Real estate value capture and the arts

Playhouse Square, looking west, Cleveland, Ohio in the Fall of 1956.

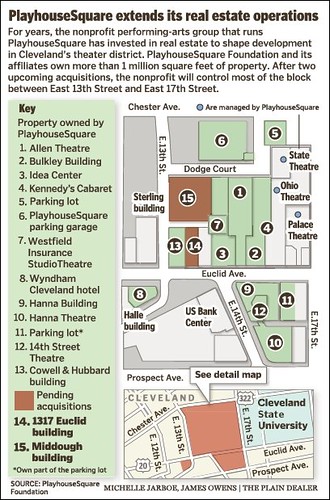

The Cleveland Plain Dealer has an excellent article, "PlayhouseSquare stars in its own real estate revival," about Playhouse Square, the arts complex on Euclid Avenue, and how 30% of its revenue comes from properties (offices, hotels, etc.) located around the district, and how these revenues are used to support the arts functions of the overall organization. The article covers the organization's real estate strategy, which is more focused on revitalization than it is revenue generation specifically.

This story from the Plain Dealer, "40 years ago, a spark helps Cleveland's PlayhouseSquare find its way back to the lights," tells the story of the person who made it happen. And as pointed out in the article, the revitalization of Playhouse Square fostered revitalization of the Warehouse District and other parts of the downtown.

Cleveland at one point was the nation's fourth largest city and has the building stock and square footage of commercial space to show for it. The abandoned May Company Department Store has one million square feet alone--equal to all of the space on H Street NE and Hechinger Mall in DC. Focused development strategies such as these are necessary to revitalization.

Labels: arts-based revitalization, public finance and spending, real estate development, taxation, urban revitalization

0 Comments:

Post a Comment

<< Home