Baltimore, riots and revitalization: distressed neighborhoods are more vulnerable to extraordinary shocks to the system

Fox News has a great article, "Riots rattle Baltimore homeowners, merchants key to urban revitalization" about the reaction of middle class residents living in various Baltimore neighborhoods in a variety of stages of revitalization to the riots and their willingness to stay the course. From the article:

The rioting and looting this week in Baltimore has homeowners and merchants crucial to the city's ongoing revitalization efforts worrying that the violence may have a chilling effect on future investments.

For decades Baltimore has relied on newcomers willing to buy and rehabilitate dilapidated -- and often abandoned -- property to power the rebound of the city's more distressed neighborhoods.

But like in many mid-sized cities across America, the revival -- captured a decade ago with a simple one-word campaign, "Believe" -- is fragile.

Vacant properties, Reservoir Hill neighborhood, Baltimore.

Vacant properties, Reservoir Hill neighborhood, Baltimore.What the issue is has to do with achieving a critical mass of people committed to, invested in, and capable of investing in revitalization, neighborhood by neighborhood.

DC uses a four stage typology to rate neighborhoods: distressed; emerging; transitioning; and healthy. Some cities use 6 or 7 stages, which I believe allows for more fine grade evaluation.

I used this model, but rating the commercial district separately from the residential area, to argue why the transportation investment in the Barracks Row commercial district of DC's Capitol Hill neighborhood seemingly had hyper velocity (see "Systematic neighborhood engagement").

But while at the time the Barracks Row commercial district significantly lagged the residential area, and was high emerging or low transitioning, the residential area was decidedly "healthy", hence speedy improvement of the commercial district, once the commitment to public investment was made. I also argue that you can rate places block by block, and apply specific interventions to improve those areas.

By contrast, most of the neighborhoods undergoing revitalization in Baltimore are at best emerging from the standpoint of the typology and therefore much more susceptible to changes in economic, social, and political conditions at the neighborhood, city, metropolitan, and state and national scales.

Baltimore's Patterson Park is a great example. It's a great area, anchored by a large park.

The Patterson Park Community Development Corporation engaged in portfolio investment, rehabbing a couple hundred properties, and either selling or renting them. But with the financial crisis of the 2008 financial crisis, they went belly up, and the neighborhood was wracked with foreclosures.

-- "Patterson Park, senators celebrate redevelopment of a city," Baltimore Sun, 1999

-- "MICA students moving to East Baltimore will face a mostly blank canvas," Baltimore Brew, 2010

-- "Unusual opportunity near Patterson Park," Baltimore Sun, 2009

Similarly, I was struck by a comment by an ANC commissioner in Anacostia quoted in a 2011 Washington Post article about changes in that neighborhood. I wrote about it in "Revitalization in stages: Anacostia." From the Post article:

Dasher and the community's other entrepreneurs are not without their critics. Anthony Muhammad, an Advisory Neighborhood Commission member who is Muslim, was concerned that Uniontown would be serving alcohol and challenged Dasher's liquor license, delaying the restaurant's opening by several months.In a blog entry, I wrote this:

In an interview, Muhammad raised concerns that Dasher, who signed a 10-year lease, and some of the younger professionals who are moving into the area were not sufficiently committed to the area.

"We've seen people come and go before," Muhammad said. "I just would like to know how long she will be in this community . . . and whether this is the type of business, one that serves alcohol and is surrounded by four churches and a school, we need to embrace."

People do come and go.

Part of it has to do with the attainment of critical mass and the ability of a group of people to overcome the inertia and force of disinvestment. People leave when they don't feel these forces can be overcome. (The article discusses factors that have contributed to the development of critical mass, without using that term.) But not understanding what contributes to this ebb and flow [of change] is a failure in part of the leadership capacities of people like Mr. Muhammad.

Riots in Baltimore. Photograph: Chip Somodevilla/Getty Images.

Riots in Baltimore. Photograph: Chip Somodevilla/Getty Images.In distressed and emerging neighborhoods, being "an urban pioneer" is really really hard.

It takes a lot out of you. You are likely to experience as many setbacks (be a victim of crimes etc.) and failures as successes, and success is in part a function of how many other people are trying to do the same thing. The whole is greater than the sum of the parts.

Some people aren't cut out for it and leave, making it that much harder to achieve critical mass. It takes a long time.

In DC, it took about 40 years to reach the critical mass necessary for revitalization momentum to continue "on its own" with limited government investment. Malcolm Gladwell calls such points "tipping points" is his book on the subject of innovation diffusion.

It happened that point was reached coincident with other factors that significantly accelerated what had been a comparatively slow process.

Marion Barry no longer Mayor as of 1999, and the new Mayor focused on improving the quality of municipal services, and crime--which had hit record peaks in the mid-1990s, started to drop.

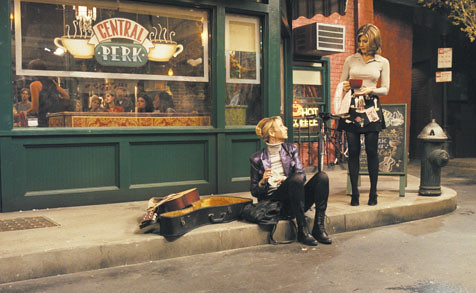

Outside "Central Perk," the coffee shop featured in the Friends tv show.

Outside "Central Perk," the coffee shop featured in the Friends tv show.Another important change was that living trends began to support living in the center city, after many years favoring suburban choices. I believe this was stoked in part by television shows like Friends and Seinfeld showing living in the city as a cool thing.

The city's investment climate changed because of the election of Anthony Williams as mayor, and then with the big post 9/11 federal spending--although more in the region rather than in the city proper--the city got another economic charge.

Baltimore hasn't been so lucky. And so its improvement is much more subject to fits and starts, despite all its great assets

Labels: community development, neighborhood revitalization, policing, public safety, urban design/placemaking, urban revitalization

9 Comments:

Baltimore got the Wire instead.

I saw David SImon say the way to end this violence is to end the drug war.

I think there is something to the idea that the rise of violence is related to the drug war -- in terms of gang killings, etc.

That said, I suspect the rise in crime in the 1960s preceded the rise of drugs and certainly the "drug war". See bars on windows.

Family breakdown. Leaded gas. Who knows.

That said, I think legalization of drugs would be the worst thing for these areas, as it would remove the only real source of cash.

The kids going into Cardozo this morning have better shoes, backpacks, clothes, and phones than my nieces and nephews. So there is money there.

(They don't have trips to Disneyworld, trust funds, soccer lessons, or something else. Not trying to compare, just pointing out the cash flows)

Dry up the illegal drug trade, dry up the money.

I'd have to go find my notes, but when William Julius Wilson spoke a couple weeks ago, he did discuss guns and crime and the effect that guns and crime had on people-communities.

The drug war certainly has created the sense of occupation by the police of neighborhoods.

But you're right of course that at the root of "the problem" is a broken micro economy. or as WJW said in the title of his book, "when work disappears."

When work disappears you don't have a functioning micro economy.

Anyway, in an increasingly globalized economy I don't have a macro solution for making new types of work appear to gainfully employ most of the US population, especially those in center cities and rural areas.

Some links:

http://www.washingtonpost.com/local/why-couldnt-130-million-transform-one-of-baltimores-poorest-places/2015/05/02/0467ab06-f034-11e4-a55f-38924fca94f9_story.html?hpid=z2

https://www.nytimes.com/books/97/05/18/reviews/pynchon-watts.html

We have argued before on the macro/micro thing; agreed with you than cities can't do much to solve what are essentialy national level problems (trade, dollar,etc)

Exit is always an option. There are jobs for unskilled elsewhere in the US and the world. Tremendous of stickiness. Related to public benefits and social capital?

I talked to one of the workers renovating cardozo last year - he was from NC, drove up every week to do the work.

Again, what is really happening with these riots is what used to be known as pogroms.

http://www.toptechnews.com/article/index.php?story_id=003000CCX1ZF

It happens on Friday I participated in a workshop on "Equitable development" concerning the likely impact on Historic Anacostia from the coming "11th St. Bridge Park" project, which will make the area more attractive to people with choices.

And then I read Klaus Philpsen's latest blog entry, on the Baltimore riots. his architecture office is around Mondawmin Mall.

http://archplanbaltimore.blogspot.de/2015/05/aspirations-of-two-baltimores.html

And I sent him a private message in response, about my equity planning ideas.

But then I was reading some of my past pieces that are related, and I guess I'll write another piece in the next couple days, but more focused on social enterprise and microenterprise development in extremely impoverished neighborhoods as a way to deal better with the here and now.

The thing like with macro/micro is short term/long term. The kinds of things I propose more generally in terms of civic asset networks and new types of programming have really long term effects. That doesn't do much for the people without skills who "want/need" jobs now.

How do you deal with the short term and the reality of the mismatch between jobs and skills, even between those jobs that don't require "book skills" like the NC guy maybe, but still require a high level of technical expertise, along with "work readiness skills" like get to work on time, come to work everyday, work safely, are generally reliable, produce quality work, give 100% effort while working etc.

The very end comment I made at the workshop was in response to someone saying that people when doing public presentations need concrete examples.

I countered with something about the reality that the Bridge Park won't, in itself, generate all that many jobs. How many people do you need to operate a small park, 10-20 people?

RE: NC guy -- construction worker, not skilled. living out a van during week.

Yep, Long term/short term.

Something like a kickstarter effort (5000 grants to get a microbusiness going).

Or city run emergency bank (ie the Donovan house murder, which seems precipitated on the need for a rent payment).

The thing about the program in Sandtown... is that it does demonstrate that some of my thinking (except that I don't know the specifics about what they did) has holes.

I wrote about the electric car2go I drove in San Diego, but I didn't write about my primary purpose in going there: to get a tour of the programs by the Price Foundation (ex. Price Club) in the City Heights neighborhood. They are basically a bunch of investments in "civic infrastructure", education programs at the schools, and some construction of social housing.

They too have spent a lot of money, close to $250MM, and they have more to go. By contrast, a similar program but less coordinated on civic assets more on housing construction, done by the Jacobs Foundation in a near by neighborhood, has still spent close to $200MM and hasn't had much impact.

But while the City Heights projects are very impressive, at the same time, I was thinking to myself, why can't you see as much physical impact?

... not unlike the old H St. story, where most of the projects conceived in the H St. Urban Renewal Plan were in fact realized, but the neighborhood still languished, but with the spending of between $100MM and $200MM (if you count the annual lease payments by DC Govt. agencies housed in the office buildings) of public monies, plus the add'l private investment (such as in Hechinger Mall).

I do think it is a program coordination, co-location, the development of new and innovative programs, but also some other stuff that we seem to be missing (like microenterprise development, etc.).

re your ideas, yes. One of the things discussed a bunch were that a lot of people "who want to start businesses" in places like Anacostia are more like micro micro micro businesses and don't have the capacity to get loans at all, so how do you build an infrastructure to support business development in that situation.

One way of course, is by markets. I have suggested that Anacostia needs "a public market type building" as a form of business development for a long time.

This is a great post about Baltimore's revitalization.

The revolting and plundering this week in Baltimore has mortgage holders and dealers urgent to the city's progressing renewal endeavors stressing that the savagery may chillingly affect future speculations.

Visit here-"bestonlinepharmacyinUSA"

I grew up in the South Bronx in the 1980s and 1990s and I agree with your piece. People love fast food everywhere, but I have seen multiple McDonalds and White Castle franchises open and closed multiple times in those eras. People who live in those places are not seen as desirable customers, people call them high crime areas, and real estate investors and entrepreneurs are afraid to go for it. (Most spree killings and mass shooters are committed by white people in suburban towns with low-minority populations but we don't have similar serious discussions, and there are spree killings daily, the news just won't cover it if there is only a handful of victims) I don't know what the answer is, but cynicism and stereotypes make the problem worse.

Post a Comment

<< Home