An illustration of the complexity of urban construction of new housing from San Francisco

Affordable housing issues and "subsidy of market rate construction" housing are issues always in the news.

Tax abatements/subsidy of market rate housing. WRT the latter, some elected officials are looking to end the 10-year tax abatement on newly produced housing ("Councilwoman Bass proposes eliminating 10-year tax abatement," Philadelphia Business Journal) and want to redirect the monies to affordable housing production.

But while it's looked upon as a subsidy, it's also a "residential recruitment device," and in a situation where Philadelphia continues to lose population even as other cities like Boston, DC, and NYC gain population, that's important. Although there is no question that maybe a 10-year full tax abatement is overly sweet ("Philadelphia 10-Year Tax Abatement Here to Stay, for Now," NBC10) and perhaps the program needs some readjustment.

A similar debate is happening in Richmond ("Richmond's tax incentive program is promoting housing inequity," Richmond Times-Dispatch), unless you have a digital subscription, you'll need to access the article via a library-based articles database). Also see:

-- "Stoney administration pitching council on tax break for Manchester developer; Richmond assessor: 'Why do you need to incentivize somewhere that's so hot?'"

-- "In reversal, developers pledge affordable units in Manchester project up for taxbreak"

It's tricky because people don't understand that generally the cost of construction of new housing, even rented at market rates, might not "pencil out" at least in the intermediate run. And that the cost of construction (and land) is high and therefore renting it to other segments of the market isn't efficacious.

"Lifetime customer value" of a new resident. And when you look at the total value of new housing in terms of resident income and sales taxes and other elements, just like how in direct marketing, you "buy" customers losing money in the short run, but making money on the "back end" in terms of purchasing over time and consideration of the total "lifetime value of the customer," the same goes for cities and adding new residents, especially those of high income.

Workforce housing production. There is a great piece in Multihousing News about workforce housing production. And I was surprised to see that MassHousing, a state government instrumentality, is happy to provide subsidies to projects that end up providing a "discount" to market rental rates of 10% to 20% tops.

-- "Work It!—Financing Solutions to the Middle-Market Housing Affordability Gap"

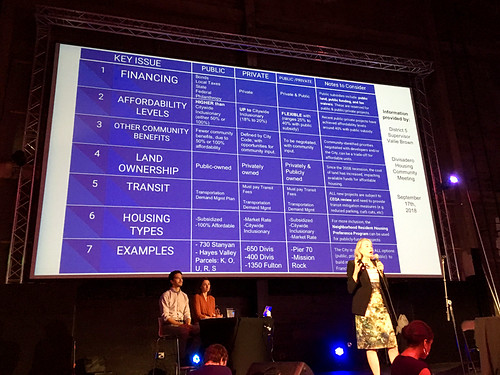

New Housing Construction in San Francisco. Jim Dyer is an community advocate and I subscribe to his Flickr photo feed (we met once at a conference years ago, he is a biking advocate too), and I saw this photo, displayed at a meeting in his San Francisco Council District held by the elected official, Supervisor. Vallie Brown ("Community meeting aims to overcome impasse on new Divisadero housing construction," Hoodlline).

The projects are controversial because they propose a density that is greater than that which exists currently, in an area that is predominated by low height industrial type buildings.

When so many of the discussions on new housing focus on only one element, the fact that this slide lists six basic elements:

- financing

- affordability levels

- community benefits

- land ownership

- transit access

- housing types

- public

- private

- or a mix

- "notes to consider"

Labels: affordable housing, housing market, real estate development, real estate financing, tax incentives and abatements

7 Comments:

The Multihousing piece is damning, and goes back to what I was saying about a finance problem.

They frame it as a local/national issue -- that workfoce means different things in different places and that absent a better definition it is hard to scale up financing.

Why question is what percent of "workforce" is GSE money -- I'd say 100.

And that the the problem. Banks and other entities won't loan you money to build cheap housing.

On GFC, see also this:

https://www.cfr.org/blog/three-sudden-stops-and-surge

from previous discussion.

Yep about the MHN piece. Years ago at an AH conference (Bisnow) in DC, I asked a presenter from WCSmith what the rent price difference was on new construction AH from market rate product and he said about 1/3 less, which is pretty significant on new construction.

Will read the cite. Thank you.

WRT GSE do you think that they should be discontinued or as others argue, merged into one bigger org, but with less purview?

I have always thought that they are risky entities, but the market is built around them and disintegrating them could be quite deleterious.

Basically we are damned either way.

wrt the cite, I am no data analysis pro, but there is a problem when you aggregate data for the entire country.

The strongest real estate markets post-crash were cities like DC and NYC. I don't know about NYC, but a fair amount of the activity in DC was generated by foreign entities. That's when Skanska got much bigger in the US, Lend Lease, etc. Qatar's sovereign wealth fund funding CityCenter, etc.

I remember the data about DC being the #1 market for foreign real estate capital. Etc.

I guess I need to read Crashed, Wolf (I was content to just read the FT columns) etc.

https://www.cfr.org/blog/read-brender-and-pisanis-globalised-finance-and-its-collapse

GSE: I'd say the GSE conundrum is a real test for the political system.

You point that out on piece on the hurricane. NYTies had a good thing on Charlotte buying back houses.

But the essential question is the same -- can the same gradual process that is politics solve this issue?

This is the same fear that drives voter to Trump - that to do the Big Hairy Change you need a strongman and not traditional politics.

My personal view on the GSE is the sooner they are put down - and we put down the 30 year mortgage with them the better.

I agree that is not going to be popular. Maybe you give people one government guarantee 30 year mortgage. That's it.

I still say the political system can build and answer these changes. Warner and Corker had a bill on the GSE.

And yes that means that financing for workforce and income limited housing is going to be in trouble as well.

It would suck but basically the Canadian residential mortgage system is like that for commercial property in the US.

Ten year loans, but amortized on a thirty year schedule. SO that every ten years the interest rate is reset.

Interestingly, if you move within the ten years, you can take the mortgage with you.

One of the problems in the system in the US is giving that rate for thirty years. Although some like that because it leads to lots of churn, refinancing, etc. and the fees that come with it.

I do think we need GSE for non-market rate housing support...

Post a Comment

<< Home