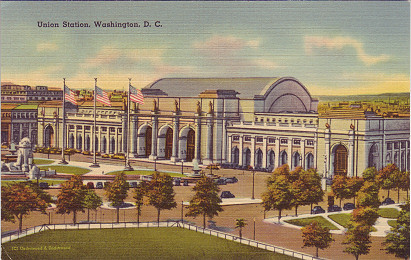

76 year long property tax abatement proposed for Union Station

The Washington Business Journal reports, in "Union Station tax break on D.C. agenda," that the property tax break that Councilman Jack Evans wants to give Union Station refuses to die.

A New York real estate company paid $160 million for the 84-year lease of Union Station. The acquisition gives it control of the station's office and retail space, concourse and ticket counters.

"We look at irreplaceable assets like this," Ashkenazy President Michael Alpert said. "We have long-term horizons. It's something we wanted to own. It's a trophy asset. We see an opportunity to create long-term value given its location, as well as the opportunity to upgrade the tenant mix."

The lease attracted 25 bidders. Union Station is considered valuable because thousands of tourists, shoppers and commuters on Amtrak, MARC and Virginia Railway Express pass through every day.

The 130 retail stores and restaurants have sales per square foot of $700 to $800, and 29 million people visit the station each year.

The corporation wouldn't have paid $160 million for the lease if the cost of property taxes was considered uneconomic. It's hard to know how much they make off the lease each year. It's reasonable to assume that rental rates are at least $50/s.f., which means the lease is worth more, as the WBJ reported in "Ground lease for Union Station changes hands" that there is 213,000 square feet of retail space in the building, that space generates gross revenue of at least $10.65 million annually. I can't think of any reason why this space shouldn't be taxed.

(Well, I can, depending on the cost of upkeep. But that presumably that comes from the lease payment to Union Station from Ashkenazy.)

Labels: Growth Machine, property tax assessment methodologies, public finance and spending, tax incentives, taxation

0 Comments:

Post a Comment

<< Home