Money for relocating to DC (resident attraction)

is discussed in this Examiner article, "D.C. considers luring new residents with cash," in which I am quoted. From the article:

The District's lead agency on the environment is proposing to dole out $3,000 to people who work in D.C. as an incentive to relocate from their suburban homes into the city, where their commute would demand less energy. ...

On a smaller scale is the proposed Live Near Your Work program, a $90,000 pilot for about 30 District workers. The D.C. government and participating employers would offer grants up to $3,000 eachto prospective homebuyers or renters who are eyeing a move into the city.

"The biggest driver of how much energy somebody uses is where they live," said George Hawkins, DDOE director. "We're trying to get people to live closer to where they work. It's not a lot of money, but it's something we want to pilot to see how it goes."

I think that for different reasons than saving energy, that DC should consider creating a local tax credit program to attract residents to the city, above and beyond which is provided by the federal government, currently $8,000 available nationally, normally there is a $5,000 federal tax credit exclusively available to first time homebuyers locating in DC.

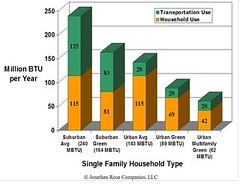

Energy consumption: Suburban Sprawl vs. Green Urban

It's true that DC residents are likely to use less energy, but it isn't a lock. Still, new residents to the city pay income taxes to the city, shop locally and generate sales tax revenues, if they own property they pay property taxes, and if we work it right, they ride transit, generating more ridership and revenue for transit, making more frequent service more realistic.

I would propose a local tax credit for buying a house/condo in DC of up to $10,000, in three tranches:

$3,000 -- for moving to and buying in DC

$3,000 -- an additional payment if by moving to DC you also get rid of at least one car (e.g., a household goes from two cars to one or from one car to none)

$4,000 -- to move to a neighborhood targeted for revitalization and preferably with present or future planned fixed rail service improvement (i.e., especially to neighborhoods that will be served by streetcars)

In the current system, people get the tax credit regardless of where they choose to live. Frankly, you don't need inducements to consider living in Georgetown, but you do when it comes to Deanwood or Trinidad.

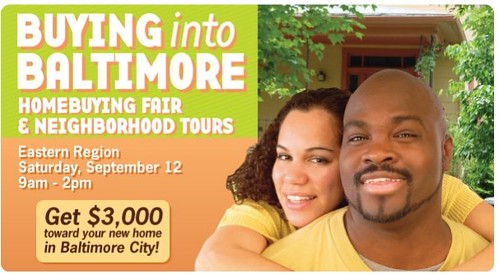

A program like this, which isn't all that much different from Baltimore's LiveBaltimore program, which provides incentive payments for residents moving to targeted neighborhoods (additional incentives are available, i.e., Baltimore's Healthy Neighborhoods program also provides special financing for people choosing to live in neighborhoods targeted for improvement).

But a program targeting revitalization energy to the neighborhoods that need it most makes much more sense. (Note: I know that some people would call this forced gentrification.)

But why shouldn't center cities provide credits to help attract new residents?

Labels: housing, resident attraction programs

0 Comments:

Post a Comment

<< Home