The nature of high value ("strong") residential real estate markets.

Infill "rowhouse" on Spring Street NW, Columbia Heights, DC.

DC's single family housing stock tends to be made up of comparatively small buildings, most no higher than two-stories tall. Housing in the core of the city tends to be comprised of attached rowhouses with a mix of apartment buildings.

Today's Washington Post has a story, "Cities turn to `missing middle` housing to keep older millennials from leaving."

In high value markets, the missing middle isn't about the type of housing, but about the price of housing. The point the article misses is the cost of property relative to household income.

A house in Levittown, New York, c. 1950s.

A house in Levittown, New York, c. 1950s.The reason you have duplexes, rowhouses, etc. is to fit more housing units on smaller plots of land.

But in a market where demand is greater than supply, housing size does(n't) matter.

DC has plenty of "middle housing" in terms of size.

Theoretically, small lot properties cost less, and in high priced markets, smaller properties are more affordable than larger properties.

But it's all relative. Because of the demand for housing relative to supply, this type of middle housing is not low cost despite it being less desirable compared to the "American Dream" of a large detached house on a large lot.

For example an alley rowhouse or small rowhouses of less than 800 s.f. can still sell for close to $600,000 depending on its location.

Or the Pullman Place DC condominiums, built on the site of a former small industrial building, adds 42 units of housing, each ranging from about 600 s.f. to 1,100 s.f., at prices up to $750,000 per unit ("Pullman Place sits above train tracks behind Union Station and offers Downtown views," Washington Post).

The reason millennials are moving out of the city isn't because they are aging out and no longer wanting to live in the city, but because they want a single family house (detached or attached) and they don't have the ability to fund a $1 million mortgage.

I was just reading an article about Vancouver ("An avalanche of money: An expert on how income disparities are reshaping Canada's metropolitan areas zeroes in on Vancouver," Toronto Globe and Mail), which describes a similar situation as covered in the Post article.

There, lower value neighborhoods now tend to be located in the suburbs, and farther from the core, by contrast to the time when center city locations were seen as undesirable, center city housing was low priced, not suburban housing.

Supergentrification vs. capital deepening. I have written about this issue over the years, where I discussed the "supergentrification" thesis of Loretta Lees, applying it to DC, although DC is still relative compared to cities like New York and San Francisco:

-- "Exogenous market forces impact DC's housing market," 2012

-- "Applying the supergentrification thesis to San Francisco, Santa Monica, and other cities experiencing hyper-demand," 2014

The second piece more succinctly makes the argument, which is that:

The highest wage earners are driving the market in the "best" neighborhoods, not average wage earners.As DC specifically and high quality urban locations become in demand for larger numbers of people at the scale of the regional residential landscape, prices rise--because more neighborhoods are attractive to more people, and properties are purchased by those who have the most money (cf. "capitalism").

Because housing inventory is constrained, only small increases in demand are necessary to generate large increases in price.

For the most part, most land suitable for residential housing has already been developed, and at comparatively low densities. The city can't grow outward, it can only "grow" intensively.

In the TGM article, Professor David Ley calls the process of high income (a variable indicating a neighborhood in high demand) neighborhoods becoming even higher income, "capital deepening," which I think is a better term than "supergentrification." From the article:

"Because every time redevelopment occurs you get a substantial increase in the socio economic status of occupants … [market-rate] supply is only for high-income people. So, whenever redevelopment occurs, it means higher income people are occupying the space," says Dr. Ley. "Two things are happening: there is gentrification in the inner city, but then there's what I call 'capital deepening,' which is an area that is becoming richer."Why adding to housing inventory doesn't lead to lower prices in the short and intermediate terms. But even if new housing is added, it doesn't "reduce prices" for three reasons.

First, it's built at current prices for land, labor, and materials, so by definition it is the most expensive housing there is. Second, because of this, it means that only over multi-decade periods as even newer housing is added to the market, will it help to slacken price growth.

Third, in the short and intermediate terms, demand even in the face of additions to the housing supply is still greater than supply. Because demand is greater than supply, housing prices continue to rise/appreciate/increase.

Tenements in Manhattan tend to be five to seven stories tall.

Tenements in Manhattan tend to be five to seven stories tall.In DC this is even more pronounced because when most of the housing in the city was constructed, the US population was about 40% of what it is today and the city wasn't burgeoning so compared to other cities constructed during the industrialization growth area (New York City, Philadelphia, Boston, etc.), so houses and apartment buildings are small, compared to the housing built in cities like New York, Montreal, Philadelphia, Boston around the same time.

Mostly new construction is made up of multiunit housing _in commercial districts_, where it is much easier to build because of building regulations and the fact that by replacing commercial uses, it doesn't displace existing residents.

New detached and attached houses being constructed at the old Methodist Home, Peabody Street NE, 2006. The building at the heart of the campus was converted to condominiums.

New detached and attached houses being constructed at the old Methodist Home, Peabody Street NE, 2006. The building at the heart of the campus was converted to condominiums.However, here and there institutional properties with "interstitial" qualities get converted to "no lot" single family housing (e.g., the old Methodist Home property on New Hampshire Ave. NE almost on the Maryland border, the EYA development in Brookland, Chancellors Row, from land deaccessioned by St. Paul's College, the EYA proposed project on land being deaccessioned by St. Joseph's Seminary, etc.

Interstitial properties tend to not be particularly close to high capacity transit.

$1 million is the ceiling for housing prices in many DC neighborhoods. It seems as if housing prices in a majority of in-demand DC neighborhoods for "average sized houses" (that is, less than 2,000 s.f., with variable lot sizes--smaller in the core, larger in the Outer City) will stabilize in the range of $1 million.

(Neighborhoods like Georgetown, Dupont Circle, Cleveland Park, Chevy Chase, with different characteristics, have a ceiling price at an even higher scale.)

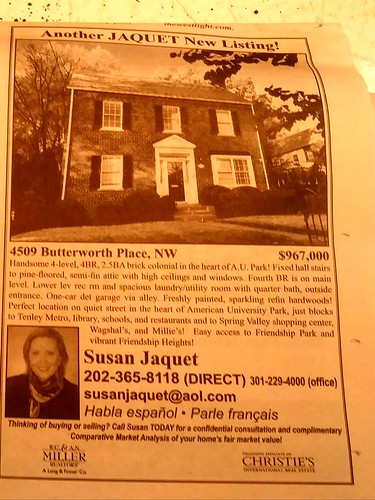

Northwest Current housing ad, 12/6/2017.

Northwest Current housing ad, 12/6/2017.Many neighborhoods are at that price point, judging by real estate ads in the Northwest Current and the Hill Rag, the city's leading community newspapers covering the city's most in-demand neighborhoods.

Other neighborhoods are moving towards that point (e.g. the most recent sale on my block in Manor Park, for a detached house, no larger than 1/6 of an acre, completely renovated, was about $835,000, for a location not quite one mile to a Metrorail station. Interestingly, that price was higher than for two other houses, larger, that sold on the block over the previous few months.)

At current interest rates,* the $1 million price is affordable to two-earner households with high incomes, especially with the tax benefits that flow back from federal income tax deductions for mortgage interest and state and local taxes.

It seems as if that million dollar price is a real ceiling, given a house I know about for sale on the 100 block of 4th Street SE in the heart of Capitol Hill.

Renovated, with a basement rental unit, within a couple blocks of the US Capitol, and on the market for less than $1.2 million. You can't find a better location in terms of proximity to Downtown, the Capitol, transit, walkscores, etc., so if the market were "unlimited" on the buying side, the price would likely be higher.

Urban sociology provides the nuance necessary to understand urban housing economics. It happens just yesterday I ran into a local historian at a neighborhood craft fair and we had an extended conversation about these issues, structural racism, etc.--what a great city it is to be able to have the opportunities for such random conversations!

To understand what's going on, it's important to be conversant with urban sociology, Robert Park's The City, which lays out the foundations of US urban sociology, and Urban Fortunes, which discusses why cities are focused on real estate development and land use intensification as the primary driver of the local economy, since local government finance is dependent on property tax revenue.

====

* Federal tax law changes will significantly change the nature of the housing market in strong market cities. Note that the changes likely coming to the tax code will significantly change housing pricing in hyperstrong markets like DC because of limitations on mortgage interest deductions and the elimination of deductions for state and local taxes (although apparently a $10,000 cap on deductions may end up in the final bill).

An $800,000 mortgage costs between $4,500 and $5,000/mo. in interest. When you can deduct that from your taxes, sustaining million dollar housing pricing is much easier.

Special housing market problems unique to DC: federal government downsizing. DC's housing market also will experience a downturn, or at least a slackening of price escalation and appreciation not just because of the tax law changes, but because of the Trump-McConnell-Ryan Administration's focus on reducing the size of government.

Agencies are getting cut as it is. Units are being dismantled. People are losing their (high paying) jobs.

Even if Democrats take either or both the House and the Senate in 2018, this process will not be reversed until Democrats control the Executive Branch.

Granted a lot of the benefits of federal government employment are enjoyed by DC's suburbs--more than 60% of the jobs located within Washington, DC are held by people not living in DC--but DC is already being impacted, not just with older millennials as discussed in today's Post, but also with younger millennials, who don't see opportunities in working for government or in related fields ("The millennials who transformed D.C. after the recession are now leaving for cheaper cities," Post) so they have stopped moving to DC, and it was millennials that drove the city's recent increase in population.

Growing the base of middle housing: intensification. Separately, there are three ways to intensify land use and add housing units to places that otherwise are for the most part, built out.

1. Adding multiunit buildings by converting low dense commercial properties (and interstitial pieces of institutional properties).

2. Making existing houses bigger and/or breaking up larger houses into multiple, smaller units.

3. Adding English basements and carriage houses to existing properties.

By severely limiting height and "defining density down" (e.g., "D.C. court rejects Brookland project for a third and possibly final time," Washington Business Journal) residents clamoring about housing affordability are eliminating opportunities to address the problem, albeit the results aren't discernable for multiple decades.

Labels: affordable housing, gentrification, Growth Machine, housing market, housing policy, multi-unit housing, real estate development, urban design/placemaking, urban revitalization

6 Comments:

Good points.

Larry Littlefield had a rant the other day on this. Goes back to Fannie Mae and income qualifications.

Basically post 2007 increasing the income/debt ration means we can push up asset prices, which benefits people who already own houses (old people) vs new entrants (young).

Also the rules on bank lending which has led to a less condo construction vs. rental post 2007, which means harder to get an entry into the equity ladder.

(DC's increased transfer taxes have not helped either).

In DC (as opposed to Vancouver) the problem is

1) as I've said for a long time, we are undertaxed on property.

2) too many owners prefer to rent smaller units privately rather than sell

3) We should be building affordable housing for sale, rather than income limited rental housing.

4) Not sure what you can do about the SFH in DC being around 1M. I don't see that is going to change. Either you are a professional dual income making about 250 a year and can afford a SFH in DC (with private school costs on top of that) or you can't.

well, wrt #4, my piece isn't a lament as much as it is a description. That doesn't mean I am ok with how things are, but the problem is structural.

But a lot of people don't seem to get how the market works and why things work the way they do. (E.g., I remember under Harriet T. the city thought it was doing a good thing by giving $5K inducements to people buying "close to work." DC had no business doing that as it had no substantive impact on choosing where to live/to live in DC, etc. Or, MB announced a $10MM fund to keep properties affordable. It needs to be 25x larger at a minimum... etc.)

#2 -- semi related. a study in UK found that 40% of "council housing units" privatized during the Thatcher years are rented out, at rates double what Council housing goes for.

But yep, in DC, it's about becoming a rentier. If you don't have to sell, why not make the income.

#3 -- I don't think it is either/or, more like and/and. The lack of AH housing for people with some money (what GGW posts often lament) is a separate issue from housing for the impoverished of various types (including SRO).

The other thing, would be to have a massive campaign to build carriage houses and English basements.

I tried to sign too late to get into the ADU summit. My thing isn't that we have to convince people of the value (although given how far we are behind best practice, we do), but to focus on operationalizing a way to build them at scale.

I know how to do it (or at least, I've come up with a model system for doing so). I don't have the financing. But I haven't tried to pull a group together to do it. But just writing this makes me realize someone I should talk to about it.

Was reading something on Porto, hot new tourist town.

Mayor was asked about the danger of AIRBNB and interrenational commerce.

His repsonce was city owned a lot of property for let, and price for a family downtown was 400 euros.

The financing and ADU thing is real. This is where the $100m should be spent in terms of loans. Just add it to your property tax for 30 years.

wrt Airbnb I think they should be allowed, but with restrictions. Normally I think "arbitrary numbers" (e.g., like how MoCo authorized a max. of either 2,000 -- I think 2,000 -- or 4,000 ADUs without regard to "carrying capacity" of properties) are bad.

But I would say put a limit on the number of "whole house" Airbnb by district (ward/neighborhood), and probably not limits on owner-occupied residents doing ancillary "fractional" rental.

I don't know what the number should be, but it shouldn't be that high. What's reasonable, 100 per ward? More?

I don't think the unions should be all apes*** about it. People who do airbnb mostly aren't interested in staying in traditional hotels.

They also should be required to pay the regular hotel/visitor tax rates for the stays. That goes for fractional uses too. (We've had to pay those taxes in Seattle and SF.)

2. Not addressing the issue of financing the "machine" to produce ADUs at scale, Edmonton I think, maybe Calgary, among others, have a $20,000 grant program to foster ADU development.

https://www.edmonton.ca/programs_services/funding_grants/cornerstones-grant-secondary-suite.aspx

Hadn't come across this before. It is a survey of not quite 2/3 of the "garden suite" owners in Edmonton and their practices concerning rents.

https://dalspace.library.dal.ca/bitstream/handle/10222/72852/April%2017%2C%202017%20Final%20Honours%20Submission.pdf?sequence=1&isAllowed=y

- unless it was extended, the Calgary grant program ($25K) is no longer in effect

https://www.calgary.ca/CS/OLSH/Documents/Affordable-housing/Enterprise-Housing-Program/Secondary-suites/Secondary%20Suites%20Grant%20Program%20Brochure.pdf?noredirect=1

I can't remember your exact argument, but you kept making the point that sub-standard rentals are at high rates in DC because of the lack of supply.

It's the flip side of "the missing middle."

JJ's point about "a large stock of old buildings" is based on the presumption that they would be low cost because they were not Class A/new/upscale properties.

Here, such properties given the demand, are still high cost.

It's actually been that case, relatively speaking, for a long time. It's why DC hasn't been an big center for foreign immigrants (e.g. comparable to Somalis in Minneapolis). Sure we have some. But for the most part, places like Annandale or Langley Park were cheaper, not than Far SE, but the imputed public safety cost wasn't worth it relatively to the decrease in rent and transportation access deficits.

... although now you do see Latinos in W7 and W8.

Philly’s wealthiest neighborhoods have median incomes that are $100,000 more than the poorest areas

Philadelphia’s Fairhill and Fishtown neighborhoods are separated by a little over two miles — and about $100,000. That’s according to new figures about the median household income from the U.S. Census Bureau. There’s a six-figure gap between Philadelphia’s wealthiest community and its lowest-income neighborhoods. While the city as a whole is getting wealthier, Philadelphia remains the poorest big city in the nation.

https://www.inquirer.com/news/philadelphia/philadelphia-neighborhoods-median-income-map-20231207

Post a Comment

<< Home