Urban retail reflections

A group of us are having a debate in e-mail about the upscale retail CityCenter development, spurred by a recent Washington Post article ("Luxury shopping arrives downtown, and Friendship Heights braces for departures"). One person sees it as a great (re)development, while I am somewhat skeptical--not because I don't think people like Kate Spade, but because there is only so much demand.

Image of CityCenter from Popville.

As far as the development goes, it's quite impressive.

From an urban design standpoint, they've broken down what would be two full blocks each with a single large superbuilding, by creating smaller buildings with "alleys"/walkways in between to create more viable and active ground floor spaces.

But DC doesn't have a huge population, suburbanites don't come into the city to shop, and the tourists and business visitors to the city don't tend to do the kind of high end shopping common to visitors to NYC, London and Paris--especially by foreign tourists.

-- Global Report on Shopping Tourism, UN World Tourism Organization

Georgetown DC.

So I suspect there isn't enough demand to support higher end retail in four different submarkets within DC as well as two more in Virginia and Maryland: CityCenter; a few blocks away on Connecticut Avenue (Burberry moved from this district to CityCenter) in the Golden Triangle Business District, and in Friendship Heights--the commercial district that straddles DC and Montgomery County, with Bloomingdales, Neiman-Marcus, Saks Fifth Avenue and Lord and Taylor (no longer an upscale anchor, but still a functioning department store chain) as anchors, let alone competitive centers in Tysons (Virginia) and Montgomery Mall, or Georgetown--which is not an upscale shopping district.

2. I have been reflecting on what I've learned from the past 15 years of my involvement in commercial district revitalization in DC because of a conference being held by LOCUS, an organization of developers committed to the creation and strengthening of "Walkable Urban Places," created by pro urban developer and researcher Chris Leinberger and sponsored by Smart Growth America.

One of the walking tours yesterday was of H Street NE. I didn't go, because I get tired of listening to the people who talk about it now, people who weren't involved at all during the initial and most difficult years--it's easy to participate in revitalization when it's already happening.

Image from HillNow.

Although I did have a good conversation with one of the (re)developers of a complex of buildings on H Street--he estimates it will be worth about $200 million and he is definitely doing it because of "the streetcar" -- the project that so many call a failure even though it has triggered more than $500 million in development on a few blocks of the corridor before it has even started service.

Interior of a Dunkin Donuts-Baskin Robbins combination store from Inside Fort Lauderdale.

3. Dunkin Donuts vs. Starbucks as an illustration of issues in urban retail recruitment. What also brings this to mind is an "argument" I had about 13 years ago with the consultant assigned by the city to assist our nascent H Street Main Street commercial district revitalization program.

-- NOTE that according to Time Magazine, this Friday is "National Donut Day" and Dunkin Donuts will give you a free donut with the purchase of a beverage. (I do get coffee at the Dunkin at 8th and Pennsylvania Avenue SE sometimes before Eastern Market meetings.)

The interior of a typical Starbucks.

He was telling me that rather than aim for "a Starbucks," what is wrong with a Dunkin Donuts?

Obviously we all know the difference in perceptions, even if Dunkin coffee is probably better--less burnt, and no longer cheaper than Starbucks. One has a subdued interior while the other is garish, etc., and in trying to "improve" a commercial district, Starbucks sends one signal while Dunkin Donuts sends another.

... then again, the first retail entrant into H Street after all the new plans was Family Dollar.

The Post ("Map: How coffee splits the United States in half"), Boston Globe ("Split country: Dunkin' vs. Starbucks") and Brandchannel ("Coffee Grind: Data Maps Show America Runs on Dunkarbucks") have articles on the competition between Starbucks and Dunkin Donuts with some insights into the meaning of the differences in the footprints of the respective chains.

And recently I wrote about Zillow's take on Starbucks as an initiator of neighborhood change--I disagree, arguing that Starbucks is a follower, not a leader of change. See "(Not) Understanding how retail chains make property decisions: Baltimore, Starbucks, andSalon Magazine" where I wrote:

* Starbucks follows, it doesn't lead. I make the joke about Starbucks "as the one thing a commercial district" because when you work in the field, that's what residents come up to you and say, repeatedly. It's not that simple. Similarly, Zillow is wrong that Starbucks knows the next hot neighborhood. They are followers, not leaders, and their locations are co-incident with what we might call high-value "amenity districts."

For example, Starbucks considers the location at 8th and D Streets SE on Eastern Market Square in Capitol Hill a distressed location, even though the number is full of houses costing $800,000 or more. There aren't many examples of Starbucks stores leading neighborhood and commercial district revitalization efforts. In DC, Starbucks followed Xando (which later rebranded as Cosi) which was the first "new coffee shop" in the city by many years.Brandchannel points out that outside of urban centers, specialty coffee chains like Peets don't do well, but the Starbucks and Dunkin brands work well in all markets.

In any case, these blog entries, now ten years old, reflect insights I had about these issues quite awhile ago, but obviously, based on some of the discussions at the conference yesterday, these are still "new" ideas.

-- "Store siting decisions"

-- "Why the future of urban retail isn't chains"

From the first piece:

[I]n my experience there are four key decision points faced by a business proprietor involved in investing in and opening a store in the center city:

1. Whether to invest-open a store--or not

2. Where to invest--city or suburbs (most retailers are focused on the suburbs)

3. If investing in the city, where to invest within the city--the northwest quadrant which has the most population and the best demographics, or within the other three quadrants of the city

4. Investing in your particular commercial district.

Even in the District of Columbia, many business proprietors only have eyes for the northwest part of the city, which has the city's best overall demographics and density. Getting people to invest in other parts of the city is still a struggle, and the people most likely to do so are those with the least experience, and therefore have a greater likelihood of failure, without the provision of some help--even they are even open to help.

The point I am making is that you need to know where in the decision chain the business proprietor is, and the process can take much longer or much shorter if you have to make a "sale" for each one of these stages.

A business proprietor who has already decided to open a store, and to invest in the District of Columbia is half sold already...

4. FWIW, I am somewhat wrong about "the future of urban retail isn't chains." Although it's not often what we prefer. See the 2012 piece "It ain't true: chain retailers are entering the city, but not necessarily on the city's terms."

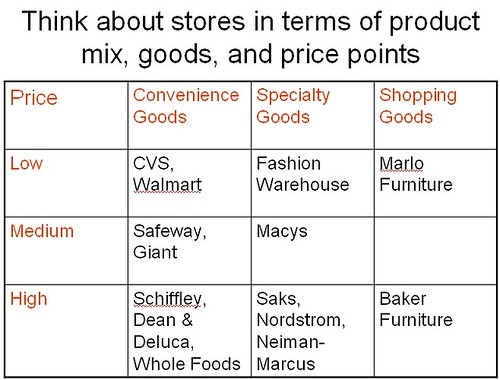

We have to differentiate between the types of goods sold: convenience, specialty and shopping goods, and price points.

For common goods at lower price points like apparel (think H&M) or electronics (Best Buy, etc.), chains will continue their reign because there aren't practical alternatives.

But other than the supermarket category, where some large independently owned regionally-based firms (e.g., Giant-Eagle, HEB, Publix, Wegman's) remain successful and dominant, most retail categories are dominated by national and international companies.

For specialty artisanal goods and restaurants, independent stores will still be able to break through. But outside of restaurants, the portion of the specialty goods sector held by independents is likely to be small, if not infinitesimal, even if particularly important to and prominent within traditional commercial districts.

But the consolidation of companies within retail categories, for example, Macy's in department stores; Walmart and Target in general discount, Kohls in apparel and housewares; Best Buy and hhgregg in electronics and appliances; Bed, Bath and Beyond in housewares, etc,; makes it very difficult to populate all the various legacy commercial districts and neighborhood centers that people want to activate.

For example, in the department store category, DC once had six mainline stores that were locally owned (Garfinckels, Hechts, Jelleffs, Kanns, Landsburghs, Woodward & Lothrop)--and they each served the city from one Downtown store, although Garfinckels had an outpost in Spring Valley, and Woodies a store just over the city line in Friendship Heights. Plus, Sears had three stores in DC, and the African-American focused Morton's chain had stores across the city, mostly in neighborhood commercial districts but a downtown store also. Of all of those stores, only the Downtown Hecht's (now Macy's) is left.

There isn't enough demand, let alone enough different store companies able to fill all the space that currently exists.

5. One newer development is how in some of the biggest or highest income cities, certain chains are opening a select set of experience-retail focused outposts different from their typical offerings. For example, how REI is opening a signature store in the old Uline Arena (a building I helped save from demolition) or how Urban Outfitters has opened a signature almost "department store" like experience in Manhattan.

This is the next stage of higher end chain retail in urban centers that I discussed some in this piece from 2012, "Another point about urban retail: Whole Foods, Design within Reach, and American Apparel," and this piece from 2010, "Speaking of the Room & Board store and not knowing how the retail industry works."

In any cases, the strong markets will still be able to attract and develop retail while the weak markets will continue to find recruiting and developing retail a slog.

The Room and Board building on 14th Street NW, before renovation.

The Room and Board building on 14th Street NW, before renovation.6. 14th Street NW has arrived. In 2010, I said it would take awhile before the retail offer on 14th Street between T and Rhode Island Avenue improves. If we extend that to U, to include the Trader Joes, I think it's fair to say that the improvement has arrived.

See "14th Street NW as a retail district."

The same building after renovation.

Although the district is dominated by restaurants, with only a smattering of retail, it works well enough for residents, because the convenience retail (Whole Foods, Trader Joes) meets real needs, and the specialty retail lends an upscale feel and appeals to a wider trade area, bringing people to the commercial district from across the metropolitan area, rather than just the neighborhood or city.

Labels: big box retail ordinances, commercial district revitalization, commercial district revitalization planning, formula retail, real estate development, retail planning, urban design/placemaking

15 Comments:

Your picture of Georgetown encapsulates the problem for high end retail in DC -- that is a fake LV bag -- look at the straps and the way they connect to the bag.

(Not a gay guy, but my GF has educated me. 85% of the LV I see here is the lowest line and fake)

And you don't see anyone -- except people from NYC -- with the 3500 bags.

Things can change -- the explosion of Moncler in the last winter is an example -- but the real high end market in DC is very very small. High income area, not a high wealth area.

West elm of course is now on 14th. Muleh (designer furniture) has moved. I'd say 14th has arrived when Lanier puts a building in. Most of the retail isn't useful.

(however, see the Shay at 9th/Florida which is coming in with high end stuff as well -- the lululemon successor that is 2x the price is interesting)

umm, you have a more eagle eye and knowledge on fashion than I. Since I bike and wreck clothes, I am happy to buy from thrift stores (like khakis). I was floored to see a pristine "vintage" Gap shirt at the Grant St. Market for $38, when I had bought in the late 1990s probably a faded version of the same shirt from a thrift store on H St. likely for under $4. I finally got rid of it in the last year or two because of tears.

2. good distinction between wealth and income and how it shapes the nature of what we buy. Thank you.

3. Yes about Muleh, I can't remember if Urban Habitat is around any more. Interestingly about Muleh. Originally it was in Bethesda, then they opened the DC store and I remember the dude at a forum saying they were selling more, and more edgy stuff at the DC location. But they shifted over time to clothes from furniture.

... and yes, I agree that it is a stretch to say that 14th St. has "arrived" as a retail district. But it is better than 5 years ago. Again, the real problem in DC is too many alternatives for retail districts. There is too much space and too many neighborhoods wanting "retail" when what is needed is concentration and focus.

E.g. the residents up in Van Ness are clamoring for the creation of a retail district, according to various articles in The Northwest Current. I've been meaning to mention this, as an illustration of the general problem. It's not possible to make Woodley Park, Cleveland Park, Van Ness, and Chevy Chase all thrive, given that for the most part, they share the same retail trade area.

For example, Baltimore has one cool independent district--well they have more, but one, Hampden is pre-eminent. They aren't trying to do 10 different districts. Same in Richmond, Carytown is pre-eminent, although W. Broad Street downtown is redeveloping, but not in the same way that Carytown has 12 albeit small blocks bookended by a historic theater and traditional supermarket strip center (Kroger). They don't have 10 districts _in the city_ all vying for the same kind of market and vibe.

Yes, there are other retail areas throughout the city, the Fan has a wee bit, etc., but there is no question that Carytown is supreme.

Philadelphia is a little different, but it also has about 1.5 million population. South Street is at one price end and vibe while Chestnut Hill is another. Mount Airy has a shopping district, both on Germantown Ave. and around the Weavers Way Co-op.

Georgetown is most comparable to Chestnut Hill, but Georgetown, being a night time destination and a magnet for tourist visitation, plus weekend visitation, is much bigger. But Chestnut Hill would be a good model for the next level down of a shopping district, and I don't think we have an equivalently coherent version.

Friendship Heights is different too. It reminds me of how Birmingham, Dearborn, and Grosse Pointe used to function when the Detroit area had some independent and successful department stores. While Hudsons moved to a mall-based model, Crowleys had stores in town centers (they purchased another company or two over time, which strengthened this). The leading national retail consultant Bob Gibbs is based in Birmingham, which had Crowleys and Jacobsons. Jacobsons was based in Jackson, but they moved east and south (even to Florida) in search of better markets. Both companies finally bit it by the early 2000s. The lesser well off cities, like Royal Oak, probably had JC Penney's stores in their downtowns. Plus there were other companies that existed (Federals was regional) including Sears, which anchored non mall locations.

Anyway, Friendship Heights has the department stores as anchors, and some are free standing, while others are not. It's the closest to how those Detroit area towns functioned outside of the Downtown and outside of Hudsons creation of Northland (Southfield), Pontiac Mall (further north), Eastland (East Detroit, now "Eastpointe"), Westland (probably in Westland or Livonia, can't remember), and eventually Southland--south of Detroit, can't remember the exact Downriver town it is located in.

RE: spreading out vs. concentration.

Yes, that is why I doubt on the 14th -- the retail isn't really concentrated, very few people say, lets go to 14th and go shopping. A lot of people are doing shopping during pub crawls etc, the retail lends a nice feeling, but mostly window dressing.

It could use an apple store.

The two areas where DC can go high end is supermarkets and restaurants. 14th, for instance, as Steets, Yes, Trader Joes and Whole Foods within 2 circulator stops.

But clothes? no.

Does say something about this generaton of urbanity than retails is more about facetime than transactions.

well, while you tend to ding me for overgeneralizing, this is one time I can get you...

It's more about people eating every day and buying clothes and other retail items pretty irregularly.

Or this generation of urbanity combined with the structure and concentration of the real estate development, financing, and retail industries.

Given the nature of specialty goods--that you want to shop around and compare items before making a final choice--small districts can't offer a wide enough array of stores and choices.

This is an exact illustration of the Reilly Law of Retail Gravitation, or the creation of concentrated districts and their strengthening over time.

So nonfood retail is going to be increasingly concentrated and much less likely to be available hyper locally.

e.g., I amazed at the boutique Willow on Upshur St. NW. But it's not like the owner is getting rich either. But the business survives, partly through low personnel costs and probably lower rents.

Not sure we disagree here. 14th st is better than 5 years ago, but retail in DC was too spread out, and the future might be more concentrated, which we don't have here.

I kind of wish that DC would have more spread out retail, when I lived there I always felt like I was going way away to do simple errands. Lack of diverse neighborhood retail (high or low) was very strange to me. Especially having just come from Northern California where you took pride in never having to leave your neighborhood to do anything. (Although downtown SF sort of sucks as far as retail goes. It's really a city of neighborhoods.)

As for Starbucks, around here I see more levels of Starbucks. There are the ones that are clearly meant to be sort of like Dunkin Donuts: cheap floors, little furniture, dark plain painted walls, built really quickly. And there are the more high end ones. We just got one in my neighborhood, and I walked in and it was so depressing: like a cheap fast food joint: big emptry room, no character at all. Service counter stuck way at the back. But while I live in Fort Greene which is not a cheap neighborhood, that stretch is more so and farther away from the bigger money.

Sometimes you'll see an Sbux location start that way and then later get an upgrade to a nicer design. It was still depressing to see we had started with what basically looked like a airport Starbucks and not something more homey.

Something I have mentioned before is how retail works in parts of Manhattan. Although it's changing too (e.g., the new Brookfield development).

But Union Square is a "regional" shopping center, while the subsidiary retail in subdistricts is more convenience goods.

I just don't think our districts in DC work that well. Well, for me it's ok, because I dress simply and Macy's downtown is fine. But I think it's tough for women unless they shop mostly at Ann Taylor or Talbots.

It'd be nice to have at least a couple signature "districts" and then work up... instead it's multispread.

Christopher, note that SF has 200,000 more residents than DC, plus Union Square is a regional draw. That makes a difference in terms of supporting better retail for some sub-districts level.

But could you really shop local besides food and other convenience goods? E.g. North Beach/Fishermans Wharf... Safeway, World Market, etc.

You used to be able to shop local for clothes. The best clothing shopping is in the Castro and the Haight. But there's also Cow Hollow and West Portal. People don't realize that the Gap actually started way out on Ocean Avenue in what would be called Ingleside I think. Williams Sonoma started in maybe Cow Hollow. (Marina District area.) There was always a boutique, a bar, a grocery store, a movie theater, in almost ever neighborhood. So sure, at times you'd be restricted and might have to go a neighborhood over, but it was not something that you had to go to Union Square to shop. Some of this is probably geography too. The hills and climate and transit make it so that the neighborhoods are pretty self contained. It's sort of reminded me of my childhood. I almost never went to the mall. We had one mall near us in suburban chicago, but we all did our shopping in my little hometown of 10,000. That was the 1980s. It's a little less easy to do that now (and chain retail has come to the western suburbs, although the mall that was there when I was a kid and the one they built i the late 1980s have both closed which is weird to think, that I've outlived to two malls and I'm only 41.)

Maybe I'm missing a trend, but I think "retail" as we know it has been slowly dying. It's gonna be drones, baby! Lots and lots of drones delivering all sorts of shit.

The more interesting discussion that I would encourage you to continue is the income vs. wealth proposition and what that means going forward.

-EE

Woodridge is getting a fancy restaurant

http://www.popville.com/2015/06/nido-opening-menu-complete-check-it-out-opening-soon-in-woodridge/

From an urban design standpoint, they've broken down what would be two full blocks each with a single large superbuilding, by creating smaller buildings with "alleys"/walkways in between to create more viable and active ground floor spaces. retail security services

They want to serve the best service to the customers and thus ask for the feedbacks.

Thus they insist their customers say up their reviews on Dunkin’ Donuts Guest Experience

Survey through the link provided telldunkin.com

https://telldunkin.online/

dunkinnation survey

telldunkin.com store

you blog is imformative for us, thanks Tellculvers

Please share it more and more 마시지

Post a Comment

<< Home