Great quotes from Marc Ratner of Streetsense

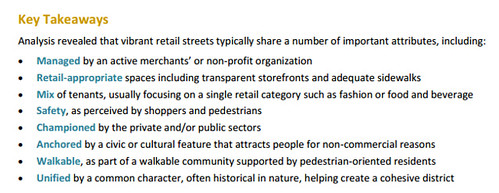

Streetsense is a national retail development business and consultancy based in the DC area. Among their projects, a few years ago DC commissioned them to do a study on traditional commercial districts outside of traditional downtowns, DC Vibrant Retail Streets Toolkit. They've since gone on to develop the approach more broadly, and have produced a book on the subject, marketed on a separate Vibrant Streets website.

-- DC Vibrant Retail Streets Toolkit and Implementation, DC Office of Planning

The Washington Business Journal has an interview (subscription required), "Rebel with a cause: How Marc Ratner is working to transform neighborhoods," with one of the company's founders, Marc Ratner, and a couple of his quotes were particularly interesting:

What is different about D.C.? There is probably nothing more powerful in this country — even if it is fucked up right now — than the fact that this is the capital of the U.S. This is where our government exists, and it is going through this enormous shift where it can’t figure out what it wants to be right now. Its identity crisis is the result of the collective’s identity crisis.

What else? We happen to be a progressive, moving society today that is embracing diversity. I mean, New York has always been a cultural city, and we are now finally at that place. And it has been happening in the past 10 years. Not that it didn’t exist before — the Howard theater has a major historical impact and place in culture today. I just

think that D.C. is now becoming an alternative to New York. It’s a more manageable city and offers many of the same sensibilities, but I think the most interesting thing that, unlike other cities, that you have this movement going on, but it is rooted in these [historical] pillars and framework. And they coexist in a really unique way.

Hardest lesson learned: You can’t force people to change. You can only provide the compassion and understanding and insight to try and help them get better. People can only get better if they allow themselves to have the opportunity. Some people don’t have the ability to do that. What frustrates me, and it’s the lesson I have learned, is that not everyone is capable of change.

Labels: commercial district revitalization planning, real estate development

11 Comments:

Meh.

Is retail in DC much different than any other strong market US city?

And if you include restaurants, maybe sweet green and five guys would work on a leaderboard.

The quote from the other WBJ article on the CRE is more interesting:

"The "aha moment" for the venture came about a year ago as Brightline and McWilliams Ballard were unveiling their research for an undisclosed firm with about 12 million square feet of office space in the D.C. region. It occurred to the group that most commercial and residential developers rely largely on market comps and other benchmarking data on similar projects to determine when's the best time to start moving on their own.

That information can tell you how quickly properties in the same area were leased up, at what rental rates, and whether they offer a fitness center or rooftop deck. But it can't predict with any great certainty how quickly the next one will lease up, since if it did, it's less likely there would ever be a problem of developers building too much office space or two many new condos. It's not much more help to the owners of older buildings that have lost their tenants to those newer projects.

So, instead, Brightline and McWilliams Ballard came up with a new model, relying heavily on extensive polling of prospective and current tenants to determine not just what they're willing to pay in rent but what will most heavily influence their decisions. That kind of polling can be as exacting as for a political campaign, with the same questions asked in different ways and sequences to get at what's most important for the C-suite as well as the employees who influence their decisions. With that information, landlords can adjust not just where they're concentrating their resources but what aspects of their buildings to emphasize in marketing materials or other leasing efforts to have the most appeal to the most targeted audience."

my emphasis.

Streets sense has a new project near 19th and M -- where they ripped the face of an older building and put in a new retail front. We'll see if they get a tenant.

I don't think DC is unique, but the point about what it wants to be is important.

I read that other article too, and I thought it was very interesting but again, not unlike your reaction to these quotes, not so much new, as newly recognized.

Buildings are just envelopes. Before tenants were driven solely by price. Now they are more concerned with place attributes, for a variety of reasons. Partly because of staff recruitment and retention and the "new" cohorts are interested in some different stuff.

E.g., when I wrote the big paper on how Walter Reed should be a biotech life sciences campus, not residential/retail, one of the examples of how research parks are changing is Research Triangle Park, and they are adding retail and housing and activity centers, when it has been a bunch of proximate but separated and independent auto-connected research buildings and sub-campuses.

Like the Vibrant Streets Toolkit, I presume that the McW-Ballard is a good framework for this.

The difference too is now (some) firms are more concerned about retaining employees than pleasing CEOs (e.g., how the reason firms would relocate to suburban Connecticut and to the Boca Raton areas was because that's where the newly hired CEO already lived.)

related:

http://www.wsj.com/articles/mall-owners-push-out-department-stores-1468202754

i'm gonna write a little piece in response to last week's piece about "coffee and bike shops." The WSJ piece fits in to that framework.

It's "more complicated" than the WCP writer made it out to be.

It's about adding social and experiential retail. Food is consumed every day, bikes not so much.

More and more "retailers" are adding food and therefore social and sometimes experience to the mix, to build repeat business.

Plus there is a new focus on interesting and different vs. standardization in "chain" retail.

Urban Outfitters vs. CVS or Macy's.

Or if not interesting and different in terms of space, in terms of frequent turnover of merchandise in so called "fast retailing" or "fast fashion" like H&M.

I regret now not checking out Primark when I was in Essen.

But Primark in the US won't succeed if they tie most of their retail strategy to co-locating with Sears.

They're probably smart enough to figure out they'll need to go their own way.

Yeah.

Don't mean to sound pissy -- I just find your analysis of retail far more cogent and connected than Streetsense. Granted you have the luxury of analysis and not packaging things for clients.

Also this --just opened on 14th and Florida.

http://dcist.com/2016/06/pizzeria_vetri.php

(see connection to Urban outfitters, which confused a lot of retail people when they did they deal).

My random intellectual passion this week is the Italian maritime city states and the value of banking. think pisa vs genoa etc.

well, generally I think Streetsense does decent enough work.

1. a few years ago one of their top people linked to one of my master pieces on the state of retail in the city on his linkedin feed.

2. I argued with a streetsense person a few years ago at a conference in Philly. There was a presentation on this cool district in St. Louis. I went up to the guy and asked him what his rent was. I can't remember exactly but it was under $10/s.f.

the streetsense person came up and started talking to him about how to apply what he said to Adams Morgan.

I scoffed and said when you're paying $45/s.f. or more, the kind of funky "naturally occurring" cool retail district isn't possible.

They don't seem to get that. They get the loulou's and other chainlets.

As you know for years and years I've been making the point that relative to the sales potential per s.f., DC's commercial retail rents are much higher than what is justified.

... getting back to your very first sentence, which I never exactly responded to:

Is retail in DC much different than any other strong market US city?

Um, yeah, it's much less interesting and creative. Excepting as you say, some restaurants. But is sweetgreen all that different from a bunch of regional chains on the west coast?

Five Guys ''cause they were 'first' among the better burger chains starting in the 1980s, but you could say, what about In-n-Out Burger? The only reason why 5 Guys is big is because they franchise, In-n-Out doesn't and they won't go national because they don't want to compromise their quality standards.

banking... as a facilitator of substantive economic activity is really interesting.

great little section in _Death and Life_ about a community bank located in an urban neighborhood and still committed to investing there was a non-redline example of success.

I was really sad when Shorebank went bankrupt in Chicago, it was a longtime example of a community development oriented bank. I think the group that took it over is still community-oriented.

maritime banking back in the day super fascinating, although I don't know much about it. Just read a schlock fiction book that involved salvage from a wreck from the 1850s, and the issue of financing maritime ventures, all the wrecks, and making scads of money from the ships that made it. Etc.

+ the Bank of North Dakota. There is an article in the new issue of Governing about the treasurer of Chicago, and a big focus of his is promoting local business, funding it etc.

The problem with this stuff is that when it gets political lots of bad decisions are made, suasion, etc.

But I have been thinking of a banking model that combines technical assistance/coaching with loans, like Shorebank + SCORE and other incubator-bus. development programs.

... because in the US, the cost to do anything is larger than what could work through the equivalent of Grameen Bank type microfinancing.

... kehs are interesting too (Korean community financing).

U R right, capital formation is interesting. (I haven't read Piketty but it's all about capital -- as a class, because yes, some individuals will lose their capital, but overall as a class, capitalists get consistent and greater returns compared to labor.)

Is it the high retail rates, or the awful clients?

Where else can Ann Taylor be selling so much women's clothes?

(and again, what sent me off on this rant was the DC=NYC Jr. thing. Not only is it dated, just not true. Retail in NYC is 100x more interesting)

And that is my point on capital and cities.

See this:

http://qz.com/728517/in-the-euro-zones-latest-crisis-italy-is-torn-between-saving-the-banks-or-saving-its-people/

Italian banks made the cities - Genoa, Florence? Did that cause a particular type of city to be created? Is that why NYC is such a singular place in North America (and getting more singular).

As I say to my NYC friends, DC is great. Like Brooklyn or Queens.

NYC kept getting agglomeration benefits and further concentrated, but SF, Chicago, Boston, Baltimore (the first real investment bank, Alex. Brown, was founded there), I don't know about Philadelphia, and to some extent St. Louis were all major banking centers, albeit regionally.

E.g., cities, though, wrt your point about Italian cities, would be the contrast between SF and the banks there, and LA, which didn't really have significantly major banks until the postwar era and some massive S&Ls.

'bout Italy, it should be both, help the banks, but the "loanees" too. That didn't really happen in the US 2002-2009 bailout.

So the virtue thing took hold -- it's bad to let people off the hook, when big companies were (and still are) walking away from loans, giving the keys to the bank, etc.

Why should big companies be able to disavow themselves of debt and still be virtuous while individusla cannot?

Very off topic.

http://fivethirtyeight.com/features/homicide-in-new-orleans/

Thanks. While the point about a small group of people mostly being involved in crime is not new, even if a sociologist didn't start documenting it til 2001, e.g., I remember an article in Chicago Magazine from sometime between 1990 and 1994--I was considering moving there and so I subscribed--about the most dangerous police precinct and how much of the crime was generated by a small group of people, it's still important.

Also how the article makes the point that people with a propensity to commit crimes need to be addressed in a manner different from addressing structural poverty, that you can address the latter but it will not address the factors and circumstances that influence individuals specifically.

I'd say probably LT poverty reduction strategies make a difference even on crime, but in the ST and Intermediate Term, not, and to reduce crime in the here and now you need the more focused strategies.

In the LT you still need those strategies as crime waxes on a cohort basis, but "hopefully" (I have to believe after all) the general propensity for criminal activity will be suppressed as neighborhoods and households are reintegrated into society and the economy. (Which excepting for the work of W.J. Wilson e.g., "when work disappears" maybe won't be able to happen...)

Post a Comment

<< Home