Learning the right and wrong lessons from best practice: Hong Kong is Transit Oriented Development on steroids

Transit oriented development is a term from the last couple decades for linking denser development with high frequency transit, most usually rail (although sometimes it includes bus rapid transit).

Ironically, it's the resuscitation of an approach that originated more than a century ago, about linking transit to development, and having higher density development immediately around stations and terminals. Mega-cities like New York or Paris or London or Tokyo couldn't operate if they were dependent on automobile transportation. High capacity transit moves thousands of people efficiently and quickly.

The concepts are captured in a long out of print publication by DC's Office of Planning, which updates these principles for today:

-- Trans-Formation: Recreating Transit-Oriented Neighborhood Centers in DC: Design Handbook

-- Center for Transit Oriented Development

-- Ten Principles for Successful Development Around Transit, Urban Land Institute

NotionsCapital points us to the Guardian article, "How public transport actually turns a profit in Hong Kong," about how the Mass Transit Railway (MTR) in Hong Kong is super profitable because they capture land value from transit adjacency in development and generate ongoing revenue from this development."

NotionsCapital points us to the Guardian article, "How public transport actually turns a profit in Hong Kong," about how the Mass Transit Railway (MTR) in Hong Kong is super profitable because they capture land value from transit adjacency in development and generate ongoing revenue from this development."Half the revenue in the system is from property development, ownership, and management.

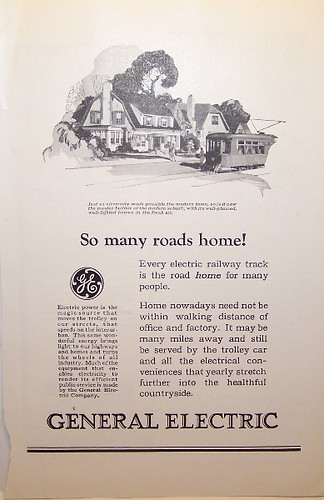

Historically, transit lines were created by land developers to make new residential development popular and successful.

In Washington, DC, for example, not only was a streetcar line built on Connecticut Avenue to Chevy Chase, Maryland, the streetcar franchise operators were required to build the street too.

The streetcar line on H Street NE where I used to live was built because developers weren't able to sell lots without it.

Railroads had massive residential recruitment promotional programs.

The Van Swerigen Brothers who built Shaker Heights and Cleveland Heights outside of Cleveland actually bought a railroad to get the right of way they needed to provide high speed transit service to their new developments ("Train Dreams," Belt Magazine).

The London Underground had great promotions in association with new lines, especially the "Metroland"of Suburban London.

In the US, transit became publicly owned because it was no longer profitable.

Especially when combined in a massive increase in auto ownership + regulatory oversight which was focused on keeping fares low.

In Asian cities, many transit systems are privately owned today because they are profitable.

Or they are run by public agencies, like MTR, but are managed to be revenue positive.

What's different about Hong Kong, many communities in Japan especially Tokyo ("Why Tokyo's Privately Owned Rail Systems Work So Well," CityLab), Seoul, and Singapore among others, is that these communities are massively dense in both building mass and housing. And most housing is multiunit.

Hong Kong.

So not only does MTR make a lot of money from development, lots of people live or work in Hong Kong and near transit stations, and so the ridership levels are huge as well--at levels far beyond what happens in most North American cities except for Mexico City and New York City.

Surprisingly, mass transit ridership in HK is about what it is in NYC, but they also have higher usage of buses, a still extant double deck tram system, and a great deal of walking, facilitated by a public system of walkway connections ("City of stairs: the interconnecting walkways of Hong Kong," Guardian) and public escalators.

Counter examples. The development at DC's Fort Totten Metrorail station in mostly a maximum of four stories, and maybe has 1,500 residents. Although there are taller buildings at other sites, such as Petworth which has one building about 8 stories high, and multiple taller buildings around the Columbia Heights and NoMA Metrorail stations. But DC's height limit puts a severe limit on the ability to build around transit.

Fort Totten. (Although development a block or two away is more dense, about double in size.)

Fort Totten. (Although development a block or two away is more dense, about double in size.)When I was writing the piece yesterday on Atlanta, I was shocked at the low ridership--only two stations of 38 in the MARTA system has more than 9,000 daily riders.

By contrast the Union Square development discussed in the Guardian article is 33 acres with 12 million s.f. of development and buildings as tall as 118 stories.

The built area includes 5,866 residential units, 2,230 hotel rooms, and 2,490 serviced apartments, alongside a shopping mall, Elements, of almost 1 million s.f.

Civic Square in West Kowloon. The shopping mall, apartments and two five-star hotels were all developed or are now owned and managed by the MTR. Photograph: Photogenic/Alamy.

Labels: fixed rail transit service, public finance and spending, real estate development, transit and economic development, transit economics, transit infrastructure, transit oriented development

5 Comments:

I've been reading a decent book on Chinese local growth politics -- "China's great wall of debt" -- and the contrast to the growth machine is striking.

Or as you said, on steroids. Although as far as I know HK does not have problem with ghost towns.

and of course a major issue in HK is the government very tightly controls the local land sales -- so there only have a limited amount of new inventory at any time. A good model for DC.

Hmm. About China I don't know much, but the power of the local governments to fund and command development and to control businesses is pretty big.

I guess it's just a different kind of political element to the growth machine. Here it's led by the private sector, there not.

Interestingly, when I did those EU pieces, local governments in Helsinki, to some extent Hamburg, and especially Vienna are much more involved in redevelopment of grayfield sites. E.g., in Helsinki they do the master planning, own the land, and then sell it off, after the plan. + they reserve some of the lots for social housing, which is addressed as part of the master planning process to begin with.

You've raised Singapore as an example in the past. It seems like HK is more like that. (Except for how Singapore has created a hybrid social housing model that is about values and the market and building equity.)

Hong Kong is great, but people get a lot wrong about their transit system.

First: the transit system alone is profitable! Their farebox recovery rate is something like 176%. So they don't need the property development to make money.

Second, (as you note) the biggest benefit of the property development is in ensuring dense, active land uses near stations.

Third, (as Charlie notes), property in Hong Kong is weird and you can't really draw any American lessons from it. All land is owned by the state. The transit agency is able to make money from developments because they've been given that land by the government essentially for free.

Thanks for these points. I guess the point I wasn't making clearly enough is that because of the density, "high ridership rates" are built in to the HK transit business model as a form of path dependence which leads to the high farebox recovery rate, which is all that much more remarkable because the fares are low.

By contrast, when you build freeways you end up with high automobile usage rate. And it runs at a loss because the gasoline excise tax rates aren't high enough to fund maintenance and repair, especially as the number of road miles grows. (That's path dependence too.)

... although as someone pointed out in the article, the system is relatively new and so they don't have to pay for hard core maintenance and rebuilding in the face of use, a cost that will come 20-40 years down the line.

===

The lesson, even though the scale is much much different is your second point, about active use and development at stations. In so many US instances, the TOD at stations is pretty limited, very small, and so has limited effect.

E.g., the touted Fruitvale development in Oakland had fewer than 100 units, so of course the related retail was mostly unsuccessful, because even with the station ridership, there wasn't enough demand/activity to support it. The station has under 7,000 daily "exits".

I was talking about the article with Suzanne and mentioned how the original c. 2000 plan for the Takoma Metrorail station (and for Brookland too) was something like 100 rowhouses, not denser multiunit housing.

Although the c. 1970s plans for DC Metrorail staitons was density, but it was fought back by residents. In some sense, I think they were right to fight the proposals in terms of design, but not about leveraging the investment in transit to add density, which in turn would help neighborhoods be more resilient, support local retail, etc.

It's an example of learning the wrong lesson.

It happens that almost 20 years later, for Takoma comparatively bigger multiunit buildings have been constructed around the Metrorail station (not on it). While some could definitely have been bigger, it's added 500-700 units of housing, and I argue this had made a significant contribution to the revivification of the Takoma commercial district, although most of the benefit has been captured by the Maryland side.

I lost my job few months back and there was no way to get income for my family, things was so tough and I couldn't get anything for my children, not until a met a recommendation on a page writing how Mr Bernie Wilfred helped a lady in getting a huge amount of profit every 6 working days on trading with his management on the cryptocurrency Market, to be honest I never believe it but I took the risk to take a loan of $1000. and I contacted him unbelievable and I was so happy I earn $12,500 in 6 working days, the most joy is that I can now take care of my family I don't know how to appreciate your good work Mr. Bernie Doran God will continue to bless you for being a life saver I have no way to appreciate you than to tell people about your good services. For a perfect investment and good strategies contact Mr Bernie Doran via WhatsApp :+1(424)285-0682 or Telegram : @Bernie_doran_fx or Email : Bernie.doranfx01@gmail.com

Post a Comment

<< Home