Smart Growth America report on businesses moving back to center cities (and suburban core business districts)

Last Thursday, Smart Growth America released a report, Core Values: Why American Companies are Moving Downtown, sharing the results of an ongoing research program there about the phenomenon of businesses moving "back to the city" after many decades where businesses were moving out of the city.

I have written about this issue for some time in terms of Chicago, Detroit (note that Compuware, not Quicken Loans, was the first major corporation to take this step), Seattle (Amazon), and San Francisco (Twitter, etc.) as well as in terms of how cities (and some suburban locations) can serve as open air research districts along a corridor, as a form of what Brookings Institution calls Innovation Districts.

-- Naturally occurring innovation districts | Technology districts and the tech sector

Another blog entry was touched off by commenter charlie suggested that this trend could be harvested as part of the redevelopment of the FBI site on Pennsylvania Avenue in Downtown DC ("Could bringing premier regionally headquartered business enterprises to the Pennsylvania Avenue Corridor be key to its renewal and revitalization?").

And the Wall Street Journal has been writing about this for awhile, since at least 2010:

-- "Companies Say Goodbye to the Suburbs," (2013)

-- "Companies Trade Suburbs for City Life," (2015)

-- "Downtowns Get a Fresh Lease," (2010)

-- "More Young Adults Stay Put in the Biggest Cities," (2015)

The report makes clear that this is not an exclusively center city phenomenon, that companies are also moving from disconnected locations and/or campuses to suburban business districts and edge cities, like Tysons-Reston in Virginia, or Conway, Arkansas, a city about 23 miles from Downtown Little Rock. But Conway is the county seat, home to some major corporations, some of which started there originally, as well as three colleges, including the University of Central Arkansas, a mostly undergraduate focused school, with about 14,000 students.

-- past blog entry, "Silver line reshaping commercial office market in Fairfax County"

-- Ten Principles for Reinventing Suburban Business Districts, Urban Land Institute (2002)

-- Ten Principles for Reinventing America's Suburban Strips, Urban Land Institute (2001)

Examples in the DC-Baltimore region of companies moving to more connected suburban locations include how Choice Hotels moved from its isolated location on Colesville Road miles away from a Metrorail station to Rockville Town Center ("Choice Hotels International Completes Move Into New Rockville Headquarters," press release) and how McCormick Spices is moving from its transit-disconnected location in Hunt Valley, Baltimore County, to a site just a few miles away, but a short walk distance from Baltimore's Light Rail system and highly visible from the road network.

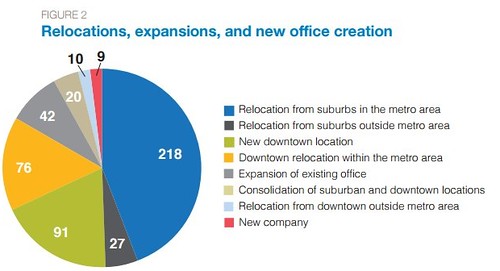

Working with Cushman & Wakefield and GWU, SGA identified 500 cases, and interviewed about 50 businesses that made the change, and another 50 people working for economic development agencies and local government and involved in business recruitment.

I've only had time to skim the report. The press conference (available online here) featured a presentation by Chris Zimmerman, SGA's vice president and former member of the Arlington County Board, and two panel discussions.

Chris' presentation is covered by the text on the Core Values webpage, which summarizes the reasons companies are moving back to centers:

- To attract and retain talented workers. As companies compete for new hires and the best talent, being located in a vibrant neighborhood is considered a crucial selling point. The businesses in our study report that current and potential employees want neighborhoods with restaurants, cafes, cultural institutions, entertainment, and nightlife as well as easy access by public transportation.

- To build brand identity and company culture: A downtown location projects innovation, connectedness, uniqueness, and allows companies to literally be at the center of things. For many companies, moving downtown was a way to set themselves apart from their competitors and to inspire their employees to live up to related brand aspirations.

- To support creative collaboration: Many companies chose locations in dynamic, creative, engaging neighborhoods to help inspire their employees and encourage collaboration among co-workers as well as with employees at other companies or in other industries.

- To be closer to customers and business partners: Streamlining the process for employees who take in-person meetings with clients and partners downtown.

- To centralize operations: A central downtown location, because of its proximity to everything, was a natural choice for many companies when consolidating multiple locations, particularly if those locations were spread out over a single region.

- To support triple-bottom line business outcomes: For many companies, investing in a city’s center was an opportunity for good corporate citizenship and a way to use their sizable investing power for good. Some reported that triple-bottom line business practices came with the ancillary benefit of making them more attractive as an employer.

Panasonic's state-of-the-art North American headquarters and Innovation Center is located in Downtown Newark, NJ. The building was designed by Gensler to achieve LEED Gold for new construction and LEED Platinum for interiors. Panasonic's hope is that its new green home in New Jersey will reflect its goal to reduce its carbon footprint by 50 percent while also stimulating the local economy with its presence. Photo and caption from Inhabitat.

Panasonic's state-of-the-art North American headquarters and Innovation Center is located in Downtown Newark, NJ. The building was designed by Gensler to achieve LEED Gold for new construction and LEED Platinum for interiors. Panasonic's hope is that its new green home in New Jersey will reflect its goal to reduce its carbon footprint by 50 percent while also stimulating the local economy with its presence. Photo and caption from Inhabitat.Companies moving back to the city. The first panel, moderated by Geoff Anderson, SGA's president, featured representatives from three companies that have moved "back to the city"

-- Be the Match, a health care and software company, focusing on bone marrow transportation and research, now in Minneapolis in a new building, highly visible, on a main walking route to nearby Target Field.

- "Be The Match breaks ground on new North Loop headquarters," Minneapolis Downtown Improvement District

-- Panasonic--best known for its consumer products, but 90% of the company's revenue comes from business-to-business activities--which moved from a suburban corporate campus of 50 acres to a 12-story office building in Downtown Newark, New Jersey, within a couple blocks of Penn Station.

- "How Panasonic learned to love Newark," Fortune Magazine

- "Christie cuts ribbon on Panasonic's new headquarters in Newark, salutes bipartisanship," Newark Star-Ledger

-- Fifth Third Bank, a large regional bank in the Midwest, based in Cincinnati, which is in the process of moving its regional headquarters from Suburban Southfield in Oakland County, Michigan, to the foot of Woodward Avenue in the heart of Detroit.

- "Fifth Third Bank to move 150 employees downtown as part of $85M investment in Detroit," Crain's Detroit Business

Each of the representatives discussed how being in the city improves the visibility of their company, allowed them to reorganize their space to support collaboration, and allows their company and its employees to be better engaged and involved in local revitalization initiatives.

For example, Panasonic's choice of Newark, where a new office building of significant size hadn't been constructed in 20 years, has helped to renew attention on Newark as a place for businesses to relocate. One significant change is that only 4% of employees used transit to get to work at their old suburban campus, while 57% of employees use transit now, and new transportation demand management programming aims to boost that to 75%.

Fifth Third Bank Eastern Michigan will employ more than 150 full-time employees in its new 62,000-square-foot downtown office on four floors in the renamed Fifth Third Bank at One Woodward building. Photo by CoStar Group Inc.

Fifth Third Bank Eastern Michigan will employ more than 150 full-time employees in its new 62,000-square-foot downtown office on four floors in the renamed Fifth Third Bank at One Woodward building. Photo by CoStar Group Inc. The Fifth Third story is equally interesting, as their initial search for a new branch location in Downtown Detroit ended up in a much bigger decision--to move their regional headquarters to Downtown and to participate in a wide variety of ways--loans, technical assistance, sponsorship activities, etc.--in the city's revitalization efforts.

This sign of commitment was particularly important and time worthy, given the city's recent emergence from bankruptcy.

The Panasonic project was fostered by tax credits, which has been controversial in some quarters.

Anderson made a good point about difficulties experienced in the moves because employees aren't always on board, at least initially.

People who live and work in the suburbs don't go Downtown, they don't know what's happening, and their perceptions of the city are out-of-date.

City revitalization and recruitment programming. The second panel, led by Chris Zimmerman, featured representatives of downtown economic development organizations (not city agencies), involved in the management and improvement of and recruitment to central business districts.

According to the report, city location and amenities characteristics that are attracting companies back to the city are:

- Walkable, live/work/play neighborhoods: Most companies are looking to locate in districts that are walkable, live/work/play environments. "These places include a vibrant mix of restaurants, cafes, shops, entertainment venues, and cultural attractions all within easy walking distance of offices" along with housing.

- Convenient access by a range of transportation options: Access to a range of mobility options is a major priority. "Companies want their employees to be able to travel easily to work each day, to daily meetings offsite, and to other cities [...] choosing locations that allow employees to walk, bike, and take transit as well as drive to work each day. Downtown location allowed these companies to provide more options for employees who live in the city, while also leaving many employees’ driving commute times unchanged. In addition, it made these businesses more accessible to potential new employees in the region."

- The right office space: Another factor in companies’ decisions are office spaces that best fit their business. [...] many reported a need for more open office space that would allow and encourage interactions among their employees. Several reported that a great space, along with a great neighborhood, went a long way in recruiting new employees. And like their choice of location, businesses wanted their office space to reflect an innovative and creative company culture. If the right type of office space wasn’t already available, many companies were willing to build new buildings or redevelop old ones to get it.

- Clean, safe streets: A few companies meant to be positive when describing their new location as “gritty,” but these companies were the exception, not the rule. Most interviewees said cleanliness and safety were important to them and for the most part, the downtowns they moved to were providing it. Some companies went out of their way to point out the differences between perception and reality in this regard, particularly among employees who hadn’t been downtown for many years. Leadership on these issues was found in both the public and private sector.

-- Downtown Cleveland Alliance, the business improvement district for Downtown

-- Conway (Arkansas) Chamber of Commerce

-- Indy Chamber, the economic development arm of the city-county.

I zoned out a bit on this panel, because for the most part, they covered stuff I already know, but even so, they made many great points.

The discussion got more interesting when they covered topics like the difference between early and later stages of revitalization, zoning changes needed to effectuate appropriate urban design, the addition of housing to previously exclusive office districts, maintaining affordability and equity, the importance of historic preservation tax credits to facilitate redevelopment of older buildings, how projects take a long time and that can be hard for elected officials and residents eager and itching for improvement, etc.

The $31 million Circa Apartments project in Indianapolis--265 units in the first phase--is one of the projects in Downtown Indianapolis that has been spurred in part by the Indianapolis Cultural Trail.

When asked what was the most effective economic development strategy, Mark Fisher from the Indy Chamber discussed how he was totally surprised about the economic and cultural impact of the Indianapolis Cultural Trail.

It was seen as a cultural initiative, but so far--and the trail has been fully operational only for about two years--more than $1 billion in new development has been attracted to areas abutting the trail, and many retail and restaurant businesses are re-orienting and adding "back" entrances to be equally accessible from front and back.

Indianapolis Cultural Trail.

Brad Lacey from Conway discussed the importance of leveraging for economic development the activities of the three colleges in the city.

Another point that came up was the difficulty of working on long time frames when the election cycle is four years. (I think of a project on H Street NE that I was involved in that took 13 years, another will be about 12 years when it is finished, but with a different design, program, and developer compared to how they started. And these are only two projects.)

Conclusion. In thinking about the presentation, it's another element of the long term trend of in-migration to cities. Just like retail is beginning to move back to the city after decades of focusing on suburban markets ("It ain't true: chain retailers are entering the city, but not necessarily on the city's terms"), now that younger, highly educated people are increasingly moving to or wanting to move to more vibrant, connected neighborhoods, employers are following rooftops too.

But we must remember that the moving back to the city "trend" has been built on decades of in-migrants of people committed to urban living, but it took about 40 years to achieve critical mass. cf.

-- Ten Steps to a Living Downtown, Brookings Institution (1999)

-- Who Lives Downtown?, Brookings Institution (2005)

It's also about generational change within corporate leadership. For a long time, corporations have moved to the suburbs because that's where the corporate leaders lived, as well as most of their employees. Now that generation of leaders is moving on and the opportunity is presented to center cities to recapture headquarters locations.

Of course, it's aided by the presence in most large, older center cities, of large formerly factory and warehouse buildings that are cool and lend themselves to adaptive reuse.

The report makes clear that companies will build new but collaboratively-supportive designed buildings if necessary, if they can't find what they want, and two of the three examples recounted above involved ground up construction of completely new buildings.

This is a newer phenomenon, as previously mostly business attraction involved reutilization of buildings dating from about 1875 to 1930, buildings like Baltimore's old Montgomery Ward distribution center or the Tide manufacturing plant ("A glimpse inside Under Armour's Baltimore campus," Baltimore Business Journal), which is the major base for Under Armour, a company that didn't exist 20 years ago, but now has about 8,000 employees and over $3 billion in annual sales.

Tthe example of Fifth Third Bank in Detroit is a bit different, as they moved into a classic modern building constructed in the 1960s--people with Detroit ties would recognize it as the old headquarters of the Michigan Consolidated Gas Company, a public utility. The building was especially noteworthy because there was a fine dining restaurant on top called "Top of the Flame". It was the first skyscraper designed by Minoru Yamasaki, who went on to design the World Trade Center in New York City.

Likely we will see more of this, although in many places such buildings are also being converted to housing or hotels--the Standard Hotel in Los Angeles is the reuse of an art deco era oil company headquarters.

Placemaking and urban design remains key. To maintain and strengthen those elements of urbanism that are attractive to residents, employees, businesses, and visitors, cities have to invest in urban design and zoning, and more focused business improvement districts are usually necessary in order to manage in a more fine grained manner street activation, clean and safe activities, programming, and business recruitment activities, because city departments generally aren't given the necessary level of resources and capacity to bring this about at the level of detail and perseverance that is required..

"Good" developers are a necessary ingredient. One thing the report didn't discuss was developers. In my experience, a lot of "bad building" has been done in terms of whether or not buildings, especially at the ground level, support urbanity with the right urban design, permeability, and connection to the world of the city outside of the four walls of the building.

The representative from Fifth Third Bank discussed this at length, how they were attracted to the city by the efforts of Bedrock Management, a large scale property owner and developer focused on Downtown Detroit.

City officials have a hard time demanding better when they are desperate for any kind of business activity. This problem of under-committed developers is accentuated by elected officials desperate for new business and so they are compelled to do anything asked of them, rather than demanding better or saying "no."

Fortunately, as this kind of redevelopment becomes more in demand, more cities are at the point of having a critical mass of pro-urban commercial real estate developers able to provide the right kinds of properties, in ways that support placemaking and street vitality.

Build stronger urban design requirements into regulations. The best way to deal with developers disinclined to do good work is to have the right urban design, zoning, and review processes in place, along with targeted incentives, to shape outcomes toward what is desired rather than taking anything that's offered.

This is happening more and more, as cities re-tune zoning regulations to favor historic building and city design practices, rather than apply the more suburban-oriented zoning and design codes that even cities had previously adopted.

Labels: business recruitment and retention, car culture and automobility, real estate development, transit and economic development, urban design/placemaking, urban revitalization

7 Comments:

Funny you pick the old Cleveland trust building which has been turned into a Heinen's supermarket.

In gereral, the perception in the Cleveland metro area is the city is doing a piss-poor job in terms of corporate locations. Beachwood has been kicking their ass. Now that might be on purpose (foundation money) but it is a problem.

From this weekend:

http://www.nytimes.com/2015/06/21/business/gaps-fashion-backward-moment.html?_r=0

"American brands are also saddled with the remnants of a shopping mall culture that is fast vanishing. Many of Gap’s coming store closures are expected to be at malls that have suffered from declining foot traffic and slumping sales. The national retailers that once anchored those malls, like J. C. Penney and Sears, also are floundering, at the same time as e-commerce is picking up steam.

By contrast, the foreign labels setting up shop in the United States are getting their pick of the best real estate, said William Susman, managing director at Threadstone Partners, a New York consumer and retail advisory firm. And overseas retailers, from the start, are used to operating all of their locations as high-traffic, high-grossing flagship stores, he said.

Ass it does here. You have High Street locations in Europe whose economics really resemble flagship stores,” Mr. Susman said. “They have a very different real estate strategy.”"

"People who live and work in the suburbs don't go Downtown, they don't know what's happening, and their perceptions of the city are out-of-date."

interesting quote- and as far as federal enterprises leaving DC is concerned- their entire urge to dissipate the US Capital City for nameless faceless sprawlburbs could undergo a sea change if corporate America continues its center city resurgence /reappraisals. The feds are usually years behind what the pirate sector does- and yet they all like to be seen as modeling their own federal workplace practices after the pirate sector -however they often fail at this because they are so caught up in copying that they often do not notice innovation or change when it actually happens. I believe that in 10 -20 years the feds are going to want to return to the city /DC again and by this time it will have become too desirable and too expensive- they are giving up their prime assetts and making sacrifices based on obsolete proactices.

Charlie -- also the purchase of Galeria Kaufhof by Hudsons Bay. Maybe it won't get f*ed up. But GK is very much center city oriented. Although at least in Germany there are "malls" but in the city center, a bit better integrated, including transit stops, than malls here.

DK how the real estate joint venture with Simon will work. I am not so familiar with them in that I don't know if like Edens, they are adding urban verve and understanding to their portfolio and approach. e.g., westfield has such knowledge in spades, from Australia, but it doesn't percolate to the US...

The GK store in Essen is at the heart of the city center, across the street from the train station, with a small part underground leveraging the underground entrance to the station.

Primark too is very center city focused. But of course, for a lot of reasons that approach makes sense in the European market, and not so much here.

See also Lidl coming into the US -- and about the only company around that started a new office space in Arlington. there are a big competitior and killing it in the UK.

I don't buy the smart growth report....with the fast fashion is more about trends (not wearing the same as everyone else) rather than real estate. they are leveraging the high street, or rather creating it as legacy malls get killed.

As you said, these chains are not developers and are happy to go where developers take them (to some degree)

Trader joes urban german roots have not helped it with being more urban.

second first, TJ's doesn't have German roots but German ownership. It was founded by a guy named Joe in California... A frequent mistake that everybody makes--including me until recently--is associating TJs and Aldi in the US.

Aldi is actually two companies, with the same name, and family ownership, but each by a different branch. They are called Aldi Nord and Aldi Sud. They share some logistics, branding, purchasing, but outside of Germany, they have divvied up the world between the companies.

Aldi Sud is the company with rights to open stores in the US. But the family that owns Aldi Nord owns TJ's.

Anyway, TJ's is weird about store siting. They have urban stores on the west coast. But it was a struggle to get them to consider DC originally, and now they do have more East Coast urban stores, but not as many as they could.

2. Lidl. I'm actually thinking of sending them a cold call letter with some of my writings on groceries. It's the Lidl Ireland division opening up in the US... I was sad they weren't in early enough to buy all the Bottom Dollars in Greater Philly that Aldi bought...

anyway, the only Lidl I've ever been was awesomely located in the Essen train station. I bought a lot of stuff there. They are more interesting than Aldi Sud in the US, definitely.

Although I happily buy basics--produce mostly, canned beans, dishwashing soap, sponges, at Aldi. I've found the processed food products not to our taste.

... however, Hamburg near the train station had a branch of a different German deep discount chain called Penny.

It was even better than the Lidl in Essen. Really awesome for a deep discount store. Some fresh breads. The cold cuts that Europeans eat for breakfast, etc.

Yep- I have been all thru Germany and definitely malls are located in city centers. Famously- Walmart left Germany because their sprawl model would not work- germans want to be able to get to a store on the train or bicycle or walk. The only car oriented parts of Germany are in the old east- but they are light syears ahead of US in terms of transit and centralization.

Thank you for providing such a valuable information and thanks for sharing this matter to get Online medicine store from Dose Pharmacy medicine.

Post a Comment

<< Home