Economic impact of locally owned hardware stores vs. big box stores

The National Hardware Retailing Association, with Independent We Stand, an organization supporting independently owned retail businesses, commissioned Civic Economics, an economic consulting firm specializing in commercial district revitalization work, to do a study (Home Sweet Home) of the hardware sector, analyzing the differentiated economic impact on local communities of consumer expenditures for the same type of project at independently owned hardware and building materials stores versus the so-called "big box" home improvement stores such as Home Depot or Lowes.

The results of the study are presented in the cover story of the July issue of Hardware Retailing Magazine.

The study focuses on what is called the multiplier effect of consumer expenditures, when money spent in a transaction is used by the seller to purchase goods and services, pay employees, etc. Chain stores spend a lot less money locally than do locally owned businesses, plus the profits are repatriated to the chain headquarters and to distant stockholders. By contrast, local businesses spend locally.

From the HR article:

Methodology. Since a typical home improvement project involves a variety of goods and services, a hypothetical project approach was used to account for all home improvement categories. The budget for the hypothetical project was $10,000 and was divided among hardware, power equipment, lumber and building materials and professional installation services, as seen below. This budget provided opportunities to analyze various hardware and power tool segments from both independents and chains.

Civic Economics studied both independent and big-box businesses, examining the services and products that can be purchased at either. To determine a retailer’s “local economic impact,” the firm analyzed the different merchants’ labor costs, profits, procurement and charitable giving.

• Labor: A larger share of operating costs for local home improvement stores goes to labor since local stores’ administrative functions are either carried out in-house or outsourced to local providers. National chains consolidate these functions at their national headquarters.

• Profits: A larger portion of independent stores’ profits remain in a community. National chains redistribute profits to their shareholders or invest in global operations.

• Procurement: A local business will pay for local accounting and legal services. National chains provide these professional services in-house from their headquarters.

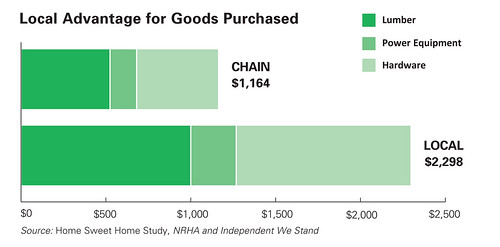

• Charitable Giving: Hometown businesses generally give back to their own communities. National chains are more likely to donate to national charities or groups located near their headquarters, not near their stores.The study found that spending at locally owned stores had almost double the impact--the multiplier effect--compared to chain stores, on the example used in the study, of an expenditure of $10,000, spending at the local store would generate an additional $2,298 of spending, while at the chain store, the impact was about half, totaling $1,164.

NRHA has created a website with a variety of support materials, including a widget that can be added to a retailer's website, enabling people to calculate the local impact--by zip code--of their spending on home improvements.

"Economic development" versus "building a local economy." This is a great illustration of the point I make about there being a difference between "economic development" versus "building a local economy." The former is focused on "getting business," while the latter approach looks more deeply at the type of business, how it functions and its multiplier effect.

One example would be the supermarket industry. While the DC area no longer has a significant number of independently owned retail chains, other places do.

In other places, there is a big difference in the local economy from buying from local stores versus chain stores, especially groceries from Walmart, which sends most of its revenue Bentonville, Arkansas, compared to locally headequartered companies.

But economic development policies by local governments don't usually reflect this, providing incentives and funding to chain stores, while providing little "help" to smaller, locally owned stores.

Another example: liquor stores in Minnesota and a level playing field between big and small stores. The Minneapolis Star-Tribune has an interesting article related to this broad topic, "Total Wine uncorks booze battles in Minnesota: Rivals of the big-box retailer are returning fire in an unfolding price war,"about the impact of a chain seller of alcoholic beverages, Total Wine, on locally owned stores. Minnesota has a wrinkle I didn't know about, as many smaller towns and cities own liquor stores (not unlike how Montgomery County, Maryland is involved in the industry, which generates about 10% of the county's revenue).

But Minnesota alcoholic beverage sales regulations requires that all retailers have access to pricing and wholesale information and to all brands and product types--that no one retailer can be an exclusive seller of a brand or product type. This extends, surprisingly, to private label items (so if Trader Joe's has "Two Buck Chuck" for sale in Minnesota, other liquor stores are able to buy the item).

From the article:

Minnesota’s existing liquor sellers have been able to gain unusual insight into Total Wine’s business because of a state law prohibiting liquor retailers from making deals to exclusively sell any alcoholic product. Instead, liquor must be sold through a distributor that every retailer can access.The "store brands" that Total Beer & Wine sells have to be made available to any retailer that wants to sell it, which provides a level playing for stores big and small.

That means all of Total Wine’s products, including its private-label Winery Direct and Spirit Direct items, can be ordered and sold by any Minnesota liquor store. Any Minnesota liquor dealer can also see Total Wine’s wholesale prices.

The law is part of a broader regulatory structure that was built over decades to ensure that smaller sellers of alcohol products won’t fall prey to larger competitors and to carve out room for both municipal and private dealers.

At the same time, those kinds of provisions in the law, if extended to other retail categories, would make it easier for smaller retailers to compete with bigger companies.

Another way, as evidenced by the Home Sweet Home study, is the example of business cooperatives in hardware. Where the organizations True Value, Ace Hardware, and Do It Best support individually owned businesses, by providing a structure that provides high quality services and technical assistance, branding and marketing support, product development, and pooling of buying to get better prices.

The average independent retailer doesn't have access to similar services, maybe other than reading trade magazines, which makes it difficult for them to compete with chains.

Labels: big box retail ordinances, building a local economy, commercial district revitalization planning, community economic development, economic development planning, formula retail, independent retailing

1 Comments:

nice information.Have a medicine website. there is a medicine that seems to work, please check out website.Take this medicne as advised by the doctor that are easily available at the online medicine store in USA.

Post a Comment

<< Home