Crystal City Arlington as Amazon one-half of HQ2 | Part 1: General + Housing impact

-- "Crystal City Arlington as Amazon one-half of HQ2 | Part 2: Leveraging Amazon's entrance for complementary economic development improvements"

-- "Crystal City Arlington as Amazon one-half of HQ2 | Part 3: Leveraging Amazon's entrance for complementary transit network improvements"

-- "Crystal City Arlington as Amazon one-half of HQ2 | Part 4: Pie in the Sky transit improvements"

Communities want Amazon HQ2 because of evident economic development value, based on the real-life experience in Seattle ("12 HQ2 Numbers That Made Every North American City Hyperventilate," Seattle Business Magazine, "Amazon: Remaking Seattle in Its Own Image," Costar, 2014) where the city is experiencing a massive boom.

And unlike a lot of tax incentive deals ("Business Incentives are Ineffective and Wasteful," CityLab), based on the history of the positive economic impact in Seattle, it's fair to argue the proclaimed benefits will be realized, which is why I thought that providing tax incentives was a reasonable decision. Although yes, this expansion has been complemented by a significant rise in housing prices.

-- "An example when I may disagree with Richard Florida: incentives for landing the Amazon HQ2"

But given that Amazon's HQ2 search hasn't focused on criteria I would have thought that mattered:

-- "The Amazon second headquarters "****show": Part 1 | Where could it go?"

-- "Amazon second headquarters list of finalists"

that is (1) lower housing costs for workers compared to Seattle, rather than equal to Seattle housing costs, and (2) providing revitalization energy for a center city that still languishes (e.g., Philadelphia, Newark, Baltimore, etc.)...

By splitting the expanded effort into two with one headquarters in Crystal City, across the Potomac River from Washington, DC, and the other in the Long Island City section of the Queens borough of New York City as has been reported by the Wall Street Journal and the New York Times ("Amazon Plans to Split HQ2 in Two Locations") they will reduce some of the worst effects on housing and commercial space costs that would come by locating in already expensive areas.

Queens is cheaper than Manhattan, and Crystal City is cheaper than DC, but they are still higher cost cities.

The DC area had three finalists: DC proper; Montgomery County, Maryland; and Northern Virginia

Relatively speaking, Arlington's commercial space is lower cost these days not only because they can build more densely compared to DC, but because they have a high vacancy rate, because of competition from other areas in Northern Virginia ("The state of Arlington County Virginia's commercial real estate market: 2012 and the future"), especially because of how the Silver Line has opened up parts of Fairfax and Loudoun Counties and lower cost land to "transit oriented development" ("Short term vs. long term thinking: transit, the Washington Examiner, Fairfax/Loudoun Counties vs. DC," 2011, and "Silver line reshaping commercial office market in Fairfax County," 2015).

Similarly, Queens is expensive relatively speaking, but Long Island City has long been utilized as a cheaper to lease "back office" location for Manhattan-based mostly financial businesses ("Citi consolidation opens a million square feet," New York Post), and it still has a lot of huge warehouse and distribution buildings able to be transformed, along with decent subway connections and inclusion within an expanding water ferry transit system.

Cloud computing as a regional competitive advantage. With regard to Crystal City, as charlie has commented, it makes sense for Amazon to have a large presence there around Amazon Web Services ("All of Amazon's 2017 operating income comes from AWS," ZDNet), its cloud computing company that has amazing profit margins--AWS's profits subsidize the e-commerce operations--and an increasing amount of business with the government, plus Northern Virginia is one of the nation's main Internet backbone hubs.

Constrained build out opportunities in DC and Montgomery County. With regard to previous announcements that DC, Montgomery County, and inner and outer Northern Virginia were all in the running, the choice of Crystal City for a smaller operation makes more sense to me too.

Both the White Flint area of Montgomery County and DC are not only physically constrained making it harder to grow the commercial space footprint over the long term, they have especially high housing prices. The increased cost of commercial space expansion in Seattle ("Amazon has its eye on 3 more blocks of Denny Triangle," Seattle Times, 2012) is a primary reason for Amazon's choice to build a second headquarters.

And the outer fringes of Northern Virginia previously touted, such as along the Silver Line, didn't make sense to me except for Reston, because those areas don't have the kinds of urban design and place characteristics that are desired by the younger demographics likely comprising the employment recruitment audience of a firm like Amazon.

Housing costs. The DC Policy Center ("How big of a deal is Amazon HQ2 for the DC Metro Region?") referencing an Urban Institute study argues that the impact of Amazon's entry won't be that significant on housing prices.

Definitely the halving of the size of the operation will make a big difference. And it's true in the context of the Washington Metropolitan Area, which has 6.2 million residents and spans an area greater than 5,500 square miles, the theoretical effect of adding 25,000 high income households is spread out and won't make much difference in the economy as a whole.

But they miss a major point. The point isn't the impact on the entire region as a market for residential housing, but the various housing sub-markets that are likely to be most desirable for newly arriving Amazon employees. Likely these are going to be close-in neighborhoods with quality transportation connections allowing for relatively quick commutes to and from the workplace.

That means already high-cost neighborhoods in Arlington, Alexandria, and DC.

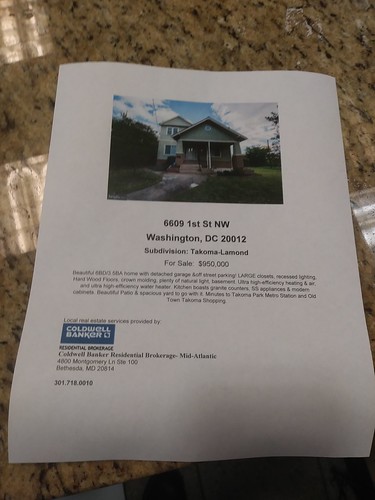

This flyer was posted at my voting precinct, a recreation center on the edge of DC. And this area is almost five miles from the city's core.

This flyer was posted at my voting precinct, a recreation center on the edge of DC. And this area is almost five miles from the city's core.I am not as familiar with the sub-markets in Arlington and Alexandria, but I know they are equal or higher in cost, and in DC the prevailing price for single family housing in many sub-markets throughout the city is close to $1 million ("The nature of high value ("strong") residential real estate markets" and "What people don't get about the DC housing market: supply is much less than demand, so prices keep rising (a/k/a basic economics)," 2017). Last week, the Washington Post had an article on $2.5 million condominiums in DC neighborhoods. Condominium prices will rise too.

Even a small increase in demand for housing in these neighborhoods, where demand is already greater than supply, will have extranormal impacts on prices.

It's those kinds of neighborhoods where the effect will be much more pronounced and more significant than is anticipated by the likes of the Urban Institute and the DC Policy Center.

Neighborhoods in Arlington and Alexandria. I called up Natalie Roy, of Arlington's Bicycling Realty Group, to get some insight from an Arlington-based Realtor. Here's a summary of our conversation.

Neighborhoods in Arlington and Alexandria. I called up Natalie Roy, of Arlington's Bicycling Realty Group, to get some insight from an Arlington-based Realtor. Here's a summary of our conversation."While no one has a crystal ball, there is a visible 'Amazon bump' that is generating excitement already in terms of investment possibilities.

I am already getting calls from investors looking for rental properties, condominiums, etc."

"There will be a bump throughout Arlington--north, east, and south, on both sides of Arlington Boulevard (Route 50) and in close in areas in Alexandria too. Other parts of Arlington--Clarendon, Rosslyn, especially those areas already on Metrorail lines, Shirlington will benefit."

"Arlington has a lot of small, nice little neighborhoods. Yes, housing prices are high already, but it depends. There's a wide range of housing types, small houses, bigger houses, and condominiums."

This house in the Penrose neighborhood is for sale for $600,000 and has 3 bedrooms and 3 baths, in 1,684 s.f., on a 1,784 s.f. lot.

"In South Arlington, neighborhoods like Fairlington, Shirlington, Penrose, and Arlington Heights. There are condo neighborhoods north of Pentagon City."

"The Columbia Pike Corridor--I would have loved to see the trolley built there. [Arlington cancelled the plans a few years ago.] It's an easy bus ride to Crystal City. But it's difficult to find anything there now, house-wise."

"Arlington Ridge, Aurora Highland, Arlington View, Addison Heights are desirable neighborhoods right now."

"Neighborhoods off 395, like Oakcrest, and Clairmount and Columbia Forest are great places to live too."

"With interest rates likely to go up, we can't be sure how the market will react."

"Alexandria--so many of the neighborhoods, especially those close to Crystal City, not just Del Ray, even Mount Vernon, which is farther out," will get an Amazon bump too.

-- Zillow map of houses for sale in Arlington County, Virginia

My take. My sense is that single family housing prices are going to top $1 million for the average house, in most if not all of these neighborhoods in Arlington and Alexandria likely to be affected by an "Amazon bump." And DC neighborhoods too will continue to climb in price, with the influx of new high income residents adding more demand to a market already unbalanced, with more demand than there is supply..

Yes, at the metropolitan scale, the impact won't be so visible--prices in Loudoun, Prince William, Prince George's, Montgomery, and much of Fairfax will remain the same. But at the micro-scale of individual neighborhoods within what I call the regional residential landscape, there will be significant impact in Arlington, Alexandria, and DC.

Too often, using gross-grained data misses variances that are significant when using a more finely tuned lens.

Labels: affordable housing, housing market, neighborhood revitalization, real estate development, real estate financing, residential real estate market

8 Comments:

In a comment on another item in this series, charlie made a point that likely neighborhoods served in the Yellow Line/Green Line corridor in DC north of Crystal City could be attractive to Amazon workers also.

A Newsday article speculates that the entry of Amazon HQ 1/2(2) along with Google, will lead increase housing prices in Queens.

https://www.newsday.com/business/amazon-hq2-long-island-home-1.23115967

11/9/2018

1. Bisnow article on other property owners that will benefit from Amazon in Greater Crystal City

https://www.bisnow.com/washington-dc/news/construction-development/beyond-jbg-smith-20-developers-poised-to-benefit-from-amazon-in-northern-virginia-94994

2. Piece by Michael Kimmelman in the NYT about the impact on Queens, how companies "should be giving back".

https://www.nytimes.com/2018/11/12/arts/design/amazon-hq2-long-island-city-costs-benefits.html

3. Separately but related, Virginia Tech announces the creation of a tech campus adjacent, comparable to the Cornell Tech initiative in NYC:

https://www.bisnow.com/washington-dc/news/economic-development/a-look-at-virginia-techs-planned-1b-potomac-yard-campus-94963

11/14/2018

USA Today on housing price increase, good for sellers, bad for buyers

https://www.usatoday.com/story/money/2019/02/26/amazon-hq-2-home-buying-season-northern-virginia-heats-up/2949276002/

Arlington offered incentives too, minimal compared to the state, but $. They set the metric as a % greater than the tax revenues from hotel stays. That hasn't grown because of covid. So there is no payout.

Arlington offered $23M for Amazon HQ2. So far, it hasn't paid a dime.

https://www.washingtonpost.com/dc-md-va/2022/09/02/arlington-amazon-hq2-incentives-covid/

Amazon HQ2 was thought up pre-pandemic. But the world is hybrid now.

https://www.washingtonpost.com/dc-md-va/2023/04/19/amazon-headquarters-arlington-virginia-hybrid/

HQ2 opened diminished expectations on employment given post-covid WFH.

Opens with about 3,000 employees, expect about 9,000 by the fall.

Why Amazon built a second headquarters and how the pandemic reshaped HQ2

https://www.cnbc.com/2023/06/19/why-amazon-built-hq2-and-how-covid-pandemic-reshaped-it.html

As Amazon HQ2 opens its doors, neighbors brace for a transformation

https://www.washingtonpost.com/dc-md-va/2023/06/15/amazon-hq2-arlington-virginia-opening

It's fascinating to see how Amazon's HQ2 development in Crystal City is transforming the area, especially in terms of housing and overall growth. The impact on the local economy, infrastructure, and real estate market is significant, and it's a trend worth watching closely. As businesses and communities adjust to these changes, it's important to consider how this growth can influence digital opportunities too. Companies, both locally and globally, could greatly benefit from increasing their online visibility. For instance, businesses looking to expand in such competitive environments can partner with a professional SEO Agency in dubai to ensure they are reaching their target audiences effectively. By utilizing SEO strategies, businesses can position themselves for success in this rapidly evolving market.

Post a Comment

<< Home