Metrolinx Toronto: 25 potential tools to fund transit-transportation infrastructure

A study has been conducted by AECOM KPMG, Big Move Implementation Economics: Revenue Tool Profiles, on the potential of various methods for funding infrastructure expansion in the Toronto region. The report provides an evaluation of 25 different funding methods.

From the Toronto Star article "The Big Move: A sneak peek at Metrolinx’s short list of ‘revenue tools’ for expanded transit":

The report ... looked at 24 potential money-makers and ranked them by criteria such as their sustained money-making potential, cost of implementation, and whether they might result in positive changes to commuting habits.

Not all the short-listed ideas will make it into the final investment strategy Metrolinx submits to the province in June. That’s when the agency gives Queen’s Park its final recommendations for raising $2 billion annually for the next 25 years — the amount estimated in Metrolinx’s 25-year, $50-billion Big Move regional transportation plan. But the short-list will form the basis for the final phase of public discussions before then. The provincial agency plans to run its list by more than 100 key community and business groups it will meet with through May.

The potential methods:

• Auto Insurance Tax

• Car Rental Fee

• Carbon Tax

• Cordon Charge

• Corporate Income Tax

• Development Charges

• Driver’s License Tax

• Employer Payroll Tax

• Fare Increases

• Fuel Tax

• High Occupancy Tolls

• Highway Tolls

• Hotel & Accommodation Levy

• Income Tax

• Land Transfer Tax

• Land Value Capture

• New Vehicle Sales Tax

• Parking Sales Tax

• Parking Space Levy

• Property Tax

• Sales Tax

• Tax Increment Financing (Special Assessment Districts)

• Utility Levy

• Vehicles Kilometres Travelled Fee

• Vehicle Registration Fee

Also see the Toronto Star article "Metrolinx transit tools rejected by 51 per cent: Poll."

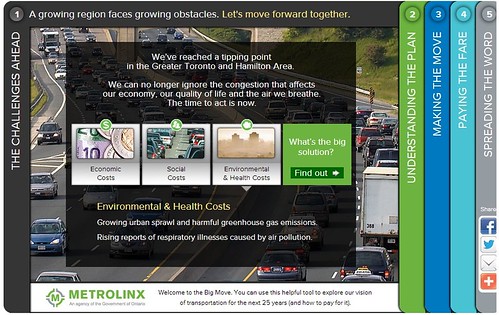

-- Big Move campaign website, Metrolinx

-- Big Move campaign interactive exercise

-- Toronto Board of Trade Let's Get the Region Moving advertising campaign to support more funding

-- DISCUSSION PAPER | A Green Light To Moving The Toronto Region: Paying For Public Transportation Expansion

Some day I hope to put together a similar report on best practices in parking and curbspace management. Having this kind of comprehensive list in one place is very useful. Rarely are all these techniques listed in one document, let alone considered and discussed in the context of a metropolitan, regional, or state transportation project funding.

Labels: public finance and spending, transit funding, transit infrastructure

12 Comments:

we've talked about DC as city-state actually has huge advantages in terms of being more flexible.

That being said, the tax revenue doesn't scale up well, and you need to surrounding metro area to kick in. And that level of coordination is very difficult in this area.

You are developing an unhealthy love for dedicated taxes and fees. In fact, capital budget mostly means dedicated fees now. Is that a good thing?

Also, a huge chunk of these fees are very regressive. With the exception of property taxes, we don't want to get into taxing capital. I understand the tax policy (capital is moveable,after all, and property isn't).

That being said, for DC a combined commuter tax, internet sales tax, and a tax on nonprofits could easily raise enough for the Blue Line.aa

I just like the concept of a master list to look at. I don't feel compelled to enact all of these taxes, just that when one is considering the issue, a thorough consideration of everything ought to be on the table.

2. Matthew Frumin, a candidate for DC Council, suggests getting the region to sign off on a 2% "commuter" tax that would only pay for infrastructure--so they wouldn't worry about us (DC) wasting the dough.

Myself, I prefer a withholding tax on wages, like in Oregon, or what the MTA has done in its service area in NY State (although I think there are some problems with how they've done it).

But for it to work, the federal govt. would have to agree to its workers being assessed for it...

3. And yes, u r absolutely right that DC isn't big enough to generate the amount of taxes necessary to do this all on its own.

b. and then, when you bring the other jurisdictions in, it gets messy because they care about other things and the positive impact gets diluted. e.g., like Prince William County and Frederick County being pro-gun vis-a-vis the recent MWCOG declaration about guns...

Hawaii is enacting an increase in the hotel room tax to pay towards the light rail in Honolulu

http://bigislandnow.com/2017/08/25/statewide-hotel-room-tax-increase-to-help-fund-honolulu-rail-project/

Vehicle Mileage Tax

https://www.sandiegouniontribune.com/columnists/story/2024-01-12/michael-smolens-the-transportation-tax-initiative-does-a-lot-but-not-one-big-thing

There’s one big thing the transportation tax won’t do

TARC in Louisville, KY has a wage tax for transit. This op ed by the head of a transit advocacy group is logically inconsistent. It talks about funding, but also cutting service, focusing on high frequency. The question of what I call the difference between network breadth and network depth.

TARC is at a crisis point; Greenberg must push Louisville transit agency in a bold, new direction

Inbox

https://www.wdrb.com/pov/tarc-is-at-a-crisis-point-greenberg-must-push-louisville-transit-agency-in-a-bold/article_551d183c-af17-11ee-a088-5f3b4fcb7854.html

Since 2020, when the COVID-19 pandemic hit and ridership plummeted, Louisville's transit agency has been kept afloat by the federal government's American Rescue Plan funding. In its 2024 budget, 25% of TARC's revenue is projected to come from ARP funds, while only 6% will come from fares. The vast majority of the remaining revenue (60%) will be generated by an occupational tax paid by people employed in Jefferson County.

https://www.seattletimes.com/seattle-news/transportation/theres-a-small-property-tax-boost-for-sound-transit-in-2025

There’s a small property tax boost for Sound Transit in 2025

1/6/25

Sound Transit’s voter-approved property tax, costing just over $16 per $100,000 of assessed value next year, will bring in 4% of next year’s $4.4 billion revenue budget.

41.7%, Federal Infrastructure Loans; 34.6%, Sales Tax; 9.3% Motor Vehicle Excise Tax; 4.2% Investment Income; 4% Property Tax; 3.9% Federal Grants; 1.4%, Passenger Fare Revenue; 0.8%, Other

Surcharge on ride hailing trips.

https://archive.ph/rLfmN

Johnson floats reviving corporate head tax to raise cash

Crain's Chicago Business, 7/29/25

A head tax is typically levied per employee hired by a business, so larger corporations are more impacted than smaller companies.

Chicago used to charge a per-employee tax more than a decade ago, but it was heavily opposed by the business community. Former Mayor Rahm Emanuel eliminated the rate in 2014, dubbing it a “job killer.”

Gross receipts tax as opposed to a corporate income tax

https://www.sfchronicle.com/opinion/openforum/article/transit-public-transportation-tax-20794117.php

A sales tax hike isn’t the way to save Bay Area’s public transportation. Here’s what should be done

A gross receipts tax, carefully structured with an exemption for small businesses, would ensure that the largest and wealthiest companies contribute their fair share to the infrastructure that helps make their record profits possible. This approach avoids placing an additional burden on families already struggling with the crushing cost of living in the Bay Area.

An economic analysis by Bay Area Forward shows that a gross receipts tax on just the top 2% of companies — those earning a combined $591 billion annually — could raise the $800 million a year we need to fully fund public transportation. Because the gross receipts tax would include a carve-out for small businesses with less than $5 million in gross receipts, 98% of Bay Area businesses will be unaffected. By contrast, a sales tax would harm many small businesses by increasing their tax liability, and it falls short of the funding needed to fill the transportation budget gap.

Not proposed for transit, but could be.

https://www.chicagobusiness.com/politics/brandon-johnson-revive-head-tax-2026-budget-plan

10/17/25

https://www.bloomberg.com/news/articles/2025-10-21/millionaire-tax-that-inspired-mamdani-fuels-5-7-billion-haul-in-massachusetts

Millionaire Tax That Inspired Mamdani Fuels $5.7 Billion Haul in Massachusetts

A millionaire levy in Massachusetts has generated $3 billion more in revenue than expected without forcing significant high-profile departures from the state.

The law, which charges a 4% surtax on incomes over $1 million, has created a $5.7 billion windfall to fund bridge repairs, literacy programs, and address the transportation system's budget deficit.

Some business leaders have complained that the tax makes the state less competitive and drives away the wealthy, but others, including a real estate developer and the president of a taser manufacturer, say they are staying in the state due to its talent pool, livability, and renowned schools.

https://chicago.suntimes.com/city-hall/2025/11/20/illinois-house-democrats-city-council-brandon-johnson-tax-online-sports-betting

Group of Illinois House Democrats urges City Council to kill Johnson's proposed tax on online sports bets

The City Council’s Finance Committee has already blown a $100 million hole in Mayor Brandon Johnson’s proposed budget by shooting down the corporate head tax he wants. Killing his plan for a 10.25% amusement tax to online sports bets would make the gap $26 million bigger.

Post a Comment

<< Home