Retail Action Strategy

AP Photo by Jeff Roberson.

Yesterday's Post had a big story, "Road to a Retail Makeover," subtitled "D.C.'s Plan to Revive Shopping Areas Leads Through H Street NE," about DC's retail action initiative, featuring an analysis of H Street. From the article:

Space is another issue. Many of the properties are small and narrow, with the tiniest at about 1,250 square feet -- too small for most national retailers to even consider. The average restaurant needs at least 2,000 square feet. A drug store such as CVS is generally 5,000 to 9,000 square feet. Even a small grocery store such as Trader Joe's claims about 40,000 square feet.

That means most property owners are searching for small, independent retailers to lease the space. But as property values rise, so do taxes -- and rent. And many merchants have found it difficult to sell enough merchandise in their small spaces to pay off the growing rents.

There have been several casualties as well. The pet shop. The bookstore. The women's specialty store, all felled by high rents and slow sales. "What can you do about that?" Saleem said. "If they can't pay the rent, they aren't coming."

There are a bunch of issues. A good introduction to thinking about this is in these blog entries:

-- (Why aren't people) Learning from Jane Jacobs

-- (Why aren't people) Learning from Jane Jacobs revisited.

1. The floorplates of the stores put a ceiling on how much revenue a property can generate. (The same goes with upper floors rented as office space or housing.) Generally superlative retail sales run from $200 to $600/s.f. annually. So a property is worth only so much. After a certain point, there is no justification for property tax assessment increases.

-- Avoiding the real problem with DC's property tax assessment methodologies

-- Another example of flaws in commercial property tax assessment methodologies

This reality needs to be reflected in the city's retail action strategy. And in the tax assessment policies and methodologies of the city's Office of Tax and Revenue. Instead, the City Council voted in favor of a tax rebate, without looking very closely at the root of the problem.

2. Successful commercial districts in cities are walking oriented. So we need more specific mapping of commercial districts, focusing stores in highly walked places. And putting off services and other B and C uses to side places.

The very walkable Carytown district in Richmond is one of my favorite commercial districts in the MD-DC-VA region. Photo by Steve Pinkus.

A spring Sunday in Adams-Morgan.

3. This means transit and walking, park once and walk at best, maybe commercial district supported delivery services, and elimination of parking requirements on a store by store basis, and the creation of "transportation management districts" to coordinate this.

4. There needs to be a focus on rebuilding the infrastructure that supports the development and maintenance of independent retail in a comprehensive fashion. Thus far, most of the city's resources have been directed to the attraction of retail chains, and chains are only somewhat interested in urban locations. Besides, uniqueness is what sets apart quality urban retail from its suburban competition.

-- Nurturing independent businesses through creatively reducing capital requirements

-- To get independent businesses you need to rebuild the supporting infrastructure

-- Why the future of urban retail isn't chains

-- Store siting decisions.

Places like Manhattan, Brooklyn, Queens, Seattle, Portland, Oregon, Chicago, and Boston are known for their independent retail. DC and Inner Harbor Baltimore not so much... People don't need to visit DC to shop at West Elm, even though as DC1974 pointed out last fall, to do so can be more efficient than going out to Tysons Corner.

5. Seattle has a very interesting coordinated Neighborhood Business District Strategy that could be a model of what to do here.

6. As industry professionals pointed out in the Post article, rebuilding retail districts is an evolutionary process. I prefer to think of it in terms of phasing.

-- One more thing about retail

First, you are just trying to get people to (re)sample the district. That's done through restaurant and entertainment, oriented to the night time. The kind of stuff Joe Englert is doing on H Street.

-- Richard's Rules for Restaurant Driven Revitalization

-- Creating the "new new" thing: commercial district revitalization

Second, people can say that they want pet shops and bookstores and the like, but you need to work through the numbers both for the business and in terms of the actual walking traffic and patronage in the commercial district, to see if the business can work.

Note that this isn't to ding the possibility but to be realistic and to work to develop multiple revenue streams to support desired retail categories. I.e., Busboys and Poets on 14th Street supports the sales of relatively low margin products in a highly competitive category--books--via the sales of food and drink.

And it can't be done by appealing to some desire to shop locally. People are busy and comfortable with their current shopping patterns. If you don't offer something competitive to what they already do, you won't succeed. That's H Street's problem and if Joe Englert hadn't decided to focus investment there, H Street would still be languishing.

-- The soft side of commercial district competition

-- An interesting look back in time

A few weeks ago, I put up a link to an old ICSC report, "Development in Underserved Retail Markets." Another good one is from the Urban Land Institute, "Ten Steps for Rebuilding Neighborhood Retail." Another excellent resource is David Milder's Business Recruitment Handbook.

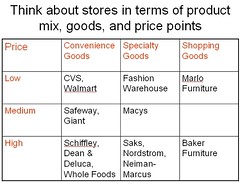

7. The tables below are tools I use to help people think about these issues with regards to their own commercial district. A specific commercial district must be considered within the regional context. Most neighborhoods lack the population necessary to support "neighborhood serving retail" let alone the full complement of all retail categories. Some types of stores rely on retail trade areas in excess of 20-60 square miles, and hundreds of thousands of potential customers.

That means that most neighborhood commercial districts need to develop specialties, and formats, like Belvedere Square in Baltimore, that allow for the provision of desired goods in unique and interesting ways.

In Cities in Full, Steve Belmont states that a neighborhood commercial district needs 10,000 households within a square half mile to be successful, and 15,000 households to support entertainment.

The unwillingness of most neighborhoods to grapple with these issues and accept selective and surgical addition of density by subway stations and along traditional transit corridors (where the streetcars used to be) doom DC commercial districts to failure, because the number of residents per household is less than 1/2 of what it was back when these districts thrived--not to mention that there is 400% more retail space nationally (mostly in the suburbs) compared to "back then" as well.

Poke through the demographics of various DC neighborhoods and you'll see what I mean. Sheets listing the statistics are available in this publication: 2007 Neighborhood Retail Opportunities Book.

More ways to think about managing store mix to attract and satisfy different market segments:

•By daypart -- morning, afternoon, evening, late-night

•By age -- children, youth, adult, senior

•By type of household -- single, couple, family, empty nest

•By newness of household (new households buy different things compared to established households)

Labels: commercial district revitalization, retail, transportation demand management, urban design/placemaking, urban revitalization

0 Comments:

Post a Comment

<< Home