Councilmember Bowser puts forward some good legislation on nuisance property taxation

DC has a problem with properties that have mouldered for years--decades in fact--for a variety of reasons, but in any case the properties are disinvested, nuisances, and make neighborhood and commercial district improvement more difficult.

I learned about this first hand in the H Street neighborhood, where I can point to many properties that have been vacant for the entire time that I have lived in the city, which as of this week, is 22 years. (Although two of the properties, old corner stores, that I have always loved, 400 K Street NE, and 500 L Street NE, are finally going through some rehabilitation.)

406 H Street, vacant for more than 20 years.

DC goes through various fits and starts with legislation to address this issue, but one of the most effective techniques has been to increase significantly the property tax rate for vacant properties. There are ways around it--slap up a for lease sign even if the building is uninhabitable and you can get around it, etc.--but for people without unlimited funds this has been an indirect policy initiative which has gotten them off their butts to either improve the property or sell it to someone willing to invest in and fix the problem.

Of course, these days, with a weak real estate market, property owners and developers are on the city to suspend this punitive tax rate, because market conditions are bad and properties are vacant as a result.

And Councilmember Jack Evans, who is always willing to do the bidding of the Building Owners and Developers when it comes to tax breaks of all sorts, is eager to modify the tax code to provide relief to the Class 3 tax classification.

Separately, Councilmember Muriel Bowser of Ward 4, has introduced legislation to create a Class 4 property tax classification, which would apply only to what she calls "blighted" properties. See "A Class 4 tax rate for blight?" from the Washington Business Journal.

-----------

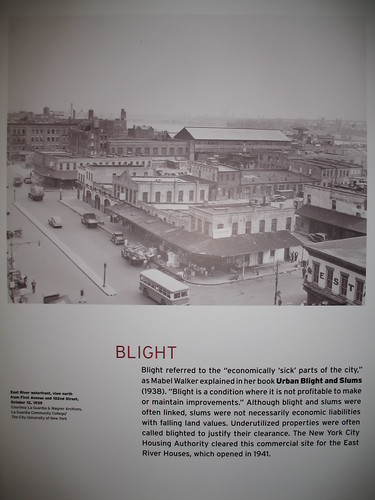

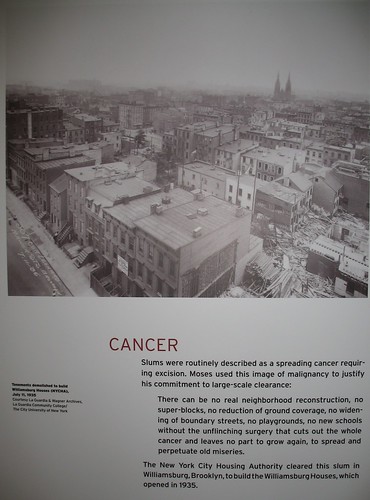

I write from time to time about what I call "the language of revitalization." The real issue is disinvestment. What people call "blight" is a result of disinvestment. Rather than blame the place (I call this "blaming the building"), focus on disinvestment and explain the process.

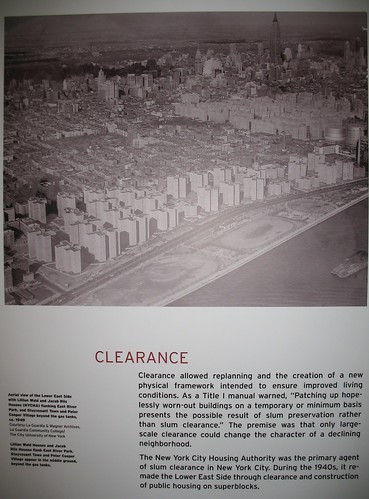

Too often people are lulled into believing that demolition, especially of historic buildings, is a solution to "blight" when merely it creates a different form of blight, one that is harder and more expensive to correct (building a new building).

----------

I think it is a good idea to better target the Vacant Property tax penalty by creating multiple categories. Persistently vacant nuisance properties need more penalty and punishment.

For past testimony to City Council on this issue (I testified about dealing with vacant and nuisance property issues quite a bit from 2002-2006), see this blog entry, "Receivership for housing."

In 2007, Mike F. went up to see the various Robert Moses' exhibits in NYC, and he shared some photos of the exhibit.

Labels: electoral politics and influence, Growth Machine, property tax assessment methodologies, public finance, urban renewal, urban revitalization

0 Comments:

Post a Comment

<< Home