a practice in the State of Washington), tolls, or increases in transit fares (more about this locally, later), because of the impact on people with lower incomes.

The point isn't to not do the right transportation policy, based on sound economics, because people with less income will have a harder time dealing with the cost impact, it's to provide other means of assisting people with lower incomes in dealing with the impact, such as with tax credits, special transit fare programs, etc.

For example, a transit agency isn't a social services program (well, it is but that's another issue, and is perceived as one by most people who don't ride transit besides). Fare decisions should be made based on system needs and regional transportation planning goals and objectives. Transit operators can and should set up programs to assist the less well off in using transit, but they should also be receiving monies from other sources to do so.

Labels: car culture and automobility, gasoline excise taxes, taxation, transportation planning

0 Comments:

Post a Comment

<< Home