Washington Post series on "Dashed Dreams: The Plight of the Black Middle Class"

The Post ran a series of articles ("The American Dream shatters in Prince George's County") concluding today on the impact of the decline of the housing market on the Black middle class, focusing on an 1,800 house subdivision, Fairwood, in Prince George's County, that was built in the early part of the last decade. With the housing crash, 1/3 of the houses tumbled into foreclosure and housing values declined precipitously, with problems abetted by various personal circumstances.

I was prepared to think, "wow, what a great series" especially because the first story led with a great graphic illustrating the vast differences between the average financial worth of white and black households.

Graphic from the Washington Post.

But the examples featured in each of the articles are about people who made incredibly bad financial decisions. Therefore, it is difficult to draw useful conclusions from the series, and they don't raise any of the issues I would have mentioned:

- Lousy financial terms make you more vulnerable financially (the articles sort of make this point, but indirectly)

- refinancing mortgages to take out cash because of higher values can go awry if housing values decline

- buying way more house than you need is expensive and can be impossible to pay if your personal economic circumstances change

- houses in what Christopher Leinberger calls "walkable urban places" tend to maintain their value more when macroeconomic circumstances change and the Fairlawn subdivision featured in the series is a conventional automobile-centric subdivision

- when you have too much house, you can take in roomers to help generate money to pay the mortgage, but it can be hard to attract roomers to auto-dependent places

But this ended up not being a resilient strategy and the county today is paying for it in terms of the crash in housing values and the high rate of foreclosures.

While you don't have the same level of price escalation in DC that you did at the height of the market before the 2008 crash, most DC neighborhoods (except East of the River) have recovered much of their pre-crash value (even if some households are still underwater mortgage-wise because of cashing out gains during the housing bubble).

These neighborhoods are mostly walkable, but not always, with increasingly vibrant neighborhood centers.

Prince George's County has some communities somewhat similar to DC in urban form although typically with significant less density, mostly along the Route 1 corridor in the western county, along the border of DC and Montgomery County.

Those neighborhoods too crashed in terms of housing values, and still are way off their peak pre-crash values, but they have recovered more compared to the conventional automobile-dependent suburbs further east.

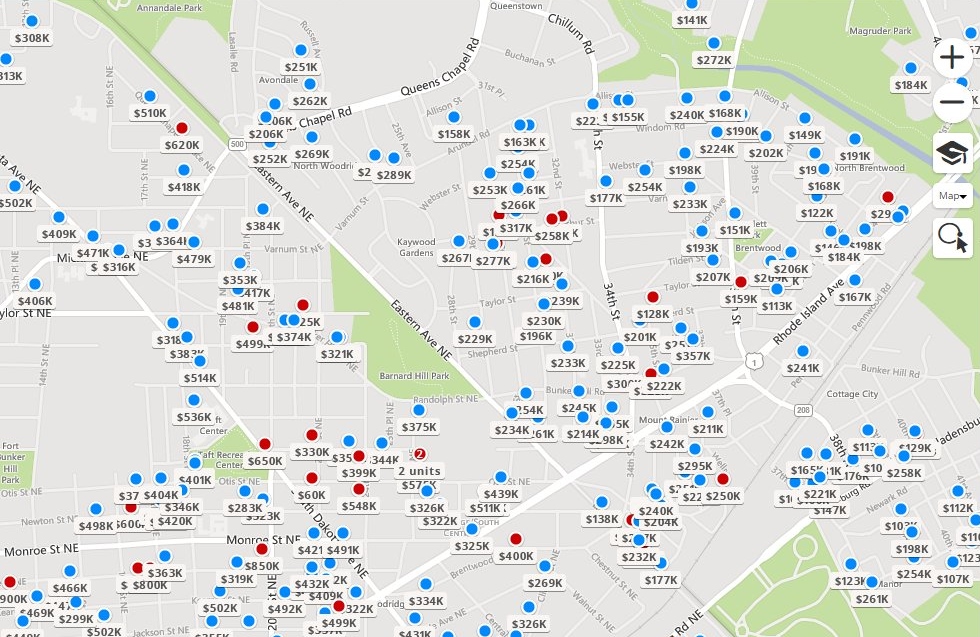

This image shows houses for sale in eastern DC's Woodridge neighborhood, and across the city-county line, houses in Mount Rainer and Hyattsville. The prices are higher in DC, even for smaller houses and lots. Source: Zillow.

We won't ever really know if Prince George's County had taken a different course towards development, and extended "urbanism" rather than conventional suburbanism, whether or not the county would today be in a different place economically.

Interesting, the biggest lesson may be that density builds value and resilience in many situations, rather than reducing it, which is the common but incorrect belief.

Yes, PG County has other issues. Traditional decline of "inner ring suburbs," is an issue. So is poverty in some areas. Like DC, PG County shoulders a disproportionate number of the region's poorest.

-- Foreclosure data webpage, Prince George's County

But maybe the biggest issue is the way that they develop land isn't the best method for building and maintaining property values over long periods of time.

=======

Interestingly, in many of the examples featured in the Post, if the households hadn't refinanced in the lead up to the crash, also on adjustable mortgages to take money out, they wouldn't be in financial predicament.

For example, one household, instead of selling a house and taking out a $200,000+ profit, which they could have used to pay towards the even newer $600,000 they bought, kept both houses. With the crash, both declined in value, the renter in the original house stopped paying rent, and their job circumstances changed, depressing their household income.

Labels: demographics, neighborhood change, neighborhood revitalization, residential mortgages, urban vs. suburban

8 Comments:

Well, as the article points out, similar car dense areas in Fairfax have sprung back.

So, it is more horrible financial decisions rather than the form.

That said, having everything built around the same time is a great recipe for prices to drop.

A denser area may be able to avoid that. Maybe.

What struck me was how much people saw PG as a cheaper alternative. You see that with the push for affordable housing. An urban area wants housing that is going to keep the price up, not just cheap housing.

The legacy of Detroit - too much cheap housing built in the 1930s and 40s just encouraged people to move (along a lot of other reasons) when the economy picked up in the 1950s.

But yes, a missed opportunity to talk about the urban form and the lack thereof in PG County.

damn, I meant to mention the point about it being cheaper as a perceived better value. There was a great quote about that in today's article.

But the difference is that cheaper is sometimes just cheaper. E.g., hill east is next to capitol hill, but was cheaper (one over neighborhood) or H St., but there were other elements of the value equation (historic building stock, historic housing, etc.) that meant that longer term value was greater.

2. wrt fairfax neighborhoods, I can't claim to be super duper familiar, but Reston values are still lower than they were, and there is a lot of housing on the market and it takes a long time to sell.

(Not unlike what's going on here. Crazy properties and/or crazy properties at too high prices are sitting. Decent houses remodeled right at a decent price are selling reasonably quick. Decent, not a low price. E.g. a big four square a few blocks from us went on the market at 799 and sold for 757, although it took a few weeks.)

I know that from friends who ended up renting their place out, rather than sell it. I think it's less than 1.25 miles to Wiehle now (it had just opened when they were leaving). But that hasn't been enough of a sweetener to increase property values.

Value vs price

This is what I meant a few days ago on the mortage discussion. The owners here didn't really want to invest in a community. That is what zero down can do.

I mean, in a perfect world, we'd be moving all the time to maximize price, but there are transaction costs and more improtantly reasons why you want people to live there 7+ years.

Also, just staggering they haven't paid for housing since 2008.

in my post I said historic building stock twice, I meant to say transit too.

... anyway, wrt value vs. price, again a very succinct sum up as you are so good at doing.

I have been told by old natives that PG has always been about cheap housing. I did some research in the wash post wash star digital archives years ago for something else, and noticed time and time again ads in the early 60s always for cheap PG houses. They also overbuilt tons and tons of cheap garden apartments And today those things are like barricades. There is value and there is just plain cheap. Cheap always costs more in the long run and pg just never learns.

Part of the issue is just legacy racism that didn't build that level of wealth that could be inherited. So sure, black middle class homeowners were sold a bill of goods and made risky purchases, but the growth in the middle class in the 1990s and 2000s was often the first generation to really benefit from economic growth. Can't tell you how many black peers I know whose parents grew up in sustenance poverty in incredibly isolated rural places in the south. Sure I have family in the midwest who grew up somewhat poor as well but we had landholdings and grandparents to offer loans. My grandparents didn't live under the Jim Crow south. So while they maybe they didn't grow up wealthy in the 30s, they had that a huge start. So sure both with hispanic and black households were especially hit by the predatory nature of the housing bubble which particular fed on both lack of inherited or borrowed family wealth as well as financial education that would come with it. That seems to be the bigger issue, walkable or not. The big issue is the legacy of racism and inequality.

Obviously, legacy racism is a big issue. Also in terms of respecting what we might call "folk wisdom" and "folk recommendations" (get a mortgage from someone at your church, keep and rent out your house because someone at church says it's a good idea).

What we don't know is if the people could have got un-predatory mortgages if they had tried.

Then we'd know how much racism was part of the issue.

But I can't see how the legacy of racism gets someone to buy a huge house that they don't really need, and costs a lot of money in monthly payments than many people can comfortably afford.

@Christopher; that , in this particular case, is pure BS.

As the article finds, native born blacks were not the problem in PG county. It was african immigrants. Also hispanic immigrants altough it doesn't say that.

And if you grew up in africa, legacy racism isn't hte problem. In fact native born blacks who bought and paid through were the ones most hurt as property values dropped.

The incredibly strange nature of the article made me realize the Post is up to old tricks. It has nothing to do with PG county, and everything to do with Mel Watt testimony on the hill yesterday.

Mel Watts, of course, wants a return to 1% down.

Post a Comment

<< Home