DC/Retail roundup

1. Harry Jaffe, Washington Examiner columnist, complains of loss of grit in the 'hood, as retailers like Ruff n' Ready Furnishings get priced out of now in-demand retail districts. See "Riot corridor becoming condo canyon."

Mostly the issue is about rents and spaces that are available. DC doesn't have a lot of good commercial buildings, in that most commercial districts don't have larger buildings that were typical of cities that were bigger than DC in the early part of the last century. So space is in demand.

And it's higher priced than it should be, because of peculilarities of DC's commercial real estate market--the high-in-demand market for office space in the central business district ends up leading to higher assessment values for most commercial property in the city, whether or not it is part of the national-international real estate play downtown.

I don't think Jaffe really understands what the problem is. He concludes with this paragraph:

But does it have to work that way? If the city would enforce district zoning rules that seek to protect local flavor, landlords might not be able to stuff their retail spaces with bars and restaurants. Otherwise, developers looking to make a buck will make 14th Street just like the nightly free-for-all that has made Adams Morgan grimy, dangerous and less livable.

You could zone for more specific retail categories, but the reality is that low margin retailers, character or not, can't compete in hot markets, unless they own their buildings, and even then costs rise as property tax assessments rise. That's what's leading to the pricing out of locally owned businesses in Georgetown like Furin's or Nathan's, even if they owned their building. (See #7 below.)

Jaffe misses the most significant factor that led to changes on 14th Street, the entry of Whole Foods Market on P Street NW, about 10 years ago.

That led, finally, to there being much more willingness to live east of 15th Street/16th Street, and the ability to redevelop comparatively large (for DC) parcels on 14th Street into condominiums and apartments with ground floor retail has driven change in this area, complemented by similar activity on U Street (specifically the Ellington condominiums).

People selling second hand furniture have a hard time competing in such a market.

This poses an opportunity to consider the link between capitalism and urbanism. As Alex Wall, author of Victor Gruen, From Urban Shop to New City, says, "commerce is the engine of urbanism."

Modern day coffee shops, diners, bookstores, hardware stores, etc., can be third places, although their ability to do so depends on their ability to be profitable. The "third place" or "outreach-community" aspect of the business is a function of profit.

It's a subsidy, not unlike how big movie theaters in downtowns across the country were "subsidized" by cross-ownership by movie production companies or streetcar companies by electric power generation companies. When the U.S. government made movie production companies sell off theaters and electric power companies sell off streetcar systems out of antitrust concerns, it became much more difficult to "subsidize" the higher costs of running these operations.

As profits from book selling get scooped up by Amazon, or hardware stores by Home Depot and Lowes, it makes it much harder for local "third places," independently or chain owned, to compete.

After all, the economic purpose of the Barnes & Noble isn't to create a third place but to sell books and related merchandise.

In "Building Capacity for Community Efficacy for Economic Development in Mississippi," in the Journal of the Community Development Society (33:2 2002) the authors argue that "community civic infrastructure" is necessary to support people's ability to meet and discuss local issues.

There is a great deal of academic work on the connection between local economic and community institutions and local civic life, versus conditions where business and other institutions are larger and nonlocal.

In short, Barnes & Noble is not Politics & Prose, or even Kramerbooks & Afterwards. The locally owned businesses will do what they can to stay in business, while chain stores can always leave as they have other locations from which to benefit.

In any case, creating broader civic asset "public" space plans to incorporate the need for community civic infrastructure is something that I have been thinking about quite a bit over the course of this year, while interacting with a graduate student writing his thesis on aspects of this question.

Commercial districts like Georgetown that serve more regional audiences than local ones lead to interesting questions, especially when most of the "new development" that is occurring is driven by the private sector, which for the most part, isn't concerned about the creation and maintenance of "community civic infrastructure."

4. DC/Big Box Retail. The National Building Museum is sponsoring a talk in their DC Builds Series on Big Box Retail.

Thursday, September 8, 6:30 - 8:00 pm

Big box retail is typically thought of, and built in, the context of suburbia or rural communities. But increasingly this retail model is being applied to urban areas. Washington, D.C. has retailers such as Target, Best Buy and Home Depot and is considering four Wal-Mart stores in various parts of the city. Join expert panelists for a discussion about how this retail model is affecting D.C.’s planning, land use, transportation, and economy.

Panelists:

Harriet Tregoning, director, DC Office of Planning

Jay Klug, principal, Acquisition & Development, JBG Rosenfeld Retail

Kennedy Smith, principal, the Community Land Use and Economics Group

Moderator: Gideon Berger, Urban Land Institute, Daniel Rose Center for

Public Leadership in Land Use

It's not in an absolutely ideal location, at Upshur and Kansas Avenue, but it is in striking distance of the little commercial block where the hip restaurant Domku is located, is around the corner from the Yes Market! on Georgia Avenue, and down the street from the Petworth Metro.

The store will be a nice size, 7,000 s.f., and is the conversion of an auto repair facility. I like how the owner says she will focus on carrying items appropriate for early 20th century building stock, which is what typifies the neighborhood.

There is also a great farmers market at Upshur Street and Georgia Avenue on Fridays.

Clearly, this area is beginning to leverage its proximity to the subway station, and the addition of multiunit housing in various sites on Georgia Avenue close to the Metro Station.

This is an example of how business cooperatives like Ace Hardware can be a source of retail innovation in urban neighborhoods. (See #8, below.)

Soupergirl already makes and sells high quality soup that people pre-order and get delivered--the company delivers to seven different zones, mostly in DC, but also including Arlington and Silver Spring, and has a separate pick up operation with 9 different sites in DC, Maryland, and Virginia.

So a retail operation in a seemingly secondary location, while adding expenses, leverages an already successful and growing business, without adding significantly to fixed and operating costs (especially if the new facility can be used to make the soups also, or to expand overall capacity in the face of growing demand).

7. Hawk & Dove, a stalwart "dive" restaurant on Capitol Hill is changing hands. Really what happened is that the lease was bought from under the owner, who no longer had a long term lease, and rather than lose everything, the owner sold the name and goodwill to Xavier Cervera, whose more modern restauranting methods allows him to pay higher rents, because he makes more money/s.f. The lesson here is in being able to adapt to your market, or not. See "Hawk 'n' Dove closing its doors" from the Washington Times.

Cervera has other advantages in that as he develops a group of restaurants, he gets advantages from scale in terms of vendor support, and the ability to develop expertise dealing with city agencies, etc.

Similarly, the creation of SILO, a store-website on Sea Island, see The Neighborhood Grocer Rebooted from Low Country Weekly, or the Downtown Phoenix Public Market, a grocery building-based operation selling locally sourced products being located adjacent to the site of the Saturday Phoenix Farmers Market are other examples.

From the article on SILO:

“We call it The New Economy Corner Store,” says Patrick, “because it’s really hard right now if you’re not part of a big chain to be able to set up a local retail food store and not lose so much in waste. This completely minimizes the risk of waste because you’re working with the growers to provide only what is ordered that week. Everything else sold separately in the store is either non-perishable or frozen.”

“I think this has a lot more potential than the standard neighborhood grocer,” says David.

Wal-Mart’s first Chicago-area Express store -- a convenience-store-sized Wal-Mart with groceries, dry goods and a pharmacy -- opened to the public on Wednesday. The store is located at the Chatham Market at 83rd and Stewart Avenue, off of the Dan Ryan Expressway.

Interestingly, with one exception, the Walmart stores to be opened in DC are not going to be located in areas where there is a paucity of grocery stores or pharmacies. And by comparison, the DC stores won't be small.

10. Anthropologist-commentator Grant McCracken has a piece on food trucks in the Harvard Business Review Business Insider, "Why The Food-Truck Trend Is A Genius Lesson In Marketing," about how food trucks are lower cost ways to be innovative, to sell food, to gather customer information, and to serve areas where barriers to entry in terms of renting storefronts can be high.

While I think some controls on food trucks are reasonable in terms of managing traffic (both on the street and sidewalk), I do think they can be an important part of the retail and attraction mix in commercial districts, and they are an entrypoint into food entrepreneurialism that needs to be supported.

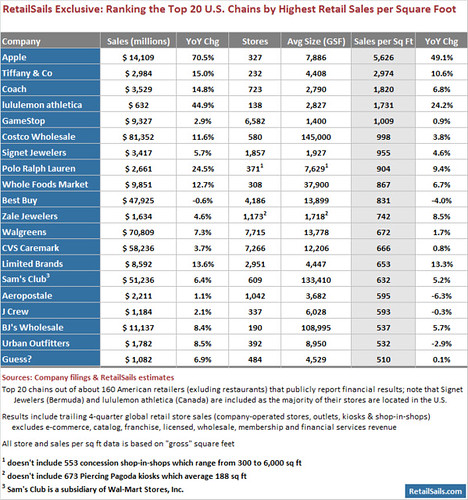

11. Retail Sails has a table on the top 20 retail store chains by sales/square foot, "RetailSails Exclusive: Ranking U.S. Chains by Retail Sales per Square Foot."

Another useful table with similar data is here, covering more companies and those companies more likely to locate in local shopping centers and other settings.

Labels: commercial district revitalization planning, formula retail, retail enterpreneurship development, retail planning

0 Comments:

Post a Comment

<< Home