Implications of a Trump/McConnell/Ryan Administration on DC's commercial real estate market

The Bisnow real estate e-letter posits the DC commercial office market (and the area economy) will benefit from a Trump presidency. From the article:

The Bisnow real estate e-letter posits the DC commercial office market (and the area economy) will benefit from a Trump presidency. From the article:Avison Young US capital markets managing director John Kevill expects to see a pickup in leasing activity from the GSA, government contractors, consultants and lobbyists. "His promise to spend on infrastructure, reinvigorate the military, hire more ICE agents than ever before," John says, "will lead to a growth in the local government footprint."

He says this may result in a resurgence in demand for existing suburban office stock that has largely been considered functionally obsolete. He also predicts a growth in lobbying for industries like healthcare and tax reform, leading to increased demand for trophy CBD office space.

Elizabeth Norton's research team at Transwestern looked at the market impacts of every election since World War II, and found generally greater local office demand when the White House was in Republican hands.

Although, she says, this is largely due to the timing of events like military conflicts and recessions, and cautions against looking too much into the party in power. "It's hard to speculate the true impact at the end of the day, but historically we find it's events, rather than the president, that truly impact the market[.]"I am not disposed to be as positive.

(This blog entry from 2015 discusses the state of the local economy within DC and this recent post is about the high cost real estate market within the city making it difficult to attract businesses seeking lower cost locations, "Choosing urbanized places vs. choosing DC as a place to locate significant headquarters business operations: Marriott and CoStar.")

While there is no question that "events' shape what happens with government and its growth and post-9/11 hyper growth of the federal government, especially the national security elements, are the perfect example.

For example the Washington Post series from 2012 on the rise of the homeland security function ("Top Secret America") outlines how the rise of the National Security State in the post-9/11 environment has significantly benefited the DC region, and more IT-related military contractors (like SAIC) are relocating their headequarters to Northern Virginia to be closer to their clients. (Also see "Montgomery County's real jobs problem is that it is an adjunct, not a full-fledged, member of the military-industrial complex.")

But while that happened, there has been plenty of stinting on other areas of government, and plenty of animus towards investing in large scale projects such as a unified campus for the Department of Homeland Security or a new campus for the FBI.

Plus military installation consolidation away from Arlington County, Virginia has crushed their commercial office market in Crystal City especially, and has for many years. And Congress hasn't been much open to paying extranormal market rates for federal leases in the Washington area ("A follow up example with regard to Metropolitan Revolutions: the National Science Foundation moving to Alexandria").

It's important to distinguish between what we should call the Legislative or Congressional Republican Party and the Presidency.

Increasingly year after year since the Gingrich Speakership in the early 1990s, Congressional Republicans haven't been much interested in "investing" in the federal government, outside of projects in their districts or state, and they especially haven't been interested in investing in federal facilities in DC in particular.

-- "Neglected National Mall Languishes," Associated Press, 2009

-- "Washington's Boom Goes Bust," New York Magazine

-- "Federal Government Downsizing Sends D.C. Region Tailspinning," Falls Church News-Press

-- "Will Congress Pull the Plug on Homeland Security's Move to St. Elizabeths," Government Executive

-- "New Year's Post #3: an illustration of the decline of the federal role in DC's real estate market (at least right now)"

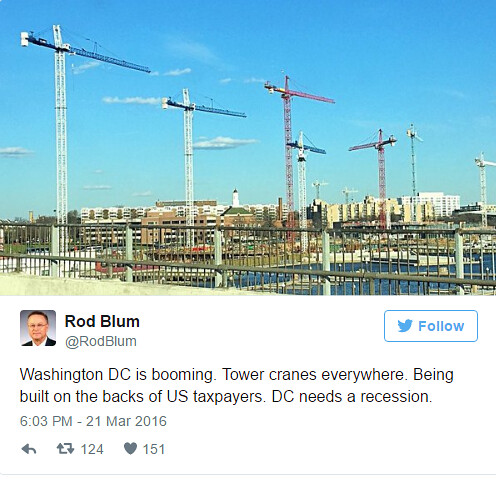

That kind of sentiment was expressed earlier in the year by Iowa Congressman Ron Blum, animated and angry about the success of DC's local economy.

With conservative control of the House and Senate I can't see them becoming pro-government in terms of agency expansion and real estate, especially in DC, or in Virginia or Maryland, both of which went for Clinton, although in Virginia it was much closer and outstate Republicans still control the state government more or less.

Another project to watch will be the final selection of a site for a completely new FBI headquarters campus. Maryland, a very Democratic state, has a Republican Governor, while Virginia's Governor is a Democrat, but the State Legislature is dominated by the Republican Party.

The Washington Business Journal ("How Donald Trump's victory might affect the FBI headquarters competition) figures the project will land in Maryland. From the article:

Clinton is a close friend of Virginia Gov. Terry McAuliffe, and her running mate, Virginia Sen. Tim Kaine, is a former governor of the commonwealth. It stands to reason that if Clinton had defeated Trump, it would have significantly boosted Virginia's shot at landing the 2.4 million-square-foot FBI headquarters.That the federal government doesn't do traditional capital budgeting is another problem. See the past entry "We are all asset managers now."

Maryland, long the front-runner for the $2 billion-plus HQ project, should remain there with Trump's victory.

Twitter photo by Ellison Barber.

But, with the Trump International Hotel in the Old Post Office Building, maybe President Trump will be inclined to push for real estate investment in DC. Or not ("Protestors gather outside Trump hotel in DC," WUSA-TV)

What about the residential market? As far as DC's residential real estate market is concerned, Republicans tend to live in the suburbs, Democrats in the city. Maybe it will stay about the same, maybe it will decline. I don't think that it will continue to be extranormally successful.

I can also see the potential for a rise of Mideast-policy-related terrorist incidents in the U.S., which mostly has been immune from it, outside of "homegrown" incidents (Orlando, San Bernardino, etc.).

If such incidents happen in DC, it could have major implications on the residential real estate market because for safety reasons, people may choose to not live in the city.

Labels: capital improvements planning, commercial real estate market, federal policies and the city, federal spending, government oversight, public finance and spending

18 Comments:

Disagree a bit.

The real danger is trump gets bored after 6 months and congress goes crazy.

In terms of benchmarking it, very easy. Track Vornado. up a bit. Not confident enough to bet on it. We don't know which properties jbg is contributing

I sure hope you're way more right than me.

from FT alphaville:

"Like happy families, rich countries (with the exception of a few Arabian petrostates) are the same in the most important respect: they are societies where people feel free to take risks without fear that they will be exploited. You might wish your tax rate were lower, but you never worry that goons from the government will show up one day and seize your business. You don’t have to worry about gangsters demanding protection money because the police will protect you. You don’t have to worry about losing everything to a dodgy business partner because the courts will help you get it back. It’s not a coincidence the regions in rich countries where these institutions and social customs are weaker — Calabria, the Deep South, Merseyside — are the most impoverished.

While we have a pretty good idea of what works, what’s less clear is why some places have institutions and cultural norms that encourage prosperity, and most other places don’t. We have no reason to believe it’s an immutable law of nature that the United States, or the UK, or France, or the Netherlands, will always enjoy the high relative standard of living we take for granted. Go back about 100 years and average living standards in Argentina were on par with America and northwest Europe. Our suspicion: the civilizing forces that make rich countries rich are quite fragile.

The big economic worry about a Trump presidency therefore isn’t that it might kick inflation up a notch or reduce manufacturing productivity by limiting import competition. The thing to be worried about is that the elevation of a man who doesn’t seem to respect some of the most basic values of an open society could contribute to the corrosion of America’s institutions.

The impact might be subtle at first, and could even be masked by a period of strong growth thanks to fiscal profligacy. But eventually we would all end up much poorer than we otherwise would have been."

In terms of being right, well, I did make out pretty well over the past few days. Certainly thought Trump would lose but not surprised on the senate.

In terms of what he wants (vs Congress) it really comes down to immigration restrictions, trade, and infrastructure.

Infrastructure going to be very good for DC.

Immigration is going to be a real issue here. My feeling is we have less illegals than most of the rest of US. Hispanic mix is very different in DC (Central and South American).

As I said earlier, a real immigration crackdown will result in spiking on service sector wages.

Trade pretty much a non-issue in DC area.

My point on Vornado is we will have a pretty easy to mark price on how the market things the DC CRE market is doing.

The general problem is oligopoly and control of rents. Until the 1990s, income spread between the CEOs and such wasn't anywhere near as great as it is now. Shareholder buybacks run apace. M&A activity and huge gains by finance (which led to Lees supergentrification thesis).

So when there are big gains but they aren't spread around, this sets the stage for anger and despair.

I was thinking after I wrote the other piece that I didn't say it but it comes down to capital vs. labor still. The trick this time is that "labor" thinks that capital is gonna help them.

Maybe with immigration and service wages, sure. But not much else.

2. wrt "infrastructure" again, I don't necessarily agree. Trump can talk all he wants about infrastructure. A Congress not in favor of government spending, against "deficits", unwilling to raise gas taxes is going to be hard to reach in terms of funding significant infrastructure.

Roads sure. Anything else, I am not so sure.

I realized some time ago that TIGER grants are a form of earmarks in a non earmark world.

Maybe the Republicans will realize that this can build support for them too and will continue the program.

Sure you have some mayors like Mick Cornett of Oklahoma City who understand the critical importance of infrastructure to urban-city success.

But he is an exception amongst Republicans, hardly the rule.

thanks too for the reprint.

Anyway, wrt calling the election, I wuz wrong. I myself didn't handicap the polling data enough to account for "social desirability bias" even though I intended to write about it before the election.

But the Comey stuff, the false equivalence about Clinton v. Trump, the steady drumbeat of the alt right, etc., I should have been more objective on the results. Still though I am shocked that every significant "toss up" state went Trump.

Not that some of them did, but every one. And if things had broken a little differently that way, the Senate would have shifted. But Barr and Johnson and Toomey hurt.

https://www.youtube.com/watch?v=aXAU4MmMIMo

It is amazing that women and minorities could not overcome the "surge" of white males - so to speak. Women have made up at least 50% of the electorate in the US since the 1960's, with a little help from minorities they should have gotten their first female president. It just goes to show that things which look good on paper don't always become reality. Are women and minorities just unreliable? Apparently so...

Draining the swamp, indeed! ROTFLMAO

Business as usual.

http://www.nytimes.com/2016/11/12/us/politics/trump-campaigned-against-lobbyists-now-theyre-on-his-transition-team.html

@Edwin: According to exit polls, 53% of white women voted for Trump. I have several close female relatives and good friends who despised Hillary but couldn't bring themselves to openly support Trump. No doubt in my mind they voted for him.

FWIW, my thought is that Hillary may thank her lucky stars she didn't get elected. We are in bi-partisan deep doo-doo financially (with our sovereign debt obligations), and have been kicking that can down the road far too long.

-EE

"Are women and minorities just unreliable? Apparently so..." Say what you will about the deplorables and the revolting masses, at least they are smart enough to know you need to show up to vote Every. Time. And not sitting out elections because a candidate doesn't make you feel warm and fuzzy or %100 align with your desired ideals. Most of life is about making choices among a bunch of sub optimal options.

The other aspect on the DC CRE market will be political consultants.

Obama had a hard line against "lobbyists" but in reality I don't think it had much change on their office space need.

Trump just dumped the entire Republican political class in winning. That is big component of DC office space and a lot of our neighbors. Going to take a while to adjust to that. Should be interesting.

@ Anonymous

Foreign countries holding US sovereign bonds are also getting irked, it's not only the bi-partisan issues in congress. The sell off in long term treasuries has been blasting the reserve balances of China and other countries that bought them to maintain stability. The dollar is appreciating strongly but the value of the bonds is dropping rapidly in expectation of interest rates increasing (due to Trump's fiscal plans).

So the faithful overseas bondholders of the US are taking it from both directions...I wonder what will come of this and how long it will last......

@Edwin, well the rise in interest rates (and decrease in Chinese reserves) is way above CRE in the DC market, no?

My sense is that the DC CRE has lost a lot of interest for foreign investors since City Center.

Fundrise and their projects are dead. They were relying on Chinese money in exchange for green cards.

We don't have a Miami situations with a lot of foreign buyers, when they do buy it is because they work for WB/IMF.

I've been reading trough the Vornado documents, JBG is not contributing Condos, highly leveraged properties, and non-core (read properties that are not near metro station) to the newco.

JBG will largely be controlled from NYC.

EE -- I was thinking too that a Clinton Administration would have been hobbled by Congress and the continued and even more forceful Republican campaign against her.

But if she had won, probably the Democrats would have carried the Senate too, and while there would have been divided houses and the problems with the ongoing anti-Clinton campaign, at least she could have appointed a Supreme Court Justice.

We could be looking at real dark ages for at least a generation.

Thinking about the election, I felt sort of at peace about not having children.

WRT the swamp and even the impact on foreign bondholders, I am not sure how much the rhetoric will become reality.

I don't see Trump building a movement based on the stuff he said. Throwing out the machine around access to government doesn't seem really possible, unless he was really motivated about it.

I think of the election more as the conservatives now get to do even more of what they wanted to, with the patina of populism.

Who knows how long it will take the supporters to wake up. E.g., I read something yesterday that said the proposed tax cuts will give the wealthy households something like $1MM+ back with a little bit to middle income households, plus vastly accelerating and increasing the deficit.

2. And with capital, if the US is no longer the "reserve" investment market for the world, which yes props up our real estate economy and overappreciation and keeps interest rates low, then the market changes completely.

You'd think that the real powers that be would understand that. Trump certainly understands where the money for his projects come from.

3. WRT charlie's point about DC's real estate market no longer being particularly of interest for foreign investment, I guess that means that ultimately the Iowa Congressman gets the last laugh as the environment people like him have created has taken the sheen off the market.

interesting about JBG. If it's to be controlled from NY, what is the benefit for them, other than some people being able to cash out?

About "those women and minorities who didn't vote," since Clinton seems to have won the popular vote pretty significantly, it's not so much that people didn't vote but voter suppression in the places where it made a difference.

But I'd argue it's not just overt acts wrt suppression that matter. I think that people on the margins (income, race, gender) in all of margin's dimensions may get discouraged and depressed and end up not voting too.

Sure Hillary Clinton did well in California (in fact I am shocked at how formerly hyper conservative counties like San Diego and Orange went for HC), it's NC, FL, PA, etc. where because of how the Electoral College works, votes mattered even more but people may have been discouraged.

I came across an article (can't find it at the moment), about how talking with people in very practical ways about the logistics of voting (where to go, when) is more important in getting them to act than more general calls to action.

It's funny to think that the people who are considered marginal, in some states because of the Electoral College, have far more relevance than is normally the case.

RE: JBG.

Of the top of my head, Vornado gets 2/3 and JBG gets 1/3 of the new JGB CES entity (Charles E Smith).

Not a REIT expert, but I'd guess the advantage of giving up control is that instead of the mature properties JBG will have you've got tremendous potential appreciation in Crystal City, which is at an absolute bottom.

REIT will not look as good in a rising interest environment as I'd rather buy a bond than get 3% from a REIT. The growth potential in CC makes up for that.

I was thinking foreign buyers in residential real estate (like Miami, or Vancouver) rather than "taking the shine off". The Miami market is 100% fucked if we impose any sort of immigration restrictions.

a couple articles in today's WSJ, talking about the general slowdown in CRE, some rise in defaults.

But it's about prime vs. outer areas. DC proper should do ok hopefully. Suburban properties outside of Metrorail stations will have less allure and continue to decline, although here and there some properties have opportunities to reposition.

The other article was on the Navy Yard submarket and how apartment buildings are still being constructed, are in high demand.

Probably because of the allure of the stadium plus "the waterfront", that area and The Wharf could continue to succeed.

Probably the submarkets proximate to the core will continue to succeed.

But I am concerned about whether or not there are a lot of potential tenants out there.

Certainly if my business relies on the swamp, I'm not looking to sign big leases for awhile.

2. Interesting about CC. DK why it's taking so long to position. I guess there is only so much demand between Rosslyn, Wilson Blvd. (Courthouse to Virginia Square), and Crystal City vis a vis the Silver Line and Alexandria and DC.

Post a Comment

<< Home