Incredibly short term memories

Don't know if you remember after Ronald Reagan died, when almost everything published about him in newspapers was laudatory, no mention of the bad things, and there were plenty of bad things that he did.

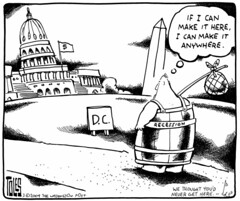

What gives with the Washington Post writing that "Washington" is that "oops, Washington isn't recession-proof after all"? See "Long Insulated By Government, Region Dragged Into Downturn" and this column by Steven Pearlstein, "There's Now No Question: Region Is Not Recession-Proof," plus this Tom Toles cartoon.

Who in their right mind would have ever argued that it is? You'd think that with the Post articles backfile that they would know better.

When I first moved here in 1987, it was on the eve of the Savings and Loan debacle. Many local financial institutions went out of business (National Bank of Washington, Madison Bank, Perpetual Savings and Loan). So did many retail companies (Garfinckels, Woodward & Lothrop, Raleighs). In 1989, at least in DC, the real estate market tanked and stunk for about 11 years. Residential home builders such as Van Metre Corporation (in Virginia) declared bankruptcy.

Or the big mergers of MCI and Bell Atlantic's (Verizon) moving between different areas had negative effects. The destruction of value in the Dot Com failure killed many local companies that had been high fliers such as PSI--remember PSI stadium in Baltimore? Ciena? Etc. The merger of May Company into Macy's meant that the locally-headquartered Hecht's department store chain riffed many many workers. Etc.

Remember the bump in the economy in 2003 that led WMATA to fire most of its engineering and planning personnel, and devolve authority for transit expansion planning to the individual jurisdictions?

DC's fundamental bankruptcy in the mid-1990s. The ongoing financial trauma of the Prince George's Hospital System? (see this archive of coverage of the hospital debacle from the Post).

Note: added, based on imgoph's comment -- and how the tourism market has tanked since 9/11/2001 because of the drop off of international tourists/visitors to DC--international visitors spend more money per trip than typical American tourists to DC It took more than one year for restaurants and nightlife to recover in places like Georgetown, which immediately after 9/11 had about a 40-50% drop off in business.

Recession proof?

Granted the employment engine of the federal government is relatively steady, but that doesn't mean that different parts of the region don't function differently in terms of the economy.

Northern Virginia is defense focused, along with consulting and technology (related to the proximity of the Dept. of Defense). Alexandria and Arlington also have a fair number of trade associations desiring proximity to the federal government at cheaper rents than are available in DC.

Montgomery County is focused on biotechnology (related to the National Institutes of Health) and technology (in part due to the National Institute for Standards and Technology). I couldn't really say what Prince George's County's competitive advantage is, maybe the University of Maryland, although the University is inadequately leveraged by the local economy. (Added--plus as kenf points out USDA and NASA facilities.) DC is focused on law firms, trade associations, lobbyists and other organizations that value access to the federal government, especially to influence policy.

As companies got larger and larger, and more and more leveraged (e.g., Bearing Point includes the consulting operations of a number of accounting firms including KPMG and Andersen Consulting, and because the consulting side of the business had much higher margins than the auditing-accounting side of the business, they broke the two businesses apart, but Bearing Point paid massive amounts to AC in breakup fees, and likely the monies borrowed to pay the fees are what led to the problems with the company today) they became more and more vulnerable to exogenous shocks in the economy.

Companies like NVRyan, which learned to significantly limit their risk (see "Land, Market Strategies Help NVR Post Profit" which discusses how the company's business model is focused on not holding property, but building houses) regardless of the functioning of the economy are better positioned.

Nothing makes the Washington region or any of its submarkets recession-proof. And the business writers of the Washington Post ought to know that better than anyone. (Or maybe I am the only person who seems to remember what has been written in the paper over the last 21 years.)

Labels: building a local economy, creative economy, economic development

0 Comments:

Post a Comment

<< Home