Housing conditions in high demand markets

1. Supergentrification. Loretta Lees, a British professor who specializes in the study of gentrification, came up with the term "supergentrification" to describe the process of change in hyper-strong real estate markets like New York City and London ("Super-gentrification: The Case of Brooklyn Heights, New York City," Urban Studies Journal, 2003, 40:12).

Abstract: This paper is an empirical examination of the process of 'super-gentrification' in the Brooklyn Heights neighbourhood of New York City. This intensified regentrification is happening in a few select areas of global cities like London and New York that have become the focus of intense investment and conspicuous consumption by a new generation of super-rich 'financifiers' fed by fortunes from the global finance and corporate service industries. This latest resurgence of gentrification can be distinguished from previous rounds of revitalisation and poses important questions about the historical continuity of current manifestations of gentrification with previous generations of neighbourhood change.I argue ("Applying the super-gentrification thesis to San Francisco") the supergentrification concept can be extended in terms of looking at hyper-strong real estate markets, like Manhattan/Brooklyn, San Francisco and West Los Angeles especially, and the impact of global economic flows on cities like London, Miami, and Vancouver, where much of the demand for high end real estate is driven by nonresidents seeking safer places to park their money, to the broad repricing upwards that increasingly popular center city submarkets are experiencing.

As far as supergentrification is concerned, Rowan Moore, architecture critic for the Observer, has written a book, Slow Burn City: London in the Twenty-First Century, on London's real estate market. From a review in the Financial Times):

Moore explores the genesis of London’s universally admired public spaces and parks, which only became accessible to all through years of struggle and political agitation. He looks at the city’s infrastructure, the building of the London Underground and Joseph Bazalgette’s sewer, which combined engineering with the provision of a riverside embankment. His scope is wide, from slum clearances and social housing, in which London was a world pioneer, to Hampstead Heath and the Brutalism of the South Bank. But his real aim is to look at the contemporary city through the lens of these achievements, to explore the erosion of public space, the lack of planning, the dearth of urbanism in a city that is acknowledged as home to more of the world’s great architects than perhaps any other.An op-ed in the Toronto Globe & Mail ("It’s too easy to blame ‘outsiders’ for Vancouver’s housing woes") argues that "outsiders" are not the cause of housing price inflation. But that is a limited view. A marginal but significant increase in housing demand, especially by people with a great deal of money, in places where housing supply is constrained, combined with the reality that all new housing that is added to supply is priced at current prices, so in each segment of the market, new housing will be the highest cost housing, will lead to significant repricing upwards.

Construction near Miami Beach in 2014. Condo developers are now cutting back on projects as sales slow. Photo: Charles Omanney, Washington Post.

Recent reports on Miami's housing market, stoked by purchases from people from South America, as Miami continues to strengthen its place as the primary gateway from the US to South America, suggest that they are approaching a bubble situation. The Wall Street Journal ("Another Condo Bust Looms in Miami") and New York Times have reported on this more recently, but the Miami Herald has been paying attention for awhile ("Is Miami in a housing bubble?").

2. Broad upward repricing of housing. But separate from supergentrification, at the metropolitan scale, in attractive markets, such as Seattle or Washington, housing prices rise significantly as more higher income households seek to live in the center city, especially in neighborhoods where the supply of housing is constrained ("Exogeneous market forces impact DC's housing market").

To address this, Paul Krugman argues ("Cities for Everyone") that restrictions on construction and density should be loosened some, and tied to the provision of other benefits (senior housing, affordable housing) as a mitigation for allowing the construction of housing for the well off.

The Montreal "plex" takes up the space equivalent to not quite two rowhouses but is set up as flats, with 5-6 units.

The Montreal "plex" takes up the space equivalent to not quite two rowhouses but is set up as flats, with 5-6 units.I agree that we need to loosen restrictions some, and expand housing availability where we can (accessory dwelling units especially), but without wholesale destruction of existing neighborhoods especially those with historic building stock. Some of the prescriptions/proscriptions I offer:

-- increased density for housing in commercial districts

-- allowing the piercing of the city's height limit

-- density bonuses for housing constructed within two to three blocks of transit stations and hubs

-- accessory dwelling units and English basements

-- adding apartments within larger houses

-- facilitating the construction of "new" types of housing to better serve more nuanced segments of the market (Single Room Occupancy, microunits, different types of flats not common to the DC housing market)

-- etc.

3. A move towards rent control in SF suburbs. The rise in demand and housing prices in Greater San Francisco has led to rent control initiatives being placed on the ballot in Alameda and Richmond ("Rent control spreads from pricey San Francisco to suburbs," SF Examiner).

4. Apartment conversion to single family housing in NYC. Speaking of supergentrification, the Wall Street Journal reports ("Buy a Building") on how high income households in New York City are buying small apartment buildings, and converting them to single family homes.

5. Garages as primary entrance to the house. I found this article, "Once-lowly garages are the new great rooms of the Twin Cities" (Minneapolis Star-Tribune), very interesting because it communicates in a practical way how mobility, in this case the primacy of the automobile, shapes the built environment. The article is a nice sum up of the architectural history of the garage, and mentions how garages are both becoming bigger,--many houses are now built with three-car garages--or getting converted.

The piece mentions that 70% of households report that their enter their house through their garage. If you make your way in the world via car, it makes sense that you connect to the world via your garage.

6. Restrictions on the purchase of new housing by non-residents. St. Ives in Cornwall, England is a highly valued location for vacation (second) homes. Residents have initiated a referendum putting restrictions on the development of new housing for nonresidents ("'In St Ives, we're facing the financial cleansing of the town's people'," Guardian). From the article:

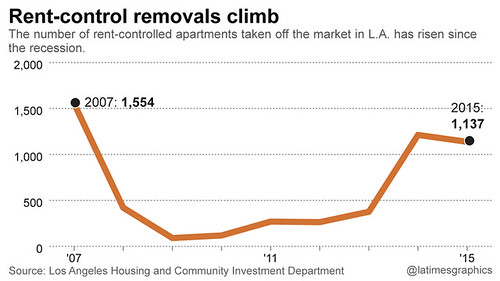

If the plan is approved, there will be a legal requirement to ensure that all new housing in the area is for principal residence., with the owners’ status checked against the electoral roll and doctors’ registers. While out-of-towners will still be able to buy second-hand houses as second homes or holiday lets, all newly built property will be reserved exclusively for the locals.7. Demolition of rent controlled buildings in Los Angeles. Smaller buildings are being demolished to build larger buildings. Because the new housing is being constructed at today's prices, the new housing is much more expensive than the housing it replaces ("More rent-controlled buildings are being demolished to make way for pricier housing," Los Angeles Times).

Labels: housing market, land use planning, real estate development, urban design/placemaking, urban revitalization

4 Comments:

just saw you put us the capital budget piece, but I'll need to absorb it.

ON this one:

1. Global money flows: The only place in DC we are seeing that is part of Georgetown where houses sell for $15 million. Arguably parts of Kalorama as well. DC has largely been spared this. I did look at a condo in Georgetown in 2012 and all the other people at open house where mainland chinese.

2. Aging+wealth. Are we building too much for overly rich people, which means people who are old. Really the only examples I can think of is some of the new places on the Wharf and City Center. Again as a sunbelt city we leave a lot to be desired.

3. How the F*** is someone born in 2000 going to buy their first house?

4. The we-work dorm model (yes, company is a scam but the idea of adult dorms not so awful).

5. IZ of course doesn't mean cheap housing -- it means income limited housing. And thanks to the magic of reality, it means you basically have to live in DC already to know and apply for a rental apartment in IZ. Let alone trying to buy an IZ condo (unless you are a council member). Huge sop to the existing voter base and not much on helping the region or DC adjust.

nope that's a one off capital budgeting piece based on the GGW piece.

Still to come is the other one. Maybe tomorrow.

wrt 5: politically connected, she wasn't a Councilmember then, but an ANC commissioner I think...

wrt 3: we watch Fixer Upper on HGTV. Some houses in Waco and its environs--they need significant work--can be bought for less than $30,000.

But yes, high value markets no. Excepting moving to the Canadian model. "25 year mortgage" in 5 year increments, interest re-set each period. Bifurcation of the mortgage market between high value and lower value locations.

What will matter is if the 5 year amortization is cheaper than renting.

And the origination costs for each new 5 year period will have to be low.

Oh, but maybe a 40 year period...

You're right of course to distinguish between wealth and income and who to build housing for.

And yes, wrt global money, DC isn't that big of a market for it.

But the general shift of the metropolitan area to higher income households and the increased interest in living in DC by those households changes the nature of the various submarkets and a broad repricing of those neighborhoods in DC that have Metrorail access.

That I guess is the center city effect-impact.

Post a Comment

<< Home