Capability of elected officials, the pandemic's effect on the economy and the 2020 elections: DC edition

Four years ago, talking with my next door neighbor about the then Ward Council election, she said that she made her choices based on who has the background and skill set to be able to become mayor, to be prepared when and if circumstances change.

I was somewhat skeptical then, but now I understand her point. You want really capable and smart people in those positions, because you never know what can happen.

And that's the situation we're in today.

DC's Council is pretty progressive and quick to pass social justice oriented legislation and budget increases. They weren't so much "tax" and spend, because the tax revenue stream was rising without increasing taxes.

But with shrinking revenues requiring shrunken budgets, DC's elected officials will need a different skill set.

And that's the point my neighbor was making in terms of who to vote for Council.

Washington Post columnist Colbert King makes a very good point today ("Because of covid-19, this election will play a critical role in D.C.’s future"), that who gets elected this year will really have to work, given the economic downturn that has resulted and will continue because of the pandemic.

DC is unique in the US, a city-state.

We don't have a state legislature and Congress restricts the ability to tax which hurts since about 70% of the jobs in the city are held by non-residents. But at the same time, the city these days is wealthy, because it controls its property, income, and sales tax revenue streams, which it doesn't have to share with a state.

Not that the city uses all of these monies wisely, especially as it relates to capital planning, see "Capital/civic asset planning, budgeting and management processes, 2015."

DC's economy is weighted to the federal government, lobbyists, law firms, and associations, and the federal presence has been shrinking with each succeeding Republican administration and Congress ("The FBI building as another example of "I told you so"," 2015). It's even worse under Trump, as his administration has moved units of the Departments of Interior and Agriculture out of the city entirely.

Diversifying the economy is tough because commercial space is pricey (see the Jane Jacobs dictum that successful cities need a "large stock of old buildings" with low rents to seed innovative ventures) and the city just doesn't have amazing engineering, business, and medical schools seeding new business ventures ("Naturally occurring innovation districts | Technology districts and the tech sector," 2014).

WRT schools, think of the way that Stanford University is connected to Silicon Valley, UCSD, Harvard, MIT, and UCSF to biotechnology, etc. ("Civic culture and organization as an element of community economic resilience," 2020).

But it's also a post-industrial economy, weighted to service jobs, tourism and the like. Tourism and entertainment (which includes eating out at restaurants) is going to be depressed for a minimum of a couple years and if a covid19 vaccine doesn't come about, potentially longer.

This is going to result in significant commercial property vacancies and a decrease in employment and business formation.

As a result, the local business community is looking for big tax breaks as a result of the loss in business activity which depresses the commercial real estate market, and real estate is DC's biggest local industry.

From the King column:

... unlike other state and local jurisdictions, and in contrast with previous challenges, today’s District government — unrepresented in the Senate and voteless in the House — might have to deal with much of the coronavirus aftermath on its own.I don't know exactly what to recommend.

The problems are daunting.

District families and communities have been devastated. This crisis has wrecked the city’s economy. Hotels stand empty. Restaurants and bars are limited to pickup and delivery. Retail trade has ground to a halt. The economic pain ripples out through lost wages and business income, and millions in city tax revenue are out the window.

Chief Financial Officer Jeffrey S. DeWitt’s presentation on the re-estimate of revenues was grim. Current revenue estimates are off 7 percent, or $722 million, and are reduced by an estimated $723 million for next year. Mayor Muriel E. Bowser (D) acknowledged that the revised budget she will present on May 12 must reflect the savings required by this sobering reality.

Enter the D.C. Council and this year’s elections.

The council, through consensus, has responded to the crisis with impact-softening measures: rent-hike freezes, mortgage deferrals, consumer protections, hospital funding, expanded unemployment benefits, restrictions on debt collectors and the like. These are necessary but temporary reactions to the public health emergency, and low-hanging fruit.

The hard part — dealing with the economic crisis — lies ahead.

Bowser framed the issue succinctly: “The need is going to outpace what we can do locally.”

That is the issue confronting the council, four of whose 13 seats will be contested in the June primary.

I'd start with this, but it's what I'd be recommending anyway, even without a coronavirus induced recession. But how realistic are my recommendations, really?

Basically I am calling for tons of spending, but long term investment in "infrastructure" and economic development that will pay off in increasing revenues. But how can this be paid for in a scenario of significantly reduced revenues?

Definitely I'd say no to a football stadium. Especially given the reality that it's going to be a long time before tens of thousands of people will be watching sports events in stadiums and arenas.

1. The city needs to intensify population wise in order to capture more income, property, and sales tax revenue. This includes dealing with the opportunity cost of not building bigger now ("Revisiting the entry: (The opportunity cost of) "Defining density down" | building for today's demand, not future demand").

Although the pandemic will reduce the city's ability to grow and expectation that the city will achieve 1 million population by 2045 probably should be dialed back.

2. The city needs to be more judicious concerning "economic development" because some types of economic activity have positive multiplier effects, while others do not ("Urban planning and the difference between "economic development" and "building a local economy">," 2013; "Building a local economy vs. economic development, 2015).

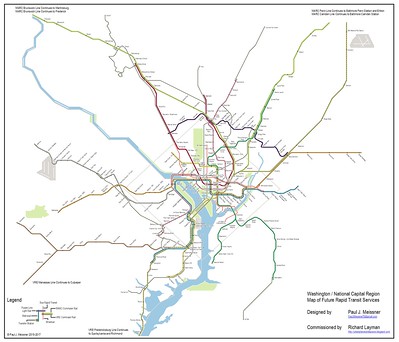

3. The city needs to expand the transit system, especially the concept of a separated blue/silver line Metrorail, as a way to bring about greater intensity. Transit is the city's primary competitive advantage when it comes to attracting business and residents ("A "Transformational Projects Action Plan" for the Metrorail Blue Line," 2020).

Conceptual future transit map showing more lines and stations in DC. Design by Paul J. Meissner. Concept by Richard Layman and Paul Meissner.

... Warsaw's Metro system has been expanding lately--3 stations to the M2 line went live last September and 3 more stations this month. Ours could too.

4. But DC also needs to take a leading role in regional passenger rail development. Leveraging what Virginia is doing ("Virginia to build Long Bridge and acquire CSX right of way to expand passenger train service") and goading Maryland to step up ("A "Transformational Projects Action Plan" for a statewide passenger railroad program in Maryland," 2019).

5. The city has to figure out how to goose the higher education sector to be more productive in terms of generating spillover economic development.

6. The city should redevelop United Medical Center in a transformational manner which would build the base for an incredible economic development initiative in Wards 7 and 8, around redeveloping the St. Elizabeths campus as a graduate education and biotechnology park.

This series outlined such a program:

-- "Ordinary versus Extraordinary Planning around the rebuilding of the United Medical Center in Southeast Washington DC | Part One: Rearticulating the system of health and wellness care East of the River," 2017

-- "Part Two: Creating a graduate health and biotechnology research initiative on the St. Elizabeths campus," 2017

-- "Part three: the potential for donations around an expanded program," 2017

-- "Revisiting East of the River medical care: United Medical Center," 2017

-- "Update on DC's plans to build a new United Medical Center," 2018

which is even more necessary in the face of the need for expanded public health programs post-pandemic.

7. But the program for UMC should also include more capability to deal with pandemics, like the rebuild of Rush Medical Center in Chicago ("Rush Medical Center (Chicago) clues us into a gap in state and regional health care planning: planning for disaster and epidemic response," 2020).

8. And to revive the city's poorest wards, DC needs to develop a real "Marshall Plan" style initiative along lines I've outlined before ("An outline for integrated equity planning: concepts and programs," 2017).

Labels: building a local economy, economic development planning, elections and campaigns, electoral politics and influence, Growth Machine, transit and economic development

11 Comments:

DC debt cab was at 12% by congress.

It was at around 11.75 last year (FY 2019). Given that we're going to see an enormous hit for current year (FY2020) at the tail end, and another enormous hit for next year (fy2021). Projections between 500M and 1B.

So very good chance DC will be over the debt cap. And that's not including the 500M they want to do for short term cash flow financing from delaying taxes.

DC was planning on selling some 800M in debt for FY2020 and 539M in FY2021. I am not sure that will be possible.

DC will be getting some 500M in federal relief, but the debt cap is measured on local revenue.

that is what Colbert King is talking about. DC need to dos one massive cutting.

Personally, I am preparing to see my housing value drop by 25-50 percent. That will be reflected in real estate tax at some point but not sure when.

Well, after I wrote this I thought it didn't really reflect reality.

I do think the hospital, public health, and Marshall Plan ought to be priorities. And something I didn't put in, figuring out a better way to value the retail portion of properties and to reduce property taxes on retail, as a way to support this sector.

From a transformational projects action planning approach, DC can probably only afford one thing, given the coming crunch.

----

But I do think it's reasonable for DC to be able to spend more on debt (provided they're being reasonable), given that the city is (was_ growing in population, not shrinking.

DC isn't in the same position as a Chicago or Baltimore...

OTOH, maybe I am totally wrong.

------

are you willing to write a piece for the blog, or at least comment, on laying out a way forward given all this, to be able to enable more of what I suggest?

-----

wrt your point about property value, it's hard to say. Why do you think the value will diminish so significantly?

At least with the GFC, for the most part, DC (and Arlington, probably Alexandria) held their value. Dropped some sure, much less crazy appreciation, and fewer buyers, but overall, prices held up.

I'm thinking in such times the same could be true?

OTOH, the value of agglomeration may be reduced because of the pandemic, along with transit. And those are the primary competitive advantage of DC in normal times.

RE: Transformational

Yeah, basically I'd say your public health one is the only one with legs; I see your separate post on that and I'll try to confine my comments there.

RE: Debt

DC is making a strong case for statehood; however in the end that is up to the powers that be. Likewise with the debt limit. Asking for a 1B bailout and an increase the debt limit would seem to be bit rich?

Does congress want the control board back? probably not.

RE: property

Agreed, DC held up ok post 2008. Not sure this time around. DC held up because it was the only place with jobs for 2-3 years; as soon as recovery came to the rest of the country DC growth started to drop.

Now we destroying all small business/retail/restaurant jobs is a nationwide problem. Will increased government spending lead to more employment in the region?

Likewise, in a transit friendly city really going to be a strong market going forward? These are trends that already existed (younger families wanting more space and a school system, people getting out of high cost areas, less transit use -- more walking/biking/teleworking)

https://wolfstreet.com/2020/04/26/how-unicorn-blowups-oil-bust-bleed-into-commercial-mortgage-backed-securities-cmbs/

RE: writing

Always easier to criticize than write! I don't have much of a coherent view here other that we've got to let the great repricing happen quickly so you can get growth again. I finally drove up to Tacoma this weekend. So much potential in the area.Ward 4 and 5 are the future.

wrt Ward 4 and 5, I really liked your point in response to my HQ2 stuff, that stations on the Yellow Line in DC have a lot of potential as a housing valve vis a vis closer in pricing, and still convenient _transit_.

Of course, for cities and transit to remain at the forefront, we'll need a strong almost authoritarian public health response. (E.g., like basically imprisoning Typhoid Mary.)

In general, will there be a hardcore response to anti-vaxxers?

E.g., I mentioned in a comment at least a month ago, I was reading an unrelated article about Calgary in a local paper out there, and it had a pop up poll about whether people would take a vaccine for covid if one is produced. 33% said no. Holy f***.

----

But to leverage that opportunity, W4 and W5 will need more density and more than people think is reasonable. But basically, people think that standards from 30-50 years ago are all that's reasonable.

(It also makes more valuable my idea of a separated yellow line from Fort Totten out New Hampshire Avenue into Montgomery County.)

I mean, 4 story buildings at Fort Totten? (Although sure, the Cafritz stuff is taller, but not the stuff on site or the Walmart building.)

----

you had already committed on your condo, because I was about to tell you about a bungalow on my block at the time. It needed a bunch of work, probably at least $100K. But it was over 2000 s.f., and could have accommodated a basement unit (it had an unlicensed second unit at the time).

At the peak a couple years ago, these houses fully renovated were selling in the mid 800s-900s. It dropped last year.

G-d knows how it will be now.

=========

wrt being better at criticism, I do understand that. That's actually how a bunch of my pieces come about, in response to other stuff.

Speaking of criticism, like I often scold others, the $1B request and the debt cap are two very different things.

Like every other state and local government, DC is f*ed by the economic destruction from the pandemic, and should be able to access the same funding stream that will be made to other governments facing the same issues.

The debt cap is different, supposed to be for infrastructure, and the justification for increasing it -- and I recognize this needs to be studied first -- is that DC is growing in population (will that still be the case?) and has capital needs beyond the set of principles that led to the current cap and that the growth that derives will have ROI from increased property, income, and sales tax revenue streams.

BUT, if no growth of commercial real estate and a decimation of tourism, all bets are off.

=========

ULI is doing a national webinar tomorrow on the state of RE in the context of the coronavirus.

I separately suggested to the DC chapter that they do a similar program, just for DC and the DC area.

I sent a link to this piece, and said in retrospect I was just spitballing and needed better guidance.

We'll see.

wrt strong public health response, think of TSA -- and my joke that TSA proves that Osama won, because of the economic drag that TSA is, the security process etc.

We can make those commitments, if people see the absolute need.

RE: Ward 4/5 yellow line

Yes. Well goes back to Walmart there. Honestly putting that building there makes absolute sense given what the current RE market looked like -- but in strong market cities things can go up very quickly. Much like the late 90s low rise housing that was dumped in DC b/c nobody thought 14th st could support such large multiunit...so you've got to build for the future.

And that' the repricing angle. Markets are good at one thing -- setting a price on something. Cities are about investing for the next 100 years. What you want is a quick price so somebody can sell the property and it gets turned into something useful. If you don't do a reprice an owner will try and drag it out 5 years.

Every RE guy I've talked to thinks that we're at the end of a a RE cycle. I don't know if that true - my thinking is we may have permanents changes in what we call the business cycle, but throw in a global depression and yes we're at the end of a cycle no matter what the stimulus.

RE: TSA. Yes Security Theatre is now Virus theatre; I love the idea of wasting $100B over the next 10 years on this. Maybe I can design the "contract tracer" outfits (joke on TSA where the 1st head spent all his time drawing up uniforms).

Was going to throw this into the public health, but basically you can see how a society is reacting by their experience with infections disease. In 3rd world still common. Gays had the HIV scares. Rest of world completely forgot they exist and are freaking out.

Re: Markets are good at one thing -- setting a price on something. Cities are about investing for the next 100 years. What you want is a quick price so somebody can sell the property and it gets turned into something useful. If you don't do a reprice an owner will try and drag it out 5 years.

Word. That's what's so f*ing frustrating as a Main Street manager. Speaking of criticism, two-way stuff, etc. I value your succinctness a lot. This is really key:

Markets are good at one thing -- setting a price on something. Cities are about investing for the next 100 years.

If you don't comment on the PH piece I'll copy the relevant stuff into the comment stream there.

offtopic:

https://ftalphaville.ft.com/2020/04/27/1588010562000/Boris-Bikes-are-booming/#comments

Wow. Thanks for that. Great piece.

I keep meaning to do something about micromobility and the latest with car share (Maven).

Haven't seen the SLC Green Bikes used very much. But the footprint is pretty narrow, in the core only, and given what's going on, I'm not in the core that much these days.

What are you seeing in DC?

I'd say at least in Ward 1 scooter/bikeshare use is down. To my eye, I don't see a lot of people biking in general. Doing 3 walks a day (morning, lunch and evening) and only after 5 do I see people on the streets in any number -- and it isn't that many.

Penske carshare gave up as well. Revel (electric scooters) doing ok.

car traffic creeping up each day.

Post a Comment

<< Home