Retail roundup #2: innovation and failure

The impact of online commerce is significant for retail stores as is the saturation of particular retail sub-categories ("Best Buy sees tough road ahead amid smartphone sales decline," Minneapolis Star-Tribune).

More info. People are buying fewer goods, more services. In between the previous piece and this one, I came across a Businessweek article on Sears ("Sears May Sell Its Best-Known Brands") and it provides more insight into the decline of retail sales. From the article:

The retailer has suffered from an industrywide decline as Americans spend differently and on different things. People are buying fewer clothes, spending more on dining and other experiences, and saving more. In the mid-’80s, 45 percent of consumer spending went to goods, the remainder to services. Today those figures are 31 percent and 69 percent, respectively, according to Customer Growth’s Johnson. When Americans do buy goods, they’re shifting where they shop—not just to online, but to off-mall retailers, such as Walmart, Costco Wholesale, and T.J. Maxx.People who buy online shop less in stores, significantly. Today's USA Today in "Millennials drive spike in online shopping" reports a recent study:

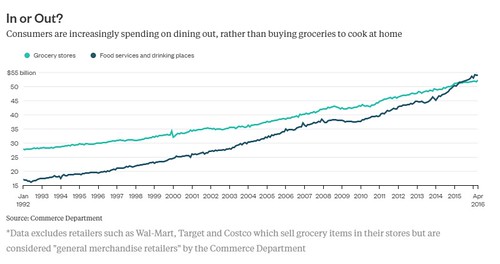

Online shopping makes up more than half of surveyed shoppers' purchases, according to a new report from shipper UPS and researcher ComScore. The companies' fifth annual survey of e-commerce shoppers — individuals who made at least two online purchases in a typical three-month period — found 51% of their purchases were made online (excluding grocery shopping), an increase from 48% of shoppers in 2015 and 47% in 2014. An estimated 40% made at least four to six purchases online, while another 40% made seven or more.More food spending now takes place out of home. While I've mentioned this here I think (definitely at Eastern Market public market board meetings) a different Bloomberg piece ("Blue Apron IPO could be waylaid by buyer like Kroger") includes this graphic:

The results come amid a tough time for traditional retailers, with many big name outlets, including Nordstrom, Macy's, Kohl's and J.C. Penney, recently posting disappointing quarterly results. Sales at stores open at least a year, a key metric for measuring the health of retail companies, were only up slightly at Target and Walmart. Meanwhile, sales at Amazon were up 28% in the recent quarter to $29.1 billion.

In response, companies are shifting their strategies, such as focusing on providing experiences and using e-commerce technologies, to improve the retail experience and social media marketing specifically to remain relevant, and stoke awareness and sales.

2. Lesson: Think center city. Since the blog started in 2005 I've been writing about the opportunity in cities for retailers that had previously been focused on greater growth opportunities in the suburbs. Today, more companies are focusing on urban markets.

While it's not a new strategy, there is a story on Best Buy in New York City operating multi-story stores, something they don't do in typical suburban locations ("Best Buy steps up its game in New York by retooling," Star-Tribune) where they build large single story buildings from the ground up.

3. Lesson: Think omnichannel and incorporate technology. Not only are brick and mortar companies desperately working the e-commerce angle, companies like Warby Parker that started out online are selectively opening physical stores in high profile locations, in large part as a marketing and awareness strategy ("At Warby Parker, a Sense of Exclusion in a Low Price," New York Times. But compared to retailers of old, they are much more selective in opening locations, far fewer in number compared to old line chains like the Gap or department store chains, which are furiously closing stores.

I do think it will be difficult for companies to compete with Amazon, especially as more categories become commoditized and undifferentiated.

But Canadian Tire, an automobile/hardware/hard goods retailer has sales by improving their traditional printed catalog and integrating it with their e-commerce platform, which is proof of the point that integrated marketing boosts sales in a variety of ways ("Canadian Tire goes back to the future with innovative new print catalogue," Toronto Globe & Mail).

And the company's "Showcase" store in Edmonton incorporates digital screens throughout the store, has VR and other simulators, supports e-commerce pick ups, has a demonstration kitchen, and other features. From the press release:

A modern and sleek new version of Canadian Tire, more than 240 store associates will use advanced interactive technology to provide personalized customer service to Edmonton shoppers. With over 100 digital screens, the Showcase store features a large exterior high resolution LED screen, digital flyer access and a plethora of helpful product selectors in the Living, Playing, Fixing, Seasonal and Automotive departments. The store's world-class Automotive department also features Canadian retail's first ever use of a car simulator, providing customers with the opportunity to test drive tires in different weather conditions before purchasing and installing them on their vehicle.4. Lesson: Think small. That being said, there are developing opportunities. Media reports that there is a rise in the development of independent bookstores, although they tend to be small ("How Independent Bookstores Are Thriving in the Digital Age," Publishing Perspectives).

Additionally, when visiting the store's Seasonal department customers can create and interact with a 3D image of their dream backyard using the 'Canada's Dream Backyard and Patio Builder.' This app technology raises the bar for our customers and their ability to engage with large interactive screens. It was built internally at Canadian Tire's "NEWcleus" digital lab in Winnipeg and utilizes state-of-the-art virtual reality technology from Oculus.

The take away is that there are opportunities in retail categories by delivering different kinds of experiences and approaches. And marketing--actively utilizing social media channels to constantly keep stores "top of mind" makes a big difference.

5. Lesson: Think different. There is a fascinating story, "Breaking All The Retail Rules," in Innovative Retail Technologies on Hointer, Beta Store, a high-end retailer in Seattle selling men's denim jeans.

5. Lesson: Think different. There is a fascinating story, "Breaking All The Retail Rules," in Innovative Retail Technologies on Hointer, Beta Store, a high-end retailer in Seattle selling men's denim jeans.The proprietor, Nadia Shouraboura, is a PhD mathematician who worked for more than a decade for Amazon and was one of the company's leading officials, launching new initiatives and specializing in logistics.

But she had the hankering to own her own store, so she left and opened an apparel store.

After a few months the store was on the brink of failure. She figured out that the more clothes people tried on, the more they bought. But the way clothing stores are organized, with stock out front and fitting rooms in back and the difficulty of getting more clothes to try on once you're in the fitting room, isn't conducive to maximizing sales.

She's extending the concept to toys. Most toy stores are packed with inventory, but kids can't try out the toys.

And Hointer has added women's clothes--which makes sense because women buy more clothes more frequently than do men.

Plus the company's stores now double as places to develop technologies that can be sold to other retailers.

6. Lesson: Think Experience. Pirch is a super high end home store in New York City, set up to demonstrate all the products they sell ("SoHo's Gilded Home Store Where Money Flows Like Water," New York Times).

Evaluating shower heads at Pirch by taking a shower. New York Times photo.

You can even take a shower. While going to that extent may be out of the question for a local hardware store selling much cheaper items, it shows the value in being able to show "how to" do something, how it feels.

Again, this isn't a new idea, but it remains rare. I've come across stores in smaller towns that do some of this, mostly with kitchen appliances, in stores that grew out of combination hardware+home furnishing stores.

Maytag has been doing this for awhile ("Maytag stores let shoppers try before they buy," USA Today), and Sears aims to do this more with their standalone appliance stores. I'd really like to get some lessons on using Kitchen Aid stand mixers in such a facility, but how can I do that?

7. Lesson: Programming and Activation. This article "Creating The Experience," from Shopping Center Business, covers how shopping centers are shifting their focus more towards attracting and retaining customers for their customers (retailers) as the number of retailers shrinks and as a way to compete with other shopping destinations in their region. From the article:

Many developers encourage shoppers to socialize and attend public events by creating places for social activity. Moreover, many are creating so-called “third places,” where visitors to the center can just spend time. These can include everything from sidewalk café seating to soft seating areas to children’s play areas, fountains and social gathering spaces. Retailers, as well, are more than ever drawing visitors to their stores with programmed events, live demonstrations, celebrity visits, book signings and even more regular events like classes.In the DC area, the revitalizing Union Market area, Reston Town Center, and promotional activities in multi-property commercial districts like Rosslyn by the Rosslyn business improvement district are examples of multi-faceted programming efforts.

8. Loyalty programs. Large and small retailers have had loyalty programs for some time, but few companies have used these programs in significantly innovative ways. One example of innovation and creating special options is how credit card companies sponsoring concerts may offer special ticketing options and experiences to their customers in association with the event.

The Dorothy Lane Market supermarket company in Ohio flipped its loyalty program by dropping spending on advertising and weekly specials, and put that money into special discounts and rewards for their best customers ("Dorothy Lane loves its customers," Fast Company). From the article:

"We realized that we couldn't give club members the deals that we wanted to give them if we continued spending $5,000 to $10,000 a week on print advertising," says Mayne, whose father, Calvin Mayne, started Dorothy Lane as a roadside stand in 1948. So, on October 27, 1995, four months after starting Club DLM, Mayne ran his last ad in the Dayton Daily News. "Whenever we ran those ads, offering a special on pork-and-beans, all we did was attract 'cherry pickers,' " Mayne says. "It was an exercise in futility. It was a headache for us — and for our regular customers."The funny thing is that Dorothy Lane Market did this in the 1990s. These days, social media programming (Twitter, Facebook, Instagram) allows even small businesses to stay in constant touch with their customers and to keep their business "top of mind."

So Mayne ceded the cherry pickers to Kroger and Meijer, his chain-store rivals. Some of his talk about ditching fair-weather shoppers ruffled feathers. But once people saw the results of this new strategy, their worries dissipated.

"This program gave us an extra three points of gross margin to give back to our best customers," says Mayne. Last Christmas, each store's 100 best customers received a Zyliss cheese grater, along with a pound of parmigiano-reggiano cheese and a thank-you. The company's 5,000 biggest spenders got invites to an oldies show — which was one of Dayton's hottest tickets last summer.

Amy Brinkmoeller, 27, DLM's director of information systems, is careful to point out that "we may have stopped advertising, but we haven't stopped communicating." Brinkmoeller, who's in charge of the loyalty program, sends out a monthly newsletter to the company's top 9,000 customers. But not every newsletter is alike. Different versions contain coupons pegged to different spending levels. And, since DLM tracks purchases so closely, it can also send highly targeted offers to its customers. Four to six customized communications go out (usually in postcard form) every month. ...

The loyalty program is only the most recent outgrowth of DLM's grassroots orientation. Members of its Kids Club come to the store on Saturdays for events like a Hawaiian luau or a cake-decorating contest. Toddlers compete in its Baby Derby to be crowned Dayton's swiftest crawler. DLM delivers groceries (at a loss) to 175 elderly customers — because, as Mayne says, "they have shopped with us all of their lives."

9. Lesson: value in focusing on large market segments with limited access to great retail experiences. That being said, there are some interesting developments in chain retail. A couple years ago, CVS bought Navarro Discount Pharmacies, a Hispanic-focused drug store chain in South Florida with 28 outlets. Unlike all of their other acquisitions, this chain was not consolidated into the standard CVS format, instead the stores remain separately run.

AP photo.

Navarro stores have been interesting to me as a model to expand retail service options in underserved communities, because some stores incorporate other functions.

For example some have in-store cafes featuring Hispanic foods, business centers, and other services that help to round out the array of retail services available in otherwise underserved areas.

CVS appointed the president of Navarro to be in charge of the corporation's "Hispanic initiatives" and the company has since opened CVS y más stores focused on providing a curated assortment of products focused on Hispanics and bilingual personnel, first in South Florida, where there are now 12 stores, and most recently in Los Angeles ("CVS 'y más' prototype stores in OC, LA target Latino shoppers," Orange County Register).

10. Lesson: look at different, innovative approaches as opportunities for learning, not as something to squelch, especially in acquisitions. The CVS y más story is an interesting contrast to Royal Ahold, parent of three supermarket chains in the Eastern U.S., Stop and Shop in New England and Greater New York, Giant-"Landover", active in DC and Baltimore, and Giant-Carlisle, based in Pennsylvania and active in PA, MD, and VA.

A Ukrop's cafe.

A few years ago, Giant-Carlisle bought "Ukrop's," an independent supermarket company in Richmond, known to be a leader in selling a wide variety of prepared foods in stores complemented by exemplary customer service--not unlike Wegman's, now considered one of the nation's most successful supermarket chains.

Stores had two-story cafes and a strong health and wellness component--new stores had interior links to fitness centers and medical facilities ("Goodbye Ukrop's," Supermarket News).

(The commissary that supplied the stores with prepared foods and baked goods still operates as a separate business owned by the Ukrop family.)

Giant renamed the stores as part of their Martin's division, and eliminated most of the elements that made the stores distinctive, in the process destroying most of the economic value of the unit, not unlike how Safeway destroyed companies they purchased in Chicago (eventually they sold off the stores piecemeal), Philadelphia (same thing, they sold the stores off piecemeal or closed them) and Texas (the Safeway-owned companies limp along, losing market share to competitors like HEB).

As part of the firm's upcoming merger with Delhaize (owner of Food Lion and Hannaford), they will be selling the Ukrop's stores off at a loss. Rumors are that the stores will be purchased by Publix, the Florida based supermarket company that has been moving into the North Carolina and Virginia markets.

Boston Globe image.

11. Even big companies can have a bit of innovation but many are inconsistent. Interestingly, in another division but not connected to a particular supermarket chain, Ahold is developing small supermarkets selling a lot of prepared foods, in the Philadelphia and Boston markets, called bfresh ("Stop and Shop parent unveils new grocery concept," Boston Globe; Gallery: Food as fashion at bfresh, Supermarket News).

(The new 365 by Whole Foods small markets, the first just opened in the Silver Lake district of Los Angeles, appears to be a similar format.)

While not every store they've opened has been successful--a more suburban location failed--mostly the bfresh stores are working well.

Because Ahold isn't known for innovation within their supermarket divisions, at least south of Pennsylvania, this is remarkable.

Relatedly, a couple years ago Ahold purchased a single store independent, Eastside Marketplace, based in Providence, Rhode Island, because of the store's reputation for innovation and excitement, and unlike how the special qualities of Ukrop's stores were extinguished, the store is still successful and it has been expanded since the purchase (Expanded Eastside Marketplace reopens today in Providence," Providence Journal).

Ahold's DC city stores are becoming somewhat more interesting as new stores are opened (see "Urban retail #4: how to prevent the coming failure of the DC region's Giant Supermarket chain")--the store at Cathedral Commons has a wine and beer tasting area, and the store in the Shaw neighborhood has an attractive cafe style seating area--but they aren't game changers like bfresh or Eastside Marketplace or the kinds of offerings in Whole Foods flagship stores or a Wegman's.

Note that in an example of "positive deviance," Ahold through the Stop and Shop division, has been very successful in developing an e-commerce food delivery service called Peapod, which operates in the Giant-Landover division too, as well as in Chicago, where the company doesn't have supermarkets.

But the reality is that Peapod was an acquisition, however it was early in the company's development, and unlike the Ukrop's example, Peapod's unique qualities weren't destroyed, but instead were enhanced, with the exception that Ahold forced Peapod to drop contracts with other retailers.

Labels: commercial district revitalization, formula retail, retail planning

1 Comments:

The points about in-store vs. online commerce and how the changes impact demand for in-store purchasing are reiterated in this piece:

http://www.innovativeretailtechnologies.com/doc/analyst-predicts-one-in-three-malls-are-doomed-0001

Post a Comment

<< Home