When BTMFBA isn't enough: keeping civic assets public through cy pres review

Buying and holding buildings for arts uses. In "BTMFBA: the best way to ward off artist or retail displacement is to buy the building" I discussed my incredulity at how the local arts community in DC doesn't seem to understand that if they don't want to be displaced, they have to own the properties they are using for artistic endeavor.

This isn't a new idea.

This isn't a new idea. In Pittsburgh, the Pittsburgh Cultural Trust runs a number of downtown cultural establishments.

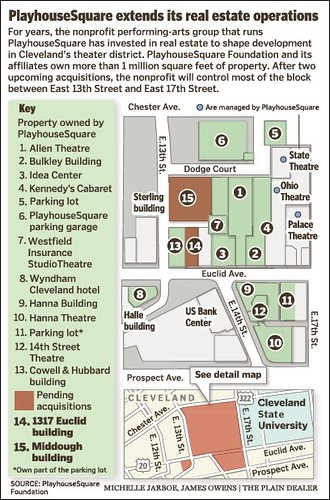

The Playhouse Square Foundation does the same thing in Cleveland, but also takes on a greater role in real estate development beyond arts uses. I wrote about Cleveland here, "Real estate value capture and the arts."

At the neighborhood scale, the Gordon Square Arts District in Cleveland is another example.

But there are hundreds of such examples across the country.

Buying and holding retail spaces for retail uses, rented at below market rates. Comparably, in Paris, the Vital'Quartier initiative charged the community development corporation SEMAEST to buy and hold real estate and rent it to desired retailers at sub-market prices.

According to Next Paris ("Opération Vital'Quartier: pour le commerce de proximité à Paris!") so far the initiative has supported 372 businesses and controls more than 500,000 s.f. of in-demand retail space.

What do you do when the arts organization sells the property to the highest bidder and the space is removed from the portfolio of civic assets supporting arts (or other public) uses? There are many examples of arts uses being a component of an otherwise for profit development. Usually these are generated by proffers by a developer in return for zoning bonuses and other allowances. If they are negotiated well, the artist use is protected in perpetuity by an easement.

But a lot of times, at least in DC, such proffers are not protected by including easements or other protections to keep the space dedicated to arts uses. Instead there is a belief that the organization "can be trusted" to do so.

A few years ago, in the case of The Source theatre, the city had to step in and stop the conversion of the sale of the building to a restaurant group ("Debt-Ridden Source Theatre Closes, Plans to Sell Building," Post). But that was a rare direct action by the city, which had provided capital improvement funds to the theatre company.

Similarly, but with a much different outcome, the city through the Attorney General's Office, was a party to the dissolution of the Corcoran Gallery of Art through what is called a cy pres proceeding:

The doctrine originated in the law of charitable trusts, but has been applied in the context of class action settlements in the United States. When the original objective of the settlor or the testator became impossible, impracticable, or illegal to perform, the cy-près doctrine allows the court to amend the terms of the charitable trust as closely as possible to the original intention of the testator or settlor to prevent the trust from failing. -- Wikipediawhere they represented the public interest in nonprofit organization's operations.

But sadly, the Corcoran was allowed to shut down ("National Gallery of Art acquires 331 more works from the Corcoran," Post). In "Should community culture master plans include elements on higher education arts programs?" I realized two years too late that the idea should have been "put out there" that the city should have taken over the Gallery and converted it into a locally-focused fine arts museum.

Mather Building, G Street NW, Washington, DC.

Another case of an arts group selling their space to the highest bidder is the Cultural Development Corporation, which had two floors of the Mather Building, located across the street from the Martin Luther King Library.

The building was converted to a condominium more than a decade ago ("D.C. sells long-vacant Mather Building" Washington Times; "Mather Building Renovation Set," Washington Post, 2001), and because it was in an arts overlay zone promoting arts uses downtown, some of the housing was sold to artists (live-work) at a discount, and space was provided--to Cultural Development Corporation--for arts uses.

A cy pres review should be initiated. But Cultural Development Corporation sold their space ("CulturalDC Sells Flashpoint Gallery," Washington City Paper) and they claim this will benefit cultural activities in the city. From the article:

CulturalDC, a prominent D.C. arts incubator, has sold its downtown office space and will search for new headquarters. CulturalDC will continue to operate Source, its theater space on 14th Street NW, and other programs around the District, but it will be shuttering Flashpoint, the longtime art gallery that shares its home at 916 G St. NW.I believe that in such situations, it should be automatic that the Attorney General's office initiate a review of the transaction, and that it likely would be best for there to be an automatic "pre-sale" review of such transactions to determine whether or not they are in the public interest.

The organization put the second floor of its Gallery Place base up for sale last fall, according to interim executive director Tanya Hilton. Groups such as Fringe Festival, Washington Improv Theater, and Step Afrika! got their start in that second-floor incubator space. “Twelve years ago, it was a thriving haven for artists and nonprofits that had a need for administrative space,” Hilton says, but in recent years the space has since gone under-used.

While CulturalDC only intended to sell its second floor, Joe Reger, principal for JCR Companies, approached CulturalDC with an offer for both: the offices as well as the storefront gallery Flashpoint and the black box Mead Theatre Lab.

“We weren’t really expecting that,” Hilton says, who would not disclose the final sale figure. “The great news is that it gives CulturalDC the opportunity to really expand and move forward and have a bigger impact on the arts community, not only in the short term but in the long term.”

I would aver that the transaction should not go through, if keeping arts spaces downtown is a planning priority, and because the Cultural Development Corporation received control of these properties through extra-normal consideration and preference within land use planning processes.

Note that I recognize that an arts organization "incubator" or office space doesn't have to be Downtown. But losing a gallery in a prominent location is an unrecoverable loss.

The YMCA at Rhode Island and 17th Street NW as another example. I never got around to writing about a similar experience with the YMCA in Dupont Circle. They sold their property to a developer and the recreation use at that site was abandoned.

YMCA said they didn't have experience with a facility serving both workers and residents and that they tried their best to increase membership but were unsuccessful ("Downtown YMCA to close amid rising competition from upscale gyms," Post; "Akridge to redevelop YMCA at 1711 Rhode Island as boutique office," Washington Business Journal). From the Post:

The YMCA approved a deal to sell the hulking, 1970s concrete building to Akridge, a big local developer, for an undisclosed amount. At 100,000 square feet, it’s the YMCA’s biggest facility in the region, and the property, according to the D.C. Office of Tax and Revenue, has an assessed taxable value of $27.2 million. ...The building that will replace the YMCA.

The National Capital facility was never a typical one for the YMCA. The nonprofit organization traditionally serves neighborhoods, not business districts, and Reese-Hawkins said the money from the sale of the building will boost the organization’s community, after-school and summer programs throughout the region.

She hopes to eventually open another full-service YMCA in the city and is in talks with community leaders to assess the best fit. There are no gyms in the District east of the Anacostia River, and Reese-Hawkins said it is possible that one could land there.

Hope is not enough.

DC activities should benefit disproportionately from the sale of the property, since it enjoyed property tax exemption benefits conferred by DC and it is likely that this facility was one of the highest value assets owned by the organization.

The public interest in the disposition of that property should be protected at the very least by an automatic cy pres review of the transaction.

For example, could a development there have been constructed in a manner that co-located other uses with the continuation of the recreational use? Could the building have become jointly owned with the city's parks and recreation department? (Another reason why parks plans should include recommendations concerning other parks and recreation assets in a community not necessarily owned and operated by the local jurisdiction...)

Granted, DC has fewer options than other jurisdictions because of the height limit. For example, a way that the YMCA could have generated money from the value of the property would have been to sell a form of "transferable development rights" to a developer to make a bigger property elsewhere. But for the most part that is a tool not available in DC because of the height limit.

Note that a cy pres review isn't a slam dunk. In New York State ("A New Cooper Union," Student Activism), California, and Pennsylvania there are many examples of the State AG engaging in such matters and representing the public interest.

However, in DC, so far the AG's Office hasn't proved to be all that willing to buck real estate interests, which are the leading industry in the city, and these transactions generally benefit real estate development at the expense of the public interest.

-- "The Cy Pres Doctrine in the United States: From Extreme Reluctance to Affirmative Action," Frances Howell Rudko, Southern New England School of Law

But in terms of developing the capacity of the DC Attorney General's Office to one day take over criminal prosecution authority from the federal government, developing a proactive approach to oversight of nonprofit organizations in the city would be an important step ("Participatory "budgeting" and disposition of funds from legal settlements").

Labels: arts-based revitalization, arts-culture, attorney general, cultural planning, law and the legal process, legal settlements, nonprofit management, urban design/placemaking

1 Comments:

https://www.crainsdetroit.com/nonprofits-philanthropy/city-birmingham-sues-community-house-maintain-center-site

City of Birmingham sues Community House to maintain center on site

12/2/2025

The city of Birmingham has sued the nonprofit Community House to enforce deed restrictions that require its downtown property to be held exclusively as a community center for Birmingham residents.

It is asking the court to issue a temporary restraining order to prohibit the sale or transfer of the property for any purposes that violate the deed restrictions.

“Such a sale is expressly prohibited by the governing deed restrictions, violates the 1989 Probate Court order and would permanently deprive the residents of the city of Birmingham of a unique civic and charitable asset intended for their benefit,” Kathleen Martone, the city's attorney with Varnum Law, said in the filing.

The lawsuit comes after the nonprofit Community House, in operation for just shy of 100 years, announced its plan last month to end its early child care and event rentals programs, lay off most of its employees, sell the historic property and convert itself to the Birmingham Area Community Foundation, effective July 1.

The moves are part of a plan to ensure its viability and help fund a permanent endowment to support other nonprofits focused on education, wellness and cultural vitality with grants and mentorship as well as provide scholarships for local students pursuing education beyond high school, the Community House told Crain’s last month.

But the city — giving voice to pushback from residents — is concerned that a sale of the Community House property to a private, third-party buyer might lead to development that isn’t consistent with the deed restrictions that it continue to operate as a community center, it said in the court filing, noting that any sale to a non-charitable, private party is expressly prohibited.

The Community House was originally formed in 1927 to promote social, civic and philanthropic activities for the benefit of Birmingham residents. It created a community trust in May 1928 to hold the real estate and executed the deed of trust in 1930, conveying the property it held to a board of trustees.

A 1989 order subsequently terminated the deed of trust and transferred the property to the Community House. The order expressly reaffirmed that the Community House must hold the property in accordance with the terms and conditions of the original 1930 trust, the city said.

Additionally, under the Dissolution of Charitable Purpose Corporations Act, a charitable-purpose corporation may not dissolve, convert, merge or amend its organizational purposes without notice to and the oversight of the Michigan attorney general, the city said.

The Community House’s plan to shift its charitable purpose and liquidate its principal charitable asset constitutes a termination of charitable purposes, the city said, and therefore requires review by the attorney general — who is also a party in the case — and compliance with the deed restrictions.

Post a Comment

<< Home