New York Times article on DC's success misses the most important point

-- "Washington’s Economic Boom, Financed by You," New York Times

The article argues that DC's success over the past 15 years is the result of a federal spending boom in response to 9/11, wars in Iraq and Afghanistan, and the increase in spending on counter-terrorism.

The article argues that DC's success over the past 15 years is the result of a federal spending boom in response to 9/11, wars in Iraq and Afghanistan, and the increase in spending on counter-terrorism.Likely that contributes, sure, but I can't fully agree with the thesis.

Federal spending has been increasing for decades, it's just that it was mostly being spent outside of DC

The reality is that federal spending has been increasing significantly throughout the past 50 years.

What happened is the bulk of that spending has been outside of Washington, DC proper, and spent in the suburbs--military spending in Northern Virginia ("Why Virginia's Become Mecca For Military Contractors" from Forbes Magazine) and health, science (NIH, NIST, FDA especially in Montgomery County), and military in Maryland, with telecommunications and computing spinoffs in NoVA somewhat derived in a broad ecosystem sense from military spending on telecomm and information technology.

However note that much of the increase in spending over the past decade, and discussed in the NYT article, has been military related (e.g., the Post series "Top Secret America," from 2010) and most of this spending isn't spent _within DC proper_ (e.g. contractors, defense agencies, etc.)

The real story is that from from the 1960s until 2000, DC wasn't capturing "its fair share" of this growth which was mostly captured by the suburbs.

And even today, almost 70% of the people earning wage income in DC continue to live in the suburbs.

What has happened is that DC is capturing a bit more of this growth in spending

Through the combination of a number of factors, over the past 10 years, DC has been able to reposition slightly vis-a-vis the suburbs in terms of capturing residents and other new development where proximity to the federal government is advantageous (trade associations, lobbyists, law firms especially). It's now seen, generally, as a competitive location for certain types of business. Especially because of the subway (see below).

But it's not a continuous upward trajectory.

DC continues to lose federal agencies--it is likely that the FBI will be the latest agency to leave the city--and other businesses with large numbers of employees (such as Intelsat or the Bureau of National Affairs) to the suburbs.

Plus DC generally isn't very successful competing for headquarters operations relocating to the metropolitan area (recently both Hilton and Northrup Grumman chose to locate in Northern Virginia).

Although it is true that military base consolidation and the relocation of some military facilities to the Navy Yard and the relocation to the area by related military contractors, has contributed somewhat to the revitalization of M Street SE and the Capital Riverfront District.

Right: rowhouses in Bloomingdale.

Right: rowhouses in Bloomingdale. Urban pioneering from the 1970s through the 1990s reaches critical mass around 2000

It is somewhat pejorative to use the term "urban pioneering," because like saying that Columbus discovered America while Native Americans were already here, the same goes for in-migration to the city, but...

Even after white flight in the 1950s, DC's population continued to decline. In 1950, the population was about 802,000, in 2000 it was 572,000.

Yet, significant numbers of people were still moving into the city, despite prevailing trends, attracted to nice neighborhoods, typically comprised of historically significant residential building stock, the ability to get to work without having to rely on a car, cultural amenities, etc., despite the double whammy of declining quality of municipal services and increasing crime.

These "pioneers" helped to stabilize otherwise declining and shrinking communities and over time in some areas (such as Capitol Hill, Dupont Circle) built up large enough numbers so that they began expanding the boundaries of where they were willing to live--e.g. "Capitol Hill" moved from around the Capitol and Union Station to eastwards of Lincoln Park and the definition of Dupont Circle continued to move southward to 14th Street.

I would argue that around 2000 and onward, in-migration began to achieve critical mass in many neighborhoods, like Logan Circle and Bloomingdale, not just in Capitol Hill. See the past blog entry "Revitalization in stages: Anacostia."

Transit

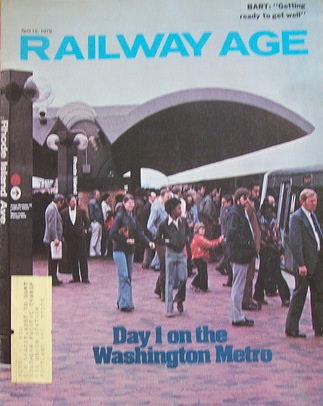

TransitThe same goes for transit oriented development. From the opening of the WMATA subway system in 1976, it took about 25 years to begin seeing significant spillover development benefit from proximity to transit.

First this happened in Downtown and West End, and over the last 10 years in the East End of Downtown (assisted a bit by Verizon Center). Then in places immediately outside the core (NoMA, Columbia Heights), and now further out.

Besides maintaining the economic relevance of the central business district, access to fixed rail transit contributed to the success of neighborhoods like Dupont Circle or Capitol Hill.

And over time, more housing proximate to transit is being built throughout the city, such as in Columbia Heights, Downtown, on U Street, H Street, etc., and even in places further out like Takoma and Fort Totten and Petworth. This has significant positive benefits.

In any case, the biggest change in the dynamics of the metropolitan housing market in Washington is that neighborhoods with high quality transit remain in demand despite the vicissitudes of the market.

This favors DC because DC has 40-42 transit stations (two are on the border and shared with Maryland) with 30 stations in the core of the city. It should be no surprise that in the core of the city, virtually every neighborhood with fixed rail transit service is either healthy or in the process of significant improvement. (The area around Rhode Island Ave. Station languishes because of the persistent application of suburban rather than urban design.)

Before large houses and lots far from the core were seen as valuable. With the real estate crash, many of these areas have lost 50% or more of their value. (Although gasoline prices are expected to decline and so this may change somewhat, plus the relative economic success of the Washington region may mean that housing distantly located will still be somewhat valuable, at least compared to other metropolitan areas.)

Before large houses and lots far from the core were seen as valuable. With the real estate crash, many of these areas have lost 50% or more of their value. (Although gasoline prices are expected to decline and so this may change somewhat, plus the relative economic success of the Washington region may mean that housing distantly located will still be somewhat valuable, at least compared to other metropolitan areas.)Right: 1st and M Streets NE in NoMA, one block from the NoMA-Gallaudet subway station.

This favors Washington, DC specifically, but also places like Arlington, Alexandria, and parts of Montgomery County which have in-demand neighborhoods that are served by high quality fixed rail transit service.

Many people think that it's transit that matters most. It's more complicated than that.

It's transit plus access to activity centers and employment in high quality neighborhoods. Successful TOD at places that have no "there" qualities ("no there there") takes much much longer--and in fact may never be achieved.

And I didn't fully realize this til the last 18 months, but much of the desire for the Silver Line subway expansion in Northern Virginia is driven by a recognition that Fairfax and Loudoun Counties would need fixed rail transit to remain competitive for new development when compared to locations that already had subway access.

Continued crime reduction

Towards the end of the 1990s crime began dropping--in the early 1990s, murders in the city approached as many as 500 per year, and in 2012, the number was 88 ("Washington, D.C., finishes 2012 with fewer than 100 homicides," Los Angeles Times). A focus on problem-oriented policing has made a big difference in the city ("Cathy Lanier Changes Policing in D.C. and Maybe Nation" from Governing Magazine) although so has outmigration from the city of poorer residents who have been displaced from changing neighborhoods.

Addition of multiunit housing

Addition of multiunit housingFor the most part, DC's neighborhoods are typically comprised mostly of rowhouses or detached housing. The buildings tend to be small and aren't typically occupied by large numbers of residents.

By adding multiunit housing, more people can be accommodated in a smaller footprint. Plus, this type of housing appeals to different segments of the housing market that might have otherwise looked elsewhere for places to live.

Since 2000, a significant amount of new multiunit housing has been added to DC. This is what supports the general economic improvement of the city and allows DC to capture a bit more of the region's growth than it had been capturing previously.

What has changed is the last 10 years is DC's ability to capture residents vis-a-vis other locations in the metropolitan landscape of choice neighborhoods

The city became much more competitive as a place to live beginning with the election of Anthony Williams, and his focus on improving the quality of local government, simultaneous with reaching the tipping point in terms of favorable attitudes towards living in the city (the "Friends" and "Seinfeld" effect).

The tipping point of a willingness to live in the city matters a lot.

The tipping point of a willingness to live in the city matters a lot. As many urban pioneers as it seemed there were, there weren't enough to significantly move neighborhoods beyond stabilization. That's why DC's retail languished for decades.

Only now, with the increase in population in many neighborhoods are you starting to see improvements in places like Petworth and 8th Street SE.

And the addition of large amounts of multiunit housing supports commercial district revitalization, retail growth, and transit frequency.

Schools as a long term issue that still is up in the air

This will be subject of another blog entry sometime in the next month (I have grand jury duty which limits my ability to do much of anything three days/week.) But... it might not matter so long as families see charter schools as the solution to problems with local elementary schools.

Labels: commercial district revitalization, neighborhood revitalization, transit and economic development, urban decline, urban design/placemaking, urban revitalization

10 Comments:

Grand jury duty? That should be very interesting.

I think both the original article, and to some extend the response, suffer from a lack of focus.

The original article, yes, doesn't focus on DC vs the region. And to a large extent it is a function of DC just catching up to the region.

That being said, there are many signs of a bubble in play.

1. The number of cranes in DC proper -- 60 now? One just went up on M and 23rd.

2. Yes, you need to throw in sub-zero and wolf ranges in condos that are in the 800K range for 2 bedrooms in order to make people feel good about it. No different that the super-lux 1930s stuff thrown up in Columbia Heights. But no question, we are near topping out on those prices. The citycenter condo prices are insane, and if you didn't have Qatar financing them, would be corrected.

3. You are severely underestimating the bush era financing and how much of that is being blown on salary/contractors. So yes, before 2001 the DC region might not be capturing a "fair share" because a lot more is capex spending, but since then the region has been capturing probably 4-5x its fair share. Military/intelligence people LOVE dc and love living here. Plenty of guys who might have been making 40-50K in the 90s were pulling in 450K or more.

4. Foreign money. Arabs to a small degree have a positive draw in DC, but in no way near the role of South Americans in Miami or HK chinese in Vancouver. You've got to be able to see a 800K condo to someone, and who is going to be rich enough to afford that? Even more so given 20% down requirements and that DC has the lowest rate of equity participation in ownership. Hell that last one alone is enough a bubble marker.

5. Finally, outside of the Bush era spending, 10 yeas of COL increases (while the rest of the county got nothing) and a job market that ensure the only place where middle class kids can get a job in DC is highly distorting. We've already lost to COL increases, and it continues that DC is about the only positive job market for white collar grads the country is fucked.

yes, I agree that the city is mostly just capturing some of the fair share.

2. I agree with you about financing effects. And that DC is reaching a ceiling somewhat on prices.

3. HOWEVER, the ceiling is being pushed higher by a sorting effect that means that more higher income people are searching for housing in DC, therefore helping to keep prices high.

E.g., just as poor people are being forced out of the city, so will middle income people be forced, if not out of the city, to neighborhoods where there is less competition for housing from higher income households.

FINALLY, your Point 5 is key. Just being here I don't see this as much. It's true, for computing stuff, for the SF Bay area too, and speaking of sorting, if you really need venture capital for your business, you end up migrating out there.

But yes, only a handful of markets--DC, NYC, Seattle, SF, and West Los Angeles--remain relatively strong in the context of the continental U.S.

Finally/2, it will take a long time for people to really understand, but one of the only way for larger swathes of the market to be able to participate in the DC single family housing market will be to add income producing units (English basements, basement apartments, carriage houses, accessory dwellings) to their house/lot.

This is especially true if the mortgage interest deduction is eliminated, and as mortgage interest rates rise. This is what drives the development of that type of housing in major cities in Canada, especially because they don't have a mortgage interest deduction there.

PS, yes, grand jury duty is interesting. Of course, it's all about whether or not to accept indictments, not whether or not someone is "guilty." I always find it interesting to experience new things. (And I've never served on a petit jury. Suzanne has twice already, and she's lived her 1/4 of the time that I have.)

Welcome to the grand jury club. I'm on one too.

Besides being horribly boring at times it is very informative at other times.

Also they system is wacked so you might get a summons to appear for a petit jury. Just alert the grand jury office and they can make it go away.

that happened to someone else on our panel...

Hmm. If I was a guy with a few axes to grind on local corruption, I'd love to be on the grand jury. Just saying.

Going back to the original argument, I'm not sure there should be a policy prescription towards getting people in single family homes. As we've talked about before, these "land hogs" have some value going forward besides density. If people are comfortable with condo living, let them condo live.

And it goes back to education. Is is such a bad thing to turn cities into child-free zones. Education costs a lot, and it might be better to outsource it to suburbs. Also, small correction -- the charter schools aren't attracting the new white kids.

Supply is an issue here, and you throw in a strong demand and very very weak supply it isn't surprising you have a strong DC market. Another benefit of urban life if it much harder (and more expensive) to overbuild vs. ex-urban estates. It can be done, and Brookland is probably a good example, but it is harder.

I'd be curious to see how the new CFPB mortgage rules play out. One thing I am learning from your writing if the value of "community" which tends to trump urban density theory. Moving away form 30 year GF mortgages will probably put a stronger value on community.

hmm. mortgage rules. reading today about BoA dialing back on its participation in the mortgage market makes me think that Fannie Mae isn't going anywhere.

2. schools/charter schools. Yes, I agree that economically speaking outsourcing ed. to the suburbs is not a bad thing. I do think that in W6 some white families are choosing 2 Rivers. I don't know enough about people in the other places in the city. On my block, they aren't "white" per se but mixed (Brazil/El Salvador; Caucasian American/Vietnamese American; cacuasian american/hispanic; and white/black + one Af-Am family. The Af-Am family sends their kids to a high quality public school, the others to private or charter schools).

Lots of Hispanic families utilize charter schools.

3. your paragraph 2 is key. Lets just understand the nature of the DC market. In some respects it is an outlier and its strength is in part sortation in the metropolitan landscape. I'd argue it was overdue, but whatever.

4. GJ -- there are different juries tasked with different primary purposes and even 18 month grand juries for federal court. I am on local stuff, which I can't write or talk about in any case.

backgrounder on new rules:

http://www.nakedcapitalism.com/2013/01/the-cfpbs-new-stealth-usury-law-on-mortgages-and-why-its-desirable.html

(and given the new relectuance of the fed to continue purchasing MBS -- and whether a deep market still exists -- it should be interesting)

thanks for the cite. That's quite a piece.

One thing to consider regarding housing is the exponential growth in college students in the last 10-15 years.

Like clockwork, DC adds and subtracts 65-75,000 every year due to the university curriculum and the comings and goings of the student population.

Recall that Tony Williams had to sue the Census Bureau a while back to get the count (could have been one of the ongoing surveys conducted by the CB) moved from June to October, although, Williams never acknowledged that was the reason.

The crane at 23rd and M is for yet another hotel.

--EE

Post a Comment

<< Home