... Housing shortage raises prices

Another story headline that is somewhat ironic is from yesterday's Louisville Courier-Journal.

I wasn't so great in economics in college, because I am not so good at higher level math.

But the policy reaction to the housing market crisis in DC makes me feel like a great economist.

-- "The nature of high value ("strong") residential real estate markets," Dec. 2017

-- "What people don't get about the DC housing market: supply is much less than demand, so prices keep rising (a/k/a basic economics)," Feb. 2017

-- "Applying the super-gentrification thesis to San Francisco, Santa Monica, and other cities experiencing hyper-demand," Jan. 2014

-- "The eight components of housing value," Sept. 2016

Housing prices are up because supply is less than demand. This is basic microeconomics.

Anti-gentrification poster, Columbia Heights, the URL redirects to DC's Department of Housing and Community Development.

But activists tend to be focused on restricting new housing production in various ways.

Criticizing new production for creating displacement (gentrification) effects.

In the past, historic preservation has been similarly criticized.

The thing is, without new housing production, even without designating neighborhoods as historic, housing prices will continue to go up regardless, because of increased demand and demand for historically attractive properties.

Not building housing isn't going to make prices go down when demand remains high and/or is increasing.

The causes of today's Housing Shortage

1. Most of the housing in the city was constructed before 1940 when the US population was less than half (132 million) of what it is today (309 million in 2010; estimated 325 million in 2017).

DC's population reached 900,000 during the war years, but declined to a "peak" of just over 800,000 in 1950. After about 10 years of population growth, after decades of continuing decline, DC's population is close to 700,000.

2. The US population has more than doubled in the last 70 years, leading to more demand for housing.

3. Household sizes are smaller today, so you need more houses to house "the same number of people" as well as more people.

4. There is also a rise in the number of single person households creating more demand for housing beyond that required for earlier and different demographic conditions.

5. Finally, there is an increase in demand for living in the city (see the arguments in Options of Urbanism) and in these conditions, even small increases in demand can result in large rates of price appreciation.

Why new housing doesn't necessarily lead to lower housing prices "right now"

1. People complain that new housing doesn't reduce prices.

2. It can't.

It's built at today's prices for land, labor, and materials.

Only over long periods does housing "built today," decline in price relative to newer production.

3. That being said, when demand is greater than supply even as new supply is added, the addition of supply doesn't decrease prices, because demand is still not fully met.

Intra-market nuances

But because the housing market is made of many different segments or types of demands, if certain segments face an oversupply, prices may drop a bit ("In expensive cities, rents fall for the rich — but rise for the poor," Washington Post), but this is more a function of calculating year-over-year percentages. Comparatively speaking, the housing is higher priced than older housing within the similar class.

Because of the nature of the availability and cost of land, the majority of new housing constructed tends to be multiunit housing. It may be offered for rent or to own (condos).

Because of the vagaries of financing, there may be too much of one and too little of the other depending on the state of the market at one particular time, leading to pricing variances from the general trends.

These market inefficiencies are also produced by the long time frame for developing, permitting, and constructing new housing. I am familiar with projects that take 15 years or longer to come to fruition.

The "lack" of middle market housing

This is something that people wring their hands over. Why there isn't enough small housing, like rowhouses, that is cheaper relative to bigger houses and detached houses.

There is middle market housing. Plenty of it.

But it's no longer middle market, because it has been bid up because of the overall shortage of supply.

Dividing up large rowhouses into multiple units/flats and adding accessory dwelling units to houses and lots where they are more easily accommodated could add supply for this type of housing, but because it is developed at today's prices and because it is also complex to do for individual property owners in terms of permitting and the regulatory environment, financing, and construction, adding housing of this type will only have impact at the margins, because the overall additions to supply will be limited.

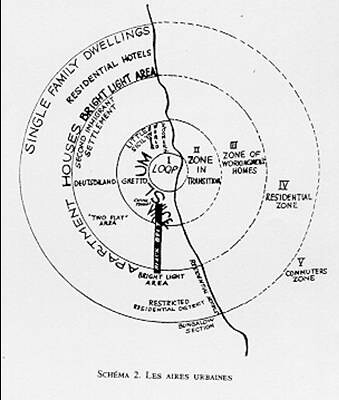

The concept of filtering was developed by the University of Chicago urban sociologists in the 1920s.

The basic idea was that cities spread outward and that as households increased their income and wealth, they would move out of the center, and that newly arriving residents, with less income and wealth, would move into these neighborhoods, restarting the same process of "ecological succession" (also called "invasion-succession theory").

-- "What filtering can and can't do," CityObservatory

This approach did not anticipate that housing at the center would remain in demand by high income households. (That's the nature of the housing market in the UK and Continental Europe, although it's bifurcated with strong demand for both in-city and "garden suburb" housing.)

For many years, center cities were "abandoned" for the most part, although most retained some neighborhoods that remained attractive to people desiring urban living, such as Guilford in Baltimore (more suburban), Palmer Park in Detroit, etc.

Lots of smart growth advocates claim that filtering is the solution to the present lack of affordability in the face of renewed demand for urban living.

But in strong markets, where high income households want to live in the core, and where there is an increased demand to live in the city and an increased demand to live in attractive historic neighborhoods, people don't leave, housing prices go up, and there are no neighborhoods that are abandoned and thereby providing cheap housing for new entrants.

This is the case for cities like Boston, New York, DC, San Francisco, West Los Angeles, etc. Pittsburgh, after decades of decline, seems to have joined this group of cities. Oakland too, because of the housing shortage in cities like San Francisco.

This isn't the case in weaker markets. In Detroit, you can find a house for less than $20,000. Just don't expect much in the way of appreciation. Cities like Baltimore, St. Louis, Philadelphia, Hartford, New Haven, St. Paul, etc., still have the conditions where the concept of filtering is operative.

Urban housing land trusts

More recently there has been discussion about land trusts as a way to assist affordability. The underlying land would be held by the trust, and because it would be nonprofit, it could be taxed at lower rates. Sales of houses are subject to affordability requirements.

-- "Not particularly radical: housing ideas from Right to the City," March 2018

But it's too late for this to have much effect in strong markets. It needed to get going 15+ years ago.

A leading book on the subject, Streets of Hope, about the Roxbury neighborhood in Boston, was published in 1994.

Today, the organization featured in that tale has 95 units of housing in land trusts (alongside 77 units in cooperative housing and 53 rental units), hardly enough to make a difference structurally, although it's valuable for the people living in it.

In a strong real estate market, being able to put land into urban housing land trusts is virtually impossible.

Labels: affordable housing, gentrification, housing market, housing policy, real estate development

0 Comments:

Post a Comment

<< Home