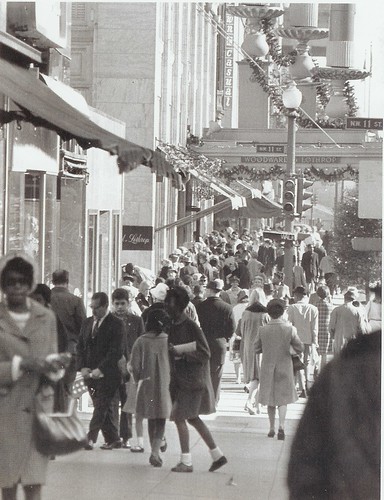

People outside of Woodward & Lothrop Department Store, F Street NW, Washington, DC, 1968. Washington Star photograph.

In the old days, cities typically had upwards of a half dozen "local" department store chains. (Actually, "back in the day," a number of local department store companies affiliated on a national basis, through either Allied Stores or Federated Stores, in addition to various other companies in the industry.)

Over the past couple decades, four of those companies have been "rolled up" in various transactions into what is now Macy's, which is roughly coast-to-coast (805 stores), after Macy's went through a period of co-branding with the stores that weren't originally Macy's stores, and then just rebadging all the stores as Macy's.

In some regions of the country, Dillards (308 stores) is also active, with about half the number of stores. There are a limited number of upscale chains active in a number of markets but with only a handful of stores (Saks Fifth Avenue, Bloomingdales, Lord & Taylor, Neiman-Marcus), plus Nordstroms (116 stores), which is also a "national" chain.

Of course, Sears (926 full line stores) and JCPenney (1,126 stores) are still active, although Sears has been on a downward trajectory for 30 years. Neither company is active in opening new stores in center cities, although JCPenney has opened a store in Manhattan, and has stores in the other boroughs.

And in a number of markets, particularly in the midwest, there are still active regional department store chains, such as Bon-Ton, with various banners (65 stores) and Van Maur (25 stores), Belk in the Southwest (305 stores), and Bealls in Florida (about 75 stores).

What this means is that if you want to fill up large retail spaces in center cities you have limited choices, especially if Macy's is already there, and Dillards isn't active in your market. Nordstroms is very picky about adding new locations, as is Macy's about locations for Bloomingdales (41 stores), and Barney's New York (15 stores).

That's why there is attention on Target (which was originally a discount division of a department store chain, but grew to take over the company, and the department stores were spun off) and even Walmart, to help fill up large spaces.

Boston is looking to Target to fill the Downtown Crossing space that was once home to Filene's Basement (Filene's Basement started as the "discount store" operation of the Filene's Dept. Store company--most local department stores had such operations--but it became successful in its own right, and split off when Filene's was acquired as part of a larger transaction by Robert Campeau). See "

TARGET MIGHT FULFILL VORNADO’S DOWNTOWN CROSSING DREAMS" from

Retail Traffic Magazine and "

Target eyes Downtown Crossing: Retailer wants flagship store in former Filene’s building" from the

Boston Herald. Target is already planning to open a store in Chicago, in space in the old Carson, Pirie & Scott Department Store, and using the same smaller "CityTarget" format of about 125,000 square feet, in Seattle, San Francisco, and Los Angeles as well. See "

Target Goes Urban with Smaller Format" from

Home Furnishings News.

And Target, which has opened a very successful store in DC as part of the DC/USA center in Columbia Heights (see "

A Rapid Renaissance in Columbia Heights," from the

Washington Post) is considering a store in the Georgetown Park Mall in the Georgetown section of DC, although the property owner would much prefer Nordstroms, which has looked at the space before.

----

One thing that it took me a long time to accept is that department stores expect financial incentives to open stores.

The reason it's reasonable to do this--with an exception for Walmart--is the stores truly are draws, bringing people to commercial districts and the people shop, eat and do other things in the area, spending money that the store doesn't get. Since they spend lots of money on advertising, which draws customers in, the department stores believe they deserve financial consideration for this effect.

The reason I argue that this is less reasonable for Walmart is that there business model is designed to capture 100% of the customer's retail transaction on each trip, leaving no money for other businesses. Therefore, they don't deserve recompense. Plus they don't advertise very much either...

In successful center cities, I believe that department stores, done right, do quite well, as does the Macy's store in Downtown DC, which was always the centerpiece of the former Hecht Company.

I just wish there were more choices for cities. Sears and JCPenney aren't really active for center city locations, Nordstroms is very picky, and in most of the successful places, Macy's is already present. That means Target and now, Walmart (

Wal-Mart's push into US cities" from BBC News).

If they don't pick Georgetown, which Georgetown Metropolitan

says is a possibility, then Georgetown Park Mall has very limited options, because it needs a department store to absorb the individual small spaces that exist there, because store spaces on the inside of the Mall will never be successful, because people don't go to Georgetown to stay inside a building, they go to experience the vitality of being on the street.

Labels: commercial district revitalization planning, department stores, formula retail, tax incentives, urban design/placemaking

0 Comments:

Post a Comment

<< Home