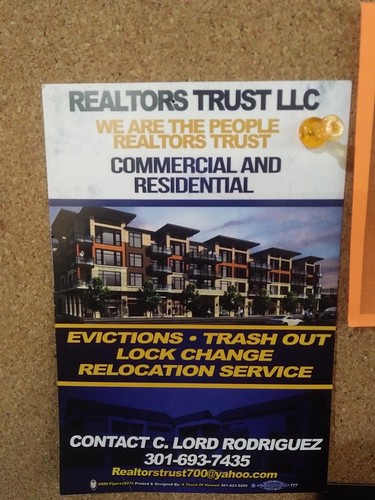

An element of the system of upward pricing of residential real estate/reproduction of urban space

I came across this postcard posted on the bulletin board of a supermarket in Petworth around when I was writing this piece in December, "The nature of high value (strong) residential real estate markets," and DC specifically, but I forgot to use this photo as an illustration of how the process of reproduction of space and neighborhoods works. There are companies that specialize in emptying houses of tenants...

Separately, my neighborhood is involved in a discussion because the old Takoma Theatre was bought by a regional real estate developer. What this did was change the nature of the property, from one with a local/neighborhood-based owner, focused on serving the neighborhood, to one that is part of the system of regional real estate property development.

This is what urban sociologists call the reproduction of space.

For this property it significantly increases the asking price for rent, the financing changes the nature of who is considered as possible tenants, the likelihood of independent uses drops significantly, etc.

Anyway, they have a lease for a clinic and are asking that the requirements for first floor space for retail be significantly relaxed.

It will be interesting to see how this plays out. But in the discussion on the neighborhood e-list, I pointed out that once the property was purchased by a company active in the regional real estate market system, things changed.

Still, by having a coherent position (not a certainty) the neighborhood will be able to extract concessions in return for agreeing to a zoning exception.

But getting to that point is very difficult. It's why in my writings on community benefits agreements, I call for the creation of neighborhood-scale consensus priorities through planning processes more generally, and the use of this information when negotiating zoning changes, to yield structural improvements, rather than always dealing with ad hoc processes.

Labels: commercial district revitalization planning, commercial real estate market, neighborhood revitalization, reproduction of space, urban sociology

4 Comments:

http://www.businessinsider.com/amazon-hq-photo-tour-seattle-make-any-city-wary-of-amazon-hq2-2017-12

Lots of interesting tidbits in there:

1) amazon is brining in tons of local retail -- not chains

2) primary food

3) requiring late hours which hurt

Very interesting. It's been awhile since we've been to Seattle (Suzanne lived there for about a decade and has relatives and friends there). It was more at the beginning of Amazon's presence in SoDo. So I haven't seen the dominance (+ I haven't been keeping up because for some reason the Seattle Times won't subscribe me to the daily e-letter, which I used to get).

wrt retail, it's tough because office workers tend to mostly buy food, not stuff. This came up in Takoma, where the market study for the Main st. program mentioned the need for office to support daytime business. Well, at best Takoma is a B market. But even so, office is on the decline in most places ESPECIALLY Silver Spring which is way better situated for it.

I made the point that the rule of thumb is an office worker supports 2 s.f. of retail and 5 s.f. of quick service (mostly) food.

So even 1,000 workers don't support all that much. (With federal workers it's worse because about 65% bring their lunch.)

And it's narrow. Look at the food court and retail at L'Enfant Plaza (although interestingly, some of the same retailers are also at Crystal City).

===

One thing the article didn't mention is that as part of community benefits agreements, they bought an additional streetcar and pay towards more frequent service.

and that FareStart restaurant example is one I'll have to remember, plus the Mary's Place example.

... but I don't know how much we should blame businesses for the rise in housing demand. Yes, it results from their move into the city and just a small marginal increase in demand has extranormal impact on pricing and appreciation.

The response should be to build more housing, not to make it impossibly difficult.

https://www.seattletimes.com/seattle-news/transportation/residents-fight-seattle-rules-allowing-apartment-developers-to-forgo-parking/

Although I can see residents not liking zoning changes that made it easier to do teardowns for small apartment buildings. (That was pretty evident the last time we were there, staying on Capitol Hill--ironically, around the corner from the building featured in the Singles movie.)

Not to mention that housing supply is developed over multiple decades and it takes that long to "catch up" once demand has been goosed.

The question is whether or not it's better to not grow at all, to keep housing prices, demand, and center city success dampened.

I argue that it's better to grow. That it's possible to manage the costs.

(which in some circles means I'm not progressive, e.g., my circle includes the people in Adams Morgan for "responsible development." We agree/work on some issues along the same lines, and not on others.)

with demand, it's why I'd rather allow big rowhouses to be split into units or making bigger houses selectively from smaller ones, but have design review to help make houses look better when added to, instead of ersatz pastiches.

This Village Voice article about Stuyvesant Town uses a term I hadn't come across, "predatory equity," about buying a property at a high price, figuring you can get rid of tenants paying low rents.

https://www.villagevoice.com/2018/01/05/biggest-nyc-affordable-housing-deal-lacks-bang-for-its-buck

I know the concept, but didn't have such a succinct way to refer to it.

Post a Comment

<< Home